Trending

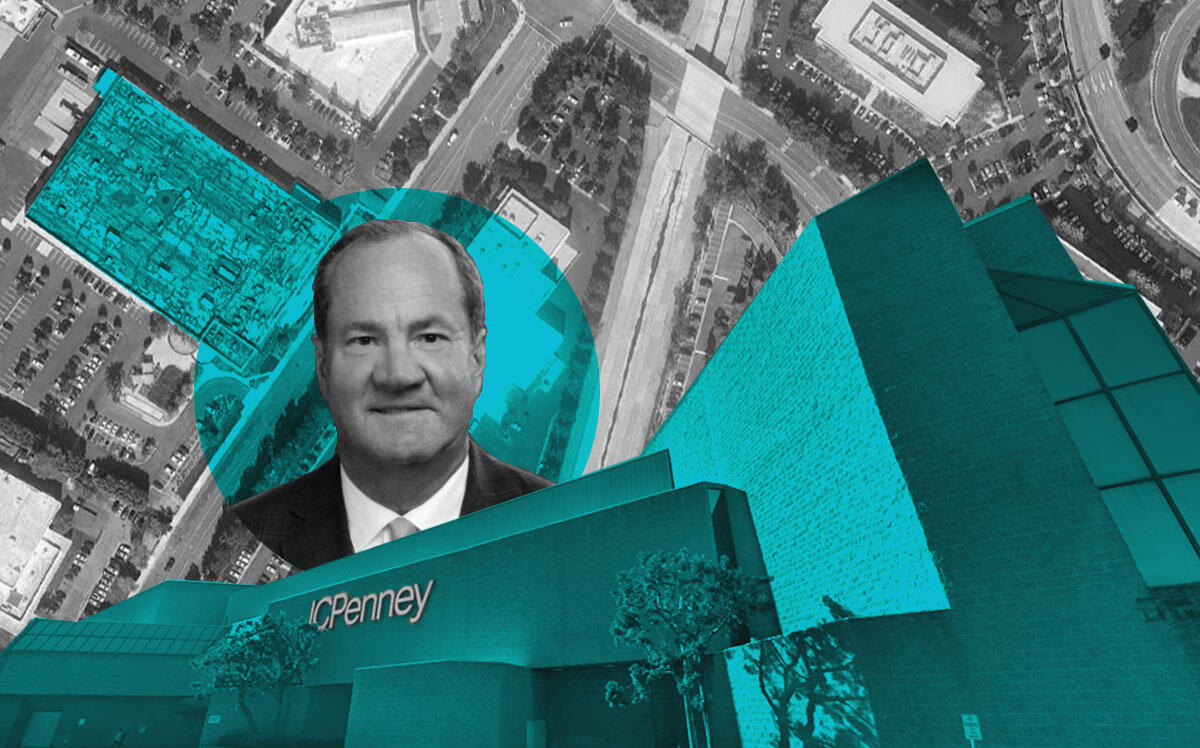

Hines finds a Penney among $250M in SoCal buys

JCPenney store at Culver City mall, fully leased manufacturing site in Tustin among deals

Hines has spent $250 million on properties in Southern California in recent weeks.

The Houston-based privately owned commercial firm’s shopping spree included the JCPenney store at Westfield Culver City and a fully-leased industrial property in Orange County, according to a Thursday announcement.

The purchases were two of five properties Hines has acquired in Southern California since December.

Orange County records show Hines bought a 112,000-square-foot manufacturing facility at 14191 Myford Road in Tustin for $50 million, or around $446 per square foot. The facility is fully leased to pharmaceutical manufacturer Avid Bioservices for the next 10 years.

“We’re planning to hold [the Tustin property] indefinitely,” Hines’ Paul Twardoski, who oversees operations across Southern California and Las Vegas.

Hines bought the property from a limited liability company linked to local mortgage company New American Funding, which bought the property in 2017 for $22.5 million, records show.

The JCPenney store was one of the many locations the national retailer sold off in 2020 amid its Chapter 11 bankruptcy. Hines declined to comment on the purchase price and the sale had not yet appeared in public records as of January 27.

JCPenney still holds a long-term lease on the property, according to Hines.

In December, the firm bought a 145,000-square-foot medical office building in Torrance for $42.5 million, indicating it could develop the site into an industrial property in the future. This month, through a separate fund focused on redevelopment, Hines bought an RV storage yard in Santa Ana for $20 million, with plans to convert it into an 82,000-square-foot industrial facility.

Further south, the firm purchased an 187,000-square-foot, four-building office campus in San Diego at Liberty Station — a waterfront residential and retail area — for an undisclosed sum through its Hines Global Income Trust segment. Records show the buildings were previously owned by Houston-based Lionstone Investments.

Hines, once known for buying and developing large office properties, is “product agnostic,” according to Twardoski. “We’re interested in assets that have many paths — you may have office now, but down the line, it could be industrial.”