Trending

In LA’s residential market, inventory is up and sales are down, Q2 report shows

Despite 2 huge sales in Beverly Hills and Brentwood, the number of luxury and non-luxury homes that sold in the second quarter dropped, according to Douglas Elliman’s latest report

July was a big month for the luxury residential market in Los Angeles.

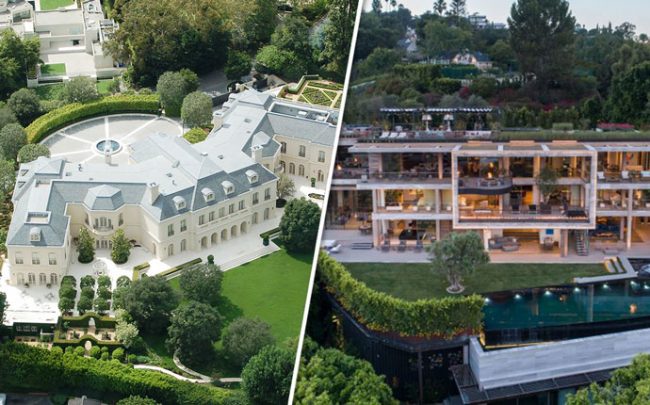

After having been listed for three years, the Spelling Manor in Beverly Hills finally sold for a record $120 million at the beginning of July and last week, developer Ardie Tavanagarian unloaded his Bel Air spec home for $75 million.

From left: Spelling Manor and Ardie Tavangarian’s mega-mansion (Credit: Wikipedia and Hilton & Hyland)

But despite those mega-sales, L.A.’s overall luxury market is still showing signs of softening as inventory keeps piling up and sales keep slowing down, according to Douglas Elliman’s second quarter report. Meanwhile, the non-luxury market has endured much of the same, with rising prices and falling sales.

The luxury breakdown

From April through June, 87 luxury homes sold, a 4.4 percent drop from the same time last year. But the quarter was a significant improvement on the first quarter of this year, when just 57 luxury homes sold.

Still, the second quarter showed other warning signs ahead for the market. The median sales price in the luxury market, which Elliman defines as the upper 10 percent of all its listings, dropped about 6.8 percent year over year to $9.3 million.

Stephen Kotler, CEO of Elliman’s Western region, said the recent big-ticket sales could be attributed to a “summer buying spree.”

“In the high end, it’s a tale of two cities,” he said. “You have realistic prices and houses that are selling, and then you have aspirational prices where houses are still sitting.”

In the non-luxury market, the median price for single-family sales in Greater L.A. rose 3.8 percent year over year to $1.5 million.

But the number of sales dropped 7.9 percent to 1,566, signaling that sellers may still have an unrealistic sense of the current market. At the same time, the overall residential market inventory jumped 22 percent to 3,355 homes.

Certain pockets of L.A. fared better than others.

In pricey Brentwood and Westwood, the number of sales increased roughly 9 and 33 percent, respectively. Prices for the homes also rose in both areas.

In Brentwood, sales have been especially strong.

Earlier this month, WeWork executive Max Gross paid $28 million for former Fleetwood Mac guitarist Lindsey Buckingham’s custom-built home mansion. Agency partner Santiago Arana also sold one of his development projects in Brentwood to Petra Ecclestone — seller of Spelling Manor — for $23 million.

Meanwhile in Malibu, sales have slipped more than 50 percent, dropping to 29 homes in the quarter.