Trending

SoFla among top 20 markets for residential loans

The South Florida market ranked among the nation’s highest for residential loans recorded during the second quarter of this year, according to a new report from RealtyTrac.

Measuring data from Miami, Fort Lauderdale and Pompano Beach, the report found that a total of 36,207 residential loans were originated in the second quarter. That number has grown 21 percent year-over-year, though it fluctuates each quarter.

Of those loans originated during the second quarter, 17,116 were taken out for the purpose of purchasing a single-family home or condo, while 19,091 were refinance loans. The average dollar amount per loan in South Florida was $744,366 — an increase of 10 percent year-over-year.

The only other metro that came close to South Florida in the state was the Tampa area, which encompasses Clearwater and St. Petersburg. That area saw 21,285 loans, which was an increase of 23 percent year-over-year — comparable growth to South Florida.

Mike Pappas, owner of Keyes Co.

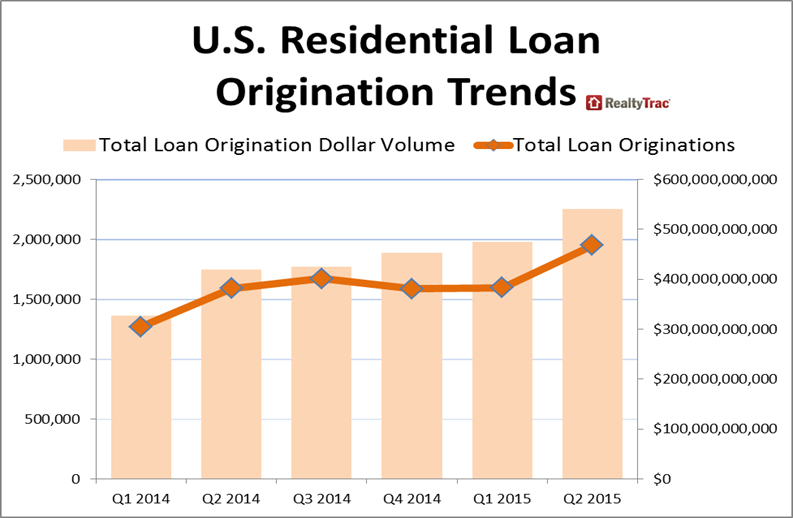

Nationally, $540 billion was lent out during this year’s second quarter. The majority of that, $307 billion, went into refinancing. The remaining $234 billion was used for residential purchases.

“Our second quarter South Florida written contracts are at a record pace, up 16 percent from a year ago,” Mike Pappas, CEO and president of Keyes Company, wrote in the report. “This should translate into a surge in loan originations in the third quarter. First time home buyers are picking up the slack from the decline in investors and taking advantage of the reduced [Federal Housing Authority] fees.”