Trending

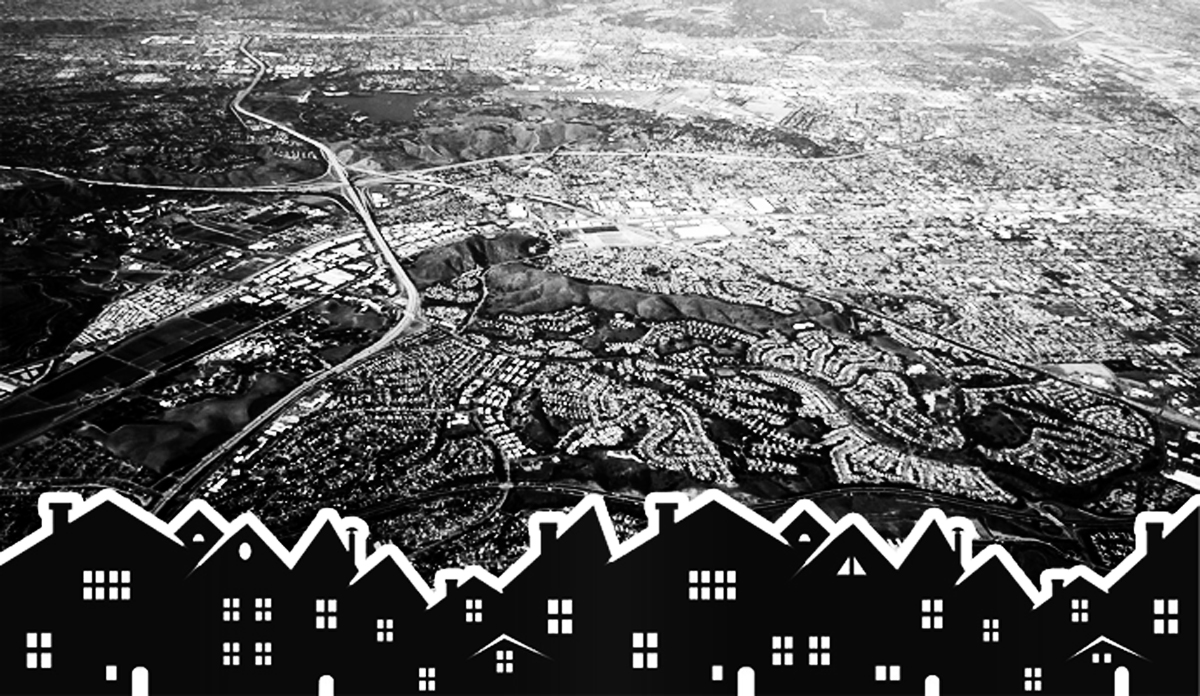

SoCal housing market is slowing but no crash in sight: economists

A cooling market will be good for buyers, who could see prices normalize

The state’s housing market has cooled in recent months following a stretch of red-hot price growth fueled in part by diminishing inventory, but economists aren’t ringing the alarm bells on a crash.

Because the U.S. economy is more solid ground than it was a decade ago — helped by regulations enacted during that period — there are fewer risks of another sharp downturn, according to analysis by the Los Angeles Times.

Home prices in Southern California hit an all-time high in June. But the numbers have not mirrored the those just before the recession. From 2000-2006, housing prices shot up 28 percent. Meanwhile, from 2012 to 2018, there has been just an 11.4 percent rise.

That rate of growth is slowing nationwide and it’s pronounced in Southern California, which has been one of the hotter large markets in the country. The region saw its slowest September in over a decade and had its slowest summer in four years. Home sales fell 17.7 percent in September year-over-year and the price gain from 2017 was much lower than in recent years.

Rising interest rates are contributing to the slowdown, experts say.

Still, fundamentals are healthier than they have been during previous booms. Lending standards are tighter and borrowers have more solid credit than they did during the 2000s bubble. The total U.S. mortgage payments in the second quarter are 4.2 percent of total disposable income, compared to 6-7 percent during the bubble.

The U.S economy is also more diverse than it was during the recession in the early 1990s, and unemployment is lower. An economic shift from manufacturing to the service industry — along with the net loss of jobs — helped fuel that downturn in Southern California. [LAT] — Dennis Lynch