Trending

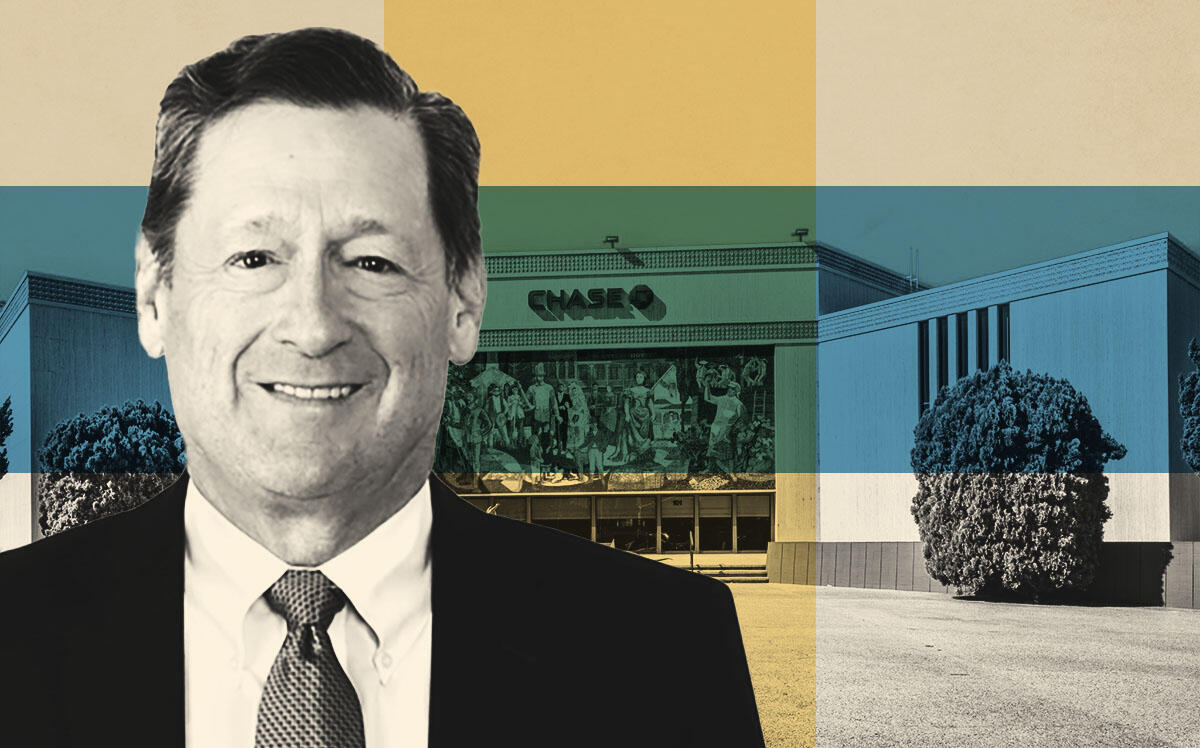

MetLife wants $150M for Chase bank portfolio across state

Insurer puts 22 bank locations from SF to LA on market

MetLife Investment Management is selling a portfolio of Chase bank locations across California after owning the properties for 32 years, The Real Deal has learned.

The insurer is marketing 22 standalone banks from San Francisco to L.A. for a price tag of $149.5 million, according to a LoopNet listing and materials from brokerage CBRE, which did not disclose the name of the seller.

JPMorgan Chase currently leases the properties, which total 252,000 square feet, according to CBRE. JPMorgan, CBRE and MetLife all declined to comment on the listing.

MetLife bought the properties from Home Savings of America in 1990, public property records and filings with the L.A. Department of Building and Safety show, and leased the properties back to the thrift. When Washington Mutual acquired Home Savings for $10.1 billion in 1999, Washington Mutual then occupied the buildings.

Washington Mutual defaulted during the 2008 financial crisis, leading the U.S. government to place the bank into receivership and sell the banking subsidiaries to JPMorgan for $1.9 billion. JPMorgan then took over the properties, using them for Chase bank locations.

The portfolio includes 12 banks in Los Angeles and Orange counties, as well as 10 in San Mateo, Santa Clara and San Francisco counties. MetLife is asking an average of $593 per square foot for the properties.

In L.A., the banks are located at 15625 Whittier Boulevard in Whittier; 2121 Torrance Boulevard in Torrance; 2270 Huntington Drive in San Marino; 2398 Sycamore Drive in Simi Valley; 401 East Valley Boulevard in Alhambra; 27319 Hawthorne Boulevard in Rolling Hills Estates; and 449 North La Brea Avenue in Fairfax.

Chase holds triple-net leases — meaning the tenant pays property taxes and other maintenance costs — on most of the properties through 2030, though leases for two properties in Torrance and San Francisco will expire in 2025.

The properties reel in $7 million in net income, according to CBRE, with Chase paying an average of $2.14 per square a month in Southern California and $2.62 in Northern California. Rents on the banks are set to increase 10 percent in 2025.

The seller has no debt on the portfolio, according to the marketing materials.

Any potential buyer can acquire the portfolio in portions — either just the Northern California properties or the Southern California ones.

MetLife’s institutional investment arm is an active player in California’s real estate market, most recently purchasing a 454,000-square-foot office campus in Irvine for $235 million through a partnership with PGGM. The deal marks the biggest office deal in Orange County this year.