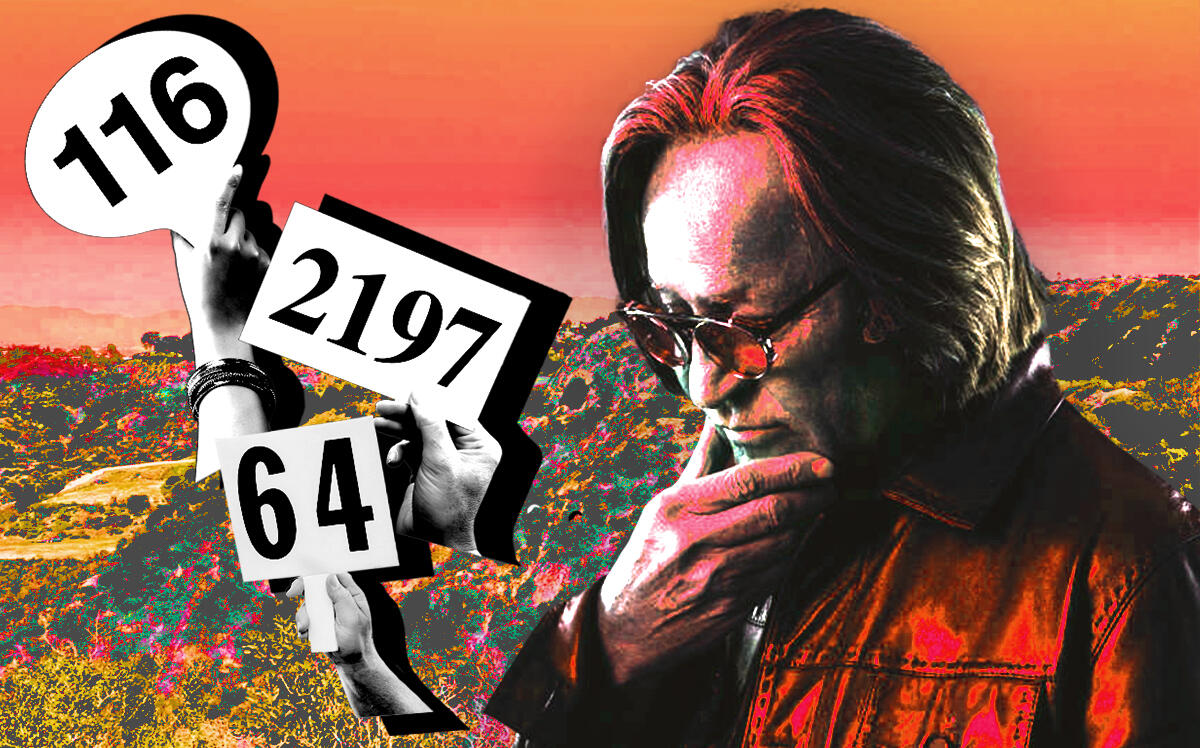

Mohamed Hadid’s last stand

Mohamed Hadid’s last stand

Trending

Bankruptcy auction produces $34M offer on Hadid’s Franklin Canyon parcels

Court approval pending on bid that includes some some cash, with other terms not yet disclosed

A bankruptcy auction for the controversial 66-acre hilltop site where spec developer Mohamed Hadid once envisioned an elaborate compound produced a $34M offer, with terms subject to review by the court.

“Based on our marketing and our feedback from the market, that was a fair price,” said Michael Walters, regional president of Tranzon Asset Strategies, which conducted the auction.

The figure is far below the ambitious pricing previously floated by some parties — in December one lawyer for Hadid insisted a fair price was north of $130 million.

The offer from a so-far undisclosed bidder does appear to cover the debts claimed on the property.

Ronald Richards, a high-powered attorney who represents an entity called Give Back, is the primary creditor in the case, with a claim of around $33.5 million. Richards also is Hadid’s main foil in the long-running saga, and has previously promised that Give Back, an entity with undisclosed funding, intends to preserve the land for public use if it gets ownership.

The auction was held both online and at the Beverly Hilton. Two qualified bidders–one of them Richards–were on site, while one additional bidder registered online but did not bid, according to Walters. A bid of $34.175 million was recorded at 10:47 a.m. Pacific Time on Thursday and remained the only offer.

More details of the offer are expected to be revealed in a pending court filing but have so far remained undisclosed: Some portion of the bid includes cash, while the offer also remains “Subject to Debt,” meaning the debts on the property would transfer to the new owner, who then would have to resolve them with creditors. The offer is subject to approval by a bankruptcy judge, with a hearing over the matter expected within days.

In an interview on Thursday Richards, citing the pending details, remained measured, although he said he supported the trustee’s effort to sell the property.

“I’m not going to oppose the [sale] motion, I can tell you that,” he said. “If this third party buys it, then that’s great — it’ll be subject to my debt.”

The lawyer added that he was relieved to see the process moving out of the court, where a frequently contentious battle has raged for months.

“I’m happy for all parties involved that we’re moving to a conclusion here,” he said.

Sam Leslie, the court-appointed trustee charged with selling the property, did not immediately respond to an interview request. Aram Ordubegian, an attorney for Coldwater Development, the indebted entity that Hadid used to buy the properties, also did not immediately respond.

If approved, the potential transfer of control of the undeveloped land from the court to a new private owner would represent a major turn in a years-long epic that ranks among L.A.’s most protracted and strangest development battles and features Hadid at its center.

The brash spec developer first bought the properties, which are located on a hilltop adjacent to the popular Franklin Canyon Park, north of Beverly Hills, more than a decade ago; at one point his vision for the land included nearly a dozen lavish estates with a helipad, horse stable and guard towers. Those grand spec dreams, however, sparked a fierce backlash from hikers and preservationists, in part because the parcels intersect with a popular public trail. After years of legal battles, Hadid’s entities declared bankruptcy in early 2021, and Give Back — a group whose funding has never been revealed but was alleged by Hadid to come from Prince Alexander von Furstenberg — began buying debt tied to the project. The entity, Richards has said repeatedly, was not interested in developing the site but intended to maintain it as some kind of preserve.

The battle between Hadid and Richards accelerated throughout much of last year, with numerous court filing and intriguing purported buyers floated by Hadid — at one point the developer claimed a member of the Saudi royal family was interested, and then that the deal had fallen through because the Saudi grew furious after believing that a nondisclosure agreement between the two had been breached. Those purported events came to light after Hadid had surreptitiously drained an escrow account related to the case; the judge then appointed the trustee in December — a move that sidelined Hadid but was nevertheless welcomed by the embattled developer’s team.

“We think a trustee can ensure a sale that’s free from interference from those who don’t want to see that sale happen,” Jeff Reeves, an attorney for Hadid, said in December. “There are a lot of people that don’t want to see that property sold for a fair price.”

Read more

Mohamed Hadid’s last stand

Mohamed Hadid’s last stand

Judge Approves Sale of The One

Judge Approves Sale of The One