Investment banker Ken Moelis adds to his Malibu portfolio

Investment banker Ken Moelis adds to his Malibu portfolio

Trending

Tech focused AXCS Capital acquires veteran multifamily financier George Smith Partners

Three-month old acquirer gets 30-year-old Century City-based investment bank on undisclosed terms

A newly incorporated commercial real estate advisory company has acquired George Smith Partners, an investment banking firm with a specialty in commercial real estate.

Los Angeles-based AXCS Capital bought the 30-year-old George Smith Partners, Bisnow reported. Terms of the deal were not disclosed.

George Smith Partners has arranged more than $65 billion in financing for multifamily and other commercial properties since 1979, including $3.5 billion in structured capital transactions last year.

Company founder George Smith, dubbed the “godfather” of real estate finance in Los Angeles, died in 2005. His annual real estate luncheon at the Century Plaza Hotel drew as many as 1,500 guests, and was called the “networking event of the year.”

David Rifkind, one of four partners to found George Smith Partners, died in 2017 at 51.

More than half the firm’s annual loans are for transactions outside the state, according to its website.

AXCS Capital, founded in March, bills itself as “a technology company redefining how capital advisory services are delivered in commercial real estate financing transactions,” according to its website. The firm lists the former office of George Smith Partners and a second office in Anacortes, Washington, 80 miles north of Seattle.

The company doesn’t clarify what the technology is or how it differs from the way capital advisory services are traditionally provided. An acquisition announcement says it envisions “digitizing the capital markets arena.”

An additional statement provided to Bisnow by a representative for the company said that “historically, archaic capital markets infrastructure is far too manual and inefficient,” and that AXCS Capital aims to “upend how capital markets services are currently delivered with modern, tech-enabled solutions that make the process simpler, more transparent, and more successful from start to finish.”

[Bisnow] – Dana Bartholomew

Read more

Investment banker Ken Moelis adds to his Malibu portfolio

Investment banker Ken Moelis adds to his Malibu portfolio

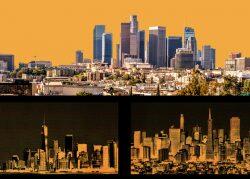

LA was top spot for commercial property investment in Covid-ravaged year

LA was top spot for commercial property investment in Covid-ravaged year