Trending

Tom Barrack’s Colony Capital looks to part with $5B portfolio amid other massive industrial deals

The company is also reportedly eyeing sale of its entire industrial holdings

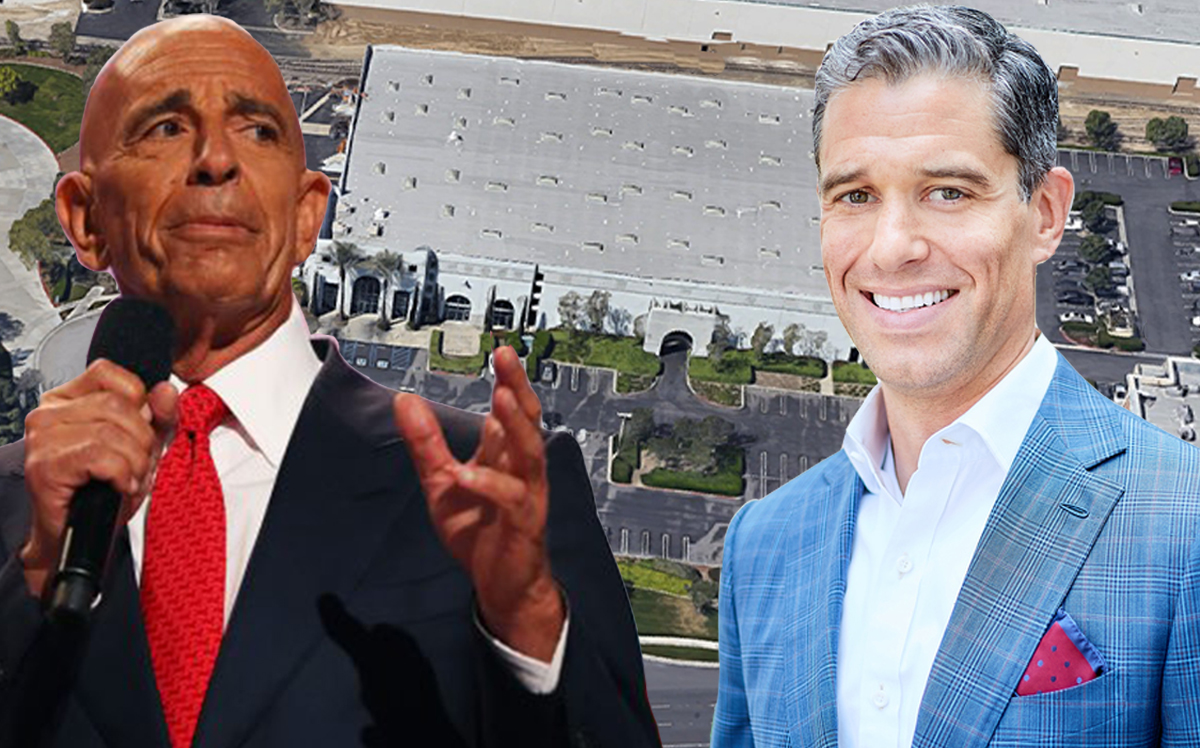

Colony Capital has sold a massive four-property industrial portfolio in the Inland Empire, the latest indication it is looking to sell its entire industrial holdings.

Colony sold a 745,580-square-foot portfolio in Rancho Cucamonga to Lincoln Property Company for $104.6 million. CBRE, which represented Colony, announced the deal Wednesday.

The buyer, Lincoln Property, recently put a sprawling office campus on the market for sale. Dubbed Campus @ Warner Center, the property is on the market for $215 million.

The announcement came hours after Bloomberg reported that Los Angeles-based Colony was in discussions with Eastdil Secured to market its portfolio of warehouses and last-mile logistics properties for around $5 billion. Brookfield Asset Management could be a potential suitor, according to the report.The four properties in the Inland Empire are fully leased to five tenants, including XT Green, Carpenter Technology., Pinole Valley Trucking, THMX Holdings and ConAgra Foods. The three properties in Rancho Cucamonga are located at 11600 Millennium Court, 8250 Milliken Avenue and 9160 Buffalo Avenue, while the fourth sits at 4850 East Airport Drive in Ontario.

Colony also recently sold a 2.3 million-square-foot industrial portfolio in Dallas to Nuveen Real Estate for $136 million.

If Colony was to sell off all its industrial holdings, the deal in the neighborhood of $5 billion would top the potential Prologis deal that is in the works. Prologis is in advanced talks to purchase Industrial Property Trust from Black Creek Group for $4 billion. That portfolio spans 37.6 million square feet across industrial properties in 21 states.