You’ll have to shell out another $15M for this private Bahamas island

You’ll have to shell out another $15M for this private Bahamas island

Trending

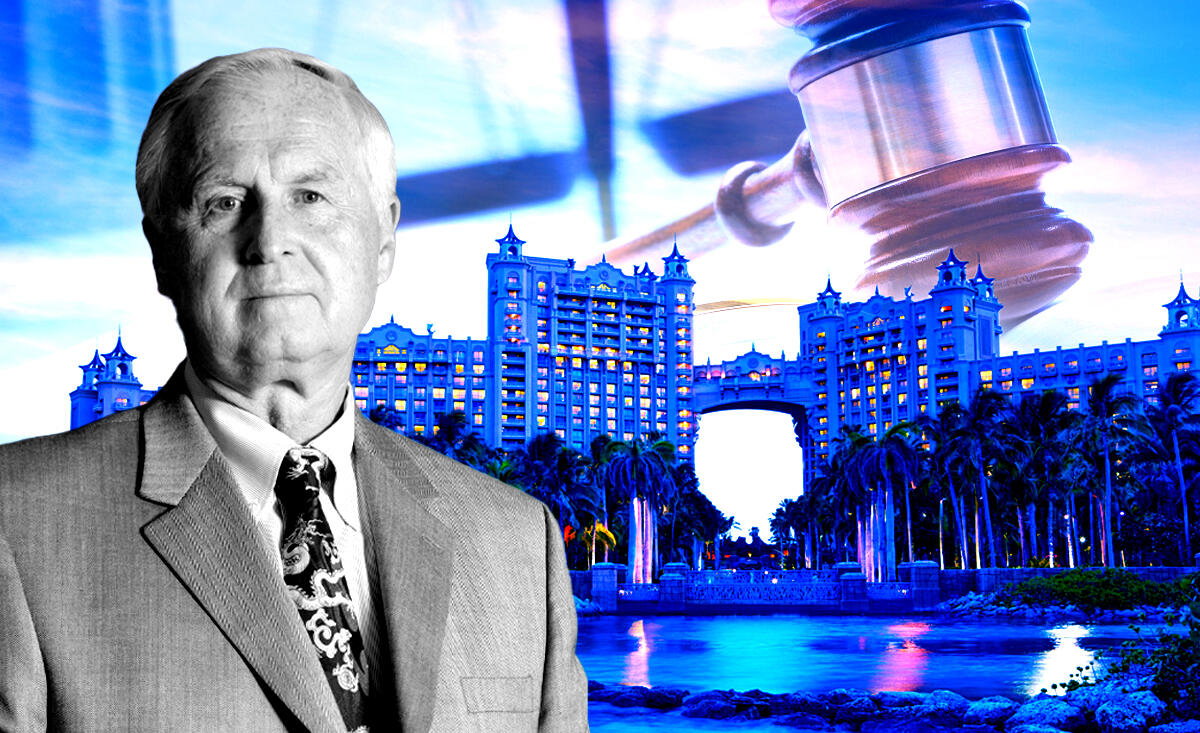

Olen Properties boss Olenicoff sues Atlantis, Brookfield over pandemic-related resort charges

Billionaire is no stranger to court system

The pandemic even affected billionaires.

Kind of.

For Igor Olenicoff, the colorful owner of the Orange County-based real estate management company Olen Properties, a sudden 2020 lockdown led to $100,000 in room charges at the Bahamas resort Atlantis.

Olenicoff says they were unwarranted — and he is suing the resort, its owner Brookfield, its partner, Marriott, and American Express. (Apparently credit limits were not the issue.)

Olenicoff’s gripe traces back to the early days of the virus: In March of 2020, according to the civil complaint filed earlier this month in federal district court, Olenicoff arrived at the Atlantis Paradise Island Resort and Marina on his corporate yacht, “RUSALKA.” The billionaire developer had planned to soak up the Caribbean sun for three months, but his itinerary quickly changed.

“Unfortunately, almost immediately upon arrival, [Olenicoff] learned of the onset of the COVID-19 pandemic and were told to immediately evacuate from the Bahamas,” the complaint says. “The entire Atlantis resort and marina were shut down and guests were taken to the airport to leave out of Nassau, as the Port Control Authorities were also shut down.”

Olenicoff claims that he had no option but to leave the yacht tied up at the resort’s marina, and that no one from the resort was available to discuss or negotiate fees. He returned to pick up the boat four months later, in July, and was hit with approximately $100,000 in credit card charges for a stay that never happened, he claims.

“The ‘room charge’ assessed by [Atlantis] was clearly a misnomer,” the complaint goes on, “as there was no one occupying the hotel at any time, and neither the Atlantis Marina nor the Resort were staffed and open to provide any services.”

The complaint does mention that one crew member stayed aboard the boat; it also points to a release on file with Atlantis that it says was signed by a deckhand and not Olenicoff.

Plaintiffs Olenicoff and Olen Properties name Island Hotel Company Limited, Atlantis’ operator, as well as Brookfield Hospitality Properties, the resort’s owner, and its partner Marriott International. The suit also names American Express, which authorized the resort charges.

A representative for Atlantis did not immediately respond to a request for comment. A representative for American Express also did not immediately respond.

Olenicoff, a longtime South Florida resident who is around 80 years old, is well acquainted with both the high life and high-profile disputes.

The future mogul was born near Moscow into a Tsarist-connected family, but as a young child fled Russia for Iran, according to some reports. (Other reports maintain Olenicoff was actually born in northern Iran, a territory then occupied by the Soviets.) When Olenicoff was 15 the family arrived in New York, according to a 2006 Forbes article, and then headed west; Olenicoff, who became a naturalized American, attended USC before later founding Olen Properties, a Newport Beach-based developer and real estate management firm that now ranks among Southern California’s most prominent. Olen, according to its website, has a portfolio of residential properties throughout the country, including in Florida, Arizona and North Carolina; it also owns and manages various commercial buildings in California, Florida and Illinois.

Along the way Olenicoff became very rich, with a fortune estimated by Forbes at $4.7 billion. He also became well acquainted with the American judicial system: In 2007, Olenicoff pleaded guilty to federal tax charges over his ownership of offshore accounts in the Bahamas, Switzerland and elsewhere. He agreed to pay $52 million to settle that case and avoid jail time.

In 2014 a jury also ordered Olenicoff to pay hundreds of thousands of dollars in an art forgery case in 2016, in what Olenicoff insisted was “sheer nonsense and fabrication,” he also turned up in the Panama Papers.

“For a change, I’m in good company. Every world leader is named in there,’’ Olenicoff told Forbes. “Usually it’s just me — the Russian immigrant who has done well. I’ve moved up in the world.”

Even “Rusalka,” Olenicoff’s yacht — or a previous iteration of it — has generated splashy headlines: Decades ago, in 1990, Olenicoff claimed that the 87-footer was docked off Cozumel when dozens of Mexican narcotics agents, in a vain search for drugs, stormed aboard and destroyed the vessel’s sleek interior, slashing silk upholstery and taking sledgehammers to expensive teak woodwork. Olenicoff also claimed that two deckhands were arrested in the fracas, and blamed the ordeal on a drug policy spat between the American and Mexican governments.

“It’s an absolute mess,” Olenicoff said of the boat at the time.

Olenicoff’s new civil suit seeks a jury trial.

Read more

You’ll have to shell out another $15M for this private Bahamas island

You’ll have to shell out another $15M for this private Bahamas island

Hundreds of California landlords down with PPP

Hundreds of California landlords down with PPP