Trending

$53M sale of Home Depot biggest for OC retail

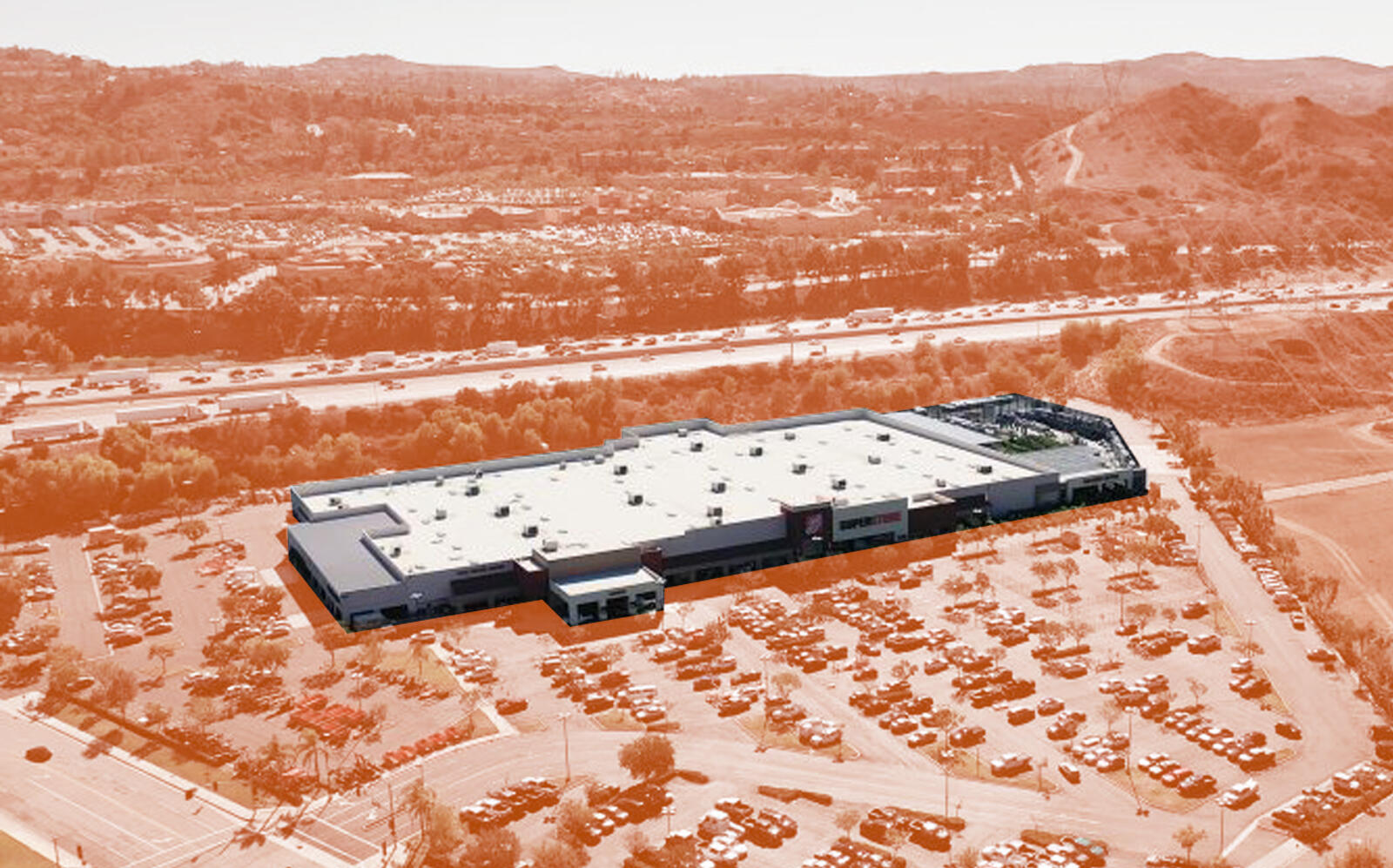

225,000-square-foot store in Anaheim traded hands for $53M

UPDATED, Wednesday, November 10: Orange County’s largest retail investment sale of 2021 closed in Anaheim last month.

The 18-acre property at 1095 Pullman Street is home to a 225,000-square-foot Home Depot store, according to the Orange County Business Journal.

An affiliate of San Diego-based investor Sunbelt Investment Holdings purchased the property from New York-based Maxim Properties for $53 million. Maxim Properties purchased the property in 2005.

Sunbelt’s portfolio spans Southern California and Arizona. It owns 17 big box retail sites across Southern California. The firm also invests in office properties, vacant land, and develops properties as well.

Phil Voorhees and the NRP West team at CBRE had the listing. The sale figures out to about $235 per square foot.

The main building totals 178,660 square feet and is supplemented by a 46,750-square-foot garden center. The property includes 923 parking spaces.

(Sunbelt Investment Holdings Inc)

Home Depot is one of the few physical retailers to thrive during the pandemic. People stuck at home flocked to Home Depots to take up projects around the house. Foot traffic last year was significantly higher than 2019 and that remains the case in 2021.

A 111,624-square-foot Home Depot-leased store in the San Fernando Valley neighborhood of Sun Valley recently sold to Santa Monica-based investor Charing Cross Partners for $61.8 million. That deal figures out to more than $553 per square foot.

The Home Depot boom may be coming to an end, however. The company’s same-store U.S. sales rose in the second quarter compared to the first quarter, but fell short of estimates.

Other retailers struggled during the pandemic and some shuttered altogether. Still others weathered the storm and have bounced back.

Shopping mall investor Simon Property Group lost nearly $1.15 billion in lease income, management fees, and other revenue streams last year, but as of the third quarter appears to be turning its business around.

[OCBJ] — Dennis Lynch

Correction: A previous version of this story said SRS Real Estate Partners had the property listing. The NRP West team at CBRE had the listing.