Trending

Reports: Florida leads U.S. in “zombie foreclosures” and sees decrease in overall foreclosure rate

They’re not living and they’re not dead, and in Florida, they’re leading the country.

Despite an overall decrease in foreclosure rates in Florida, the Sunshine State has the most zombie foreclosures — houses that have been vacated but haven’t been repossessed, according to two separate reports released this week.

Foreclosure rates are down

Foreclosure rates in Miami, Miami Beach and Kendall decreased for the month of November over the same period last year, according to CoreLogic data released Thursday.

The rate of foreclosures among outstanding mortgage loans in Miami-Dade was 4.78 percent for the month of November 2014, a decrease of 4.57 percentage points compared to November of 2013 when the rate was 9.35 percent.

The area’s mortgage delinquency rate also decreased by nearly 5 percentage points — 10 percent of mortgage loans were late by 90 days or more.

Yet: One in four U.S. foreclosures are “zombies,” a.k.a. vacated by their homeowners and not yet repossessed by banks

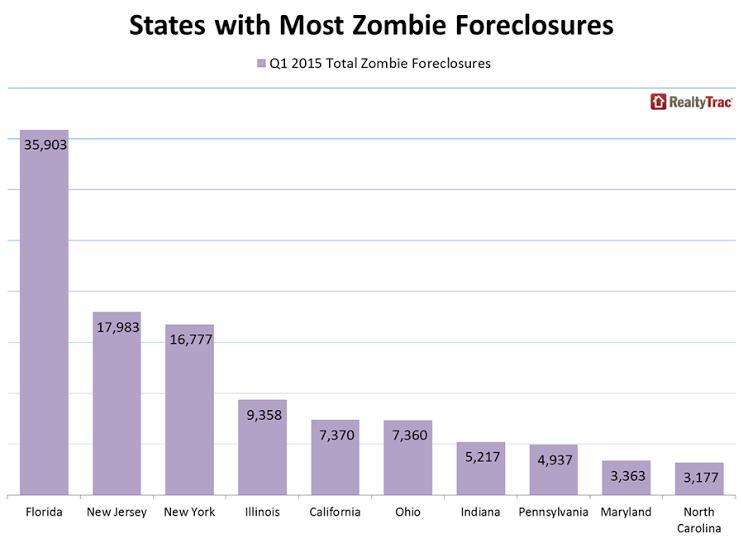

Despite the decrease in foreclosure rates, Florida continues to lead the nation in what RealtyTrac is calling “zombie foreclosures” — and that’s with a 35 percent decrease in those foreclosures compared to a year ago — with 35,903, down from 54,908 in the first quarter of 2014.

Zombie foreclosures accounted for 26 percent of all foreclosures in Florida.

RealtyTrac vice president Daren Blomquist said that’s not necessarily a bad thing.

“In states with a bloated foreclosure process, the increase in zombie foreclosures is actually a good sign that banks and courts are finally moving forward with a resolution on these properties that may have been sitting in foreclosure limbo for years,” Blomquist said in a statement. “In many markets there is plenty of demand from buyers and investors to snatch up these distressed properties as soon as they become available to purchase.”

New Jersey and New York closely followed the Sunshine State in the number of zombie foreclosures.