Stake in the Century Plaza Hotel heads for auction block

Stake in the Century Plaza Hotel heads for auction block

Trending

Double whammy: Reuben brothers hit with second Century Plaza suit

EB-5 lenders sue investor bros over shifting up debt stack on $2.5B project

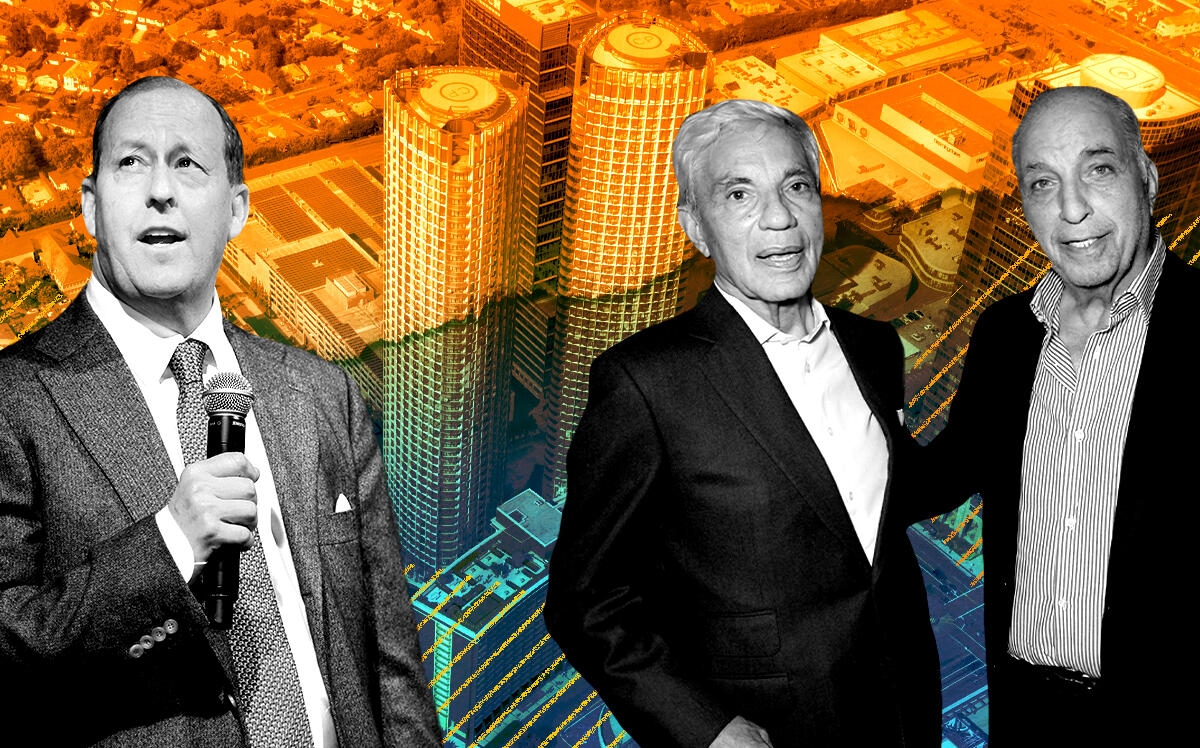

The Reuben brothers want Michael Rosenfeld’s $2.5 billion Century Plaza project all to themselves.

Months after DigitalBridge — a mezzanine lender on the Century City development — sued the investor brothers for allegedly doing nothing after Rosenfeld and his firm defaulted on almost $1.8 billion in loans, the Reubens are now facing a suit from another group of mezzanine lenders.

A group of EB-5 lenders sued the Reuben brothers last week, claiming the U.K.-based investors and their investment vehicle have conducted “a wrongful and tortious campaign to destroy [their] undisputed property interest and any real prospect of repayment.”

The lender group is comprised of 900 foreign investors who each contributed $500,000 to the loan pool in exchange for seeking a permanent visa in the U.S. through the federal EB-5 program.

Together, the group contributed a $450 million junior mezzanine loan in 2016, to be used as construction financing. JPMorgan Chase Bank and a consortium of investors that included the Reubens contributed a $446 million senior loans, while DigitalBridge — formerly Colony Capital — gave a $120 million senior mezzanine loan.

Senior lenders, like JPMorgan Chase and the consortium, in this case, would get paid out in the event of a default before the mezzanine lenders.

Over the course of four years, the Reubens carefully reshuffled the debt stack to hold more than $1.2 billion in senior and mezzanine loans. By doing so, the brothers have whittled away the rights of more junior lenders to reclaim loan payments, the EB-5 lenders said in their complaint.

Neither a representative for the Reuben brothers, nor Rosenfeld, responded to requests for comment, though the Reubens declined to comment for a previous story on Century Plaza.

Now that the property is facing foreclosure, with an auction scheduled for Dec. 14, the Reubens and their investment vehicle Motcomb Estates plan to bid on the property, according to the filing.

“The Reuben brothers will receive all of the profits from future operation of the now recently fully-completed project,” the EB-5 lenders wrote. “To the detriment of the plaintiffs.”

Sayonara

Michael Rosenfeld, who spent nearly 15 years planning to redevelop the historic Century Plaza Hotel at 2025 Avenue of the Sars, is all but guaranteed to lose the project at the UCC foreclosure auction, unless he can come up with cash — and a lot of it — to bid on the project.

Rosenfeld and his firm, Next Century Associates, would need to pay at least $965 million to avoid a foreclosure — an amount that is ever increasing, according to notices filed with L.A. County and court documents.

The EB-5 lenders claim that the Reuben brothers burdened Rosenfeld with excessive amounts of debt, instead of agreeing to an extension on the loan in July 2021, at least until the project opened and it could start to collect income.

The Reubens were strategic, the lenders said, “recognizing that the setbacks caused by the pandemic gave [them] the opportunity to seize control of the project without placing its own money at risk.”

One caveat in a contract between the Reuben brothers, Rosenfeld and DigitalBridge was revealed in the EB-5 suit: the brothers can charge high rates of interest for “protective advances” given to the project.

Protective advances are sums given to the borrower and they often involve a superior lien against the physical property. In the event of a default, it would get paid out first.

When the Reubens took over as a senior lender in 2020, and said they would provide an additional $275 million senior mezzanine loan, they required any additional funding be taken as protective advances, rather than the senior mezzanine loan.

In this case, Rosenfeld would have had to pay 20 percent interest to the Reubens to access any funding for the project.

By making the capital more expensive, the suit claims, it was going to be impossible for Rosenfeld to ever pay back enough to cover the original EB-5 loan.

“Hardass sons of bitches”

The EB-5 lenders are now at odds with the more senior mezzanine lender, DigitalBridge.

When DigitalBridge filed its suit earlier this year, it pushed the court to force the Reubens to foreclose on the project, so the firm could recover some of its owed debt.

But, the EB-5 lenders are now seeking to block the foreclosure, arguing the court should first determine the alignment of the debt stack and whether the Reubens breached a fiduciary duty.

The Reubens now have two routes to obtain the property — through a UCC foreclosure sale in December, or a deed of trust sale. For the latter, a court requires a property be sold to pay off the most senior debt, in this case, the Reubens’ senior loan.

Given that the Reubens hold both the senior and mezzanine loans, there is essentially no way for anyone else to take control of the project, unless a bidder can come up with cash to match what is owed on the property.

The Reubens have spent a significant chunk of the last two and a half years shaking up the commercial real estate industry across the U.S. They’ve initiated foreclosure proceedings against One Thousand Museum in Miami and the Witkoff Group and Ian Schrager’s West Hollywood Edition in L.A.

“Everybody now knows the Reuben brothers that are coming to town to lend money are hardass sons of bitches,” Todd Michael Glaser, who was part of a consortium that developed One Thousand Museum, told TRD last year. “They just want to be assholes.”

Read more

Stake in the Century Plaza Hotel heads for auction block

Stake in the Century Plaza Hotel heads for auction block

Inside Michael Rosenfeld's $1.8B odyssey at Century Plaza

Inside Michael Rosenfeld's $1.8B odyssey at Century Plaza