Trending

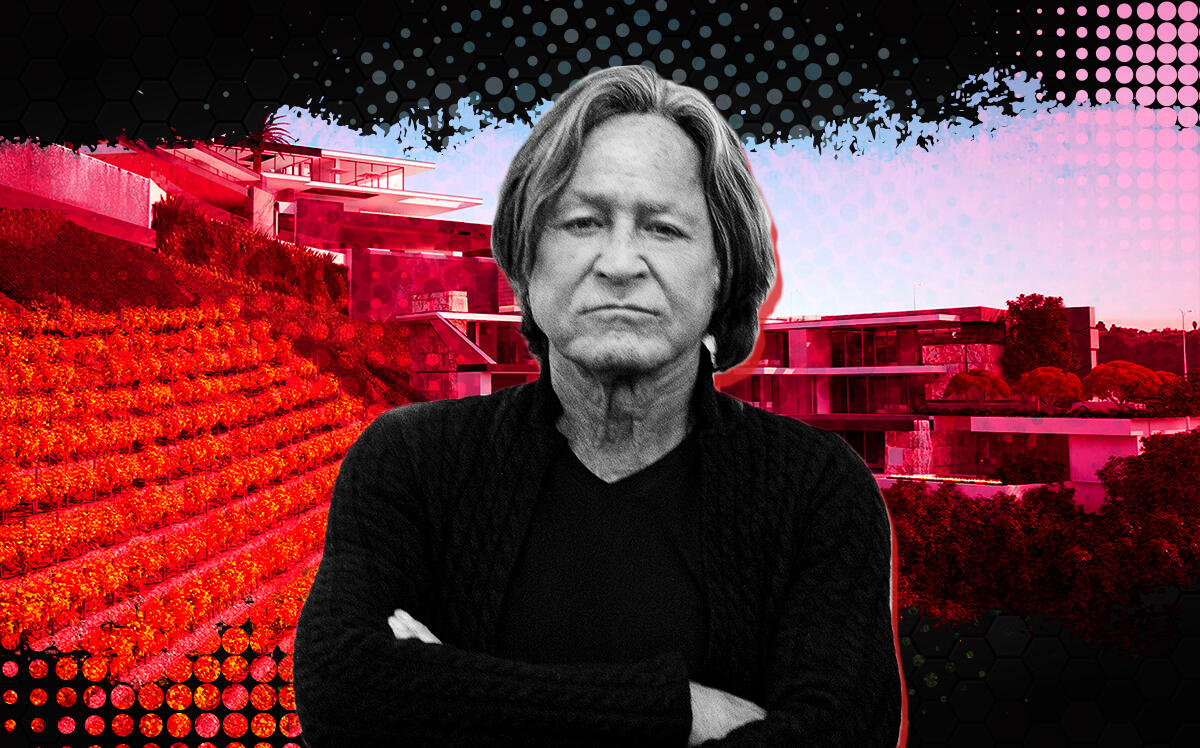

Judge OKs emergency loan to fix erosion at Hadid mansion

Custom developer has filed bankruptcy on partially built 37-acre Beverly Hills estate

A partially built megamansion owned by Mohamed Hadid, which reportedly holds the distinction of being the largest home ever permitted in Los Angeles County, was in danger of being dismantled before a judge approved emergency funding to save the site.

California Bankruptcy Court Judge Sheri Bluebond approved a $6.5 million loan for a Hadid-controlled entity called Treetop Development LLC, recent court filings show. The limited liability company owns 9650 Cedarbrook Drive in Beverly Hills, a planned 78,000-square-foot home that was once on the market for $250 million. Custom-house developer Hadid filed for bankruptcy on the property last August.

In a court filing, Hadid’s counsel cited erosion issues that threatened to damage both the mansion and neighboring properties. The debtor-in-possession financing — a type of loan given to companies under Chapter 11 bankruptcy protection — will go towards paying for contractor and engineering services to deal with erosion at the site. The lender for the loan is 364 Capital LLC, a Florida-based firm headed by Renzo Renzi.

According to court documents, the erosion issues also pose a risk to the entitlements on the property. The project, which sits on a 37-acre lot, consists of 12 separate parcels. Plans for the site call for a main residence and a guest house with 19 bedrooms, 28.5 bathrooms, a Turkish bath, indoor and outdoor pools and a bowling lane.

“Failure to implement these measures risks the loss of the property permits, as well as threatens the physical stability of the property and neighboring parcels. Moreover, if the debtor loses its permits, it may be required to return the property to its original condition and deconstruct all of the existing initial development conducted to date,” the court document states.

Hadid relisted the Cedarbrook Drive property in August of last year.

In addition to the astronomical $250 million asking price, he also offered to sell the property for $92 million once the foundation was completed. The value of the property is a moving target, court records show. In his bankruptcy filing, Hadid estimated the property at $105 million. An appraisal report from June 2018 had the “as-is” market value of the mansion at $87.5 million. That report also estimated a valuation of $106 million once the project was completed. The latest valuation, a broker’s opinion of value from September, estimated the “as-is” value of the property at $80 million.

This is not the first time that Hadid has faced structural issues with one of his properties. In 2019, a judge declared a half-built Bel-Air mansion that he owned at 901 Strada Vecchia Road “a danger to the public” and ordered a teardown of the site. Last year, he was ordered to pay $3 million in damages for that project.