Trending

The week in real estate reports

Miami ties for third-highest share of distressed home sales

Miami-Dade County had the nation’s third highest share of distressed home sales during September, behind only Tampa and Orlando.

Out of all the county’s home sales that month, 21.2 percent of them were distressed — a home that’s either at risk of foreclosure or lender-owned, according to a CoreLogic report.

Though the local rate is comparatively high, Miami-Dade’s share of distressed sales has been gradually decreasing as the housing market strengthens. Compared to the same month last year, the county’s distressed sales rate is down 4.5 percentage points.

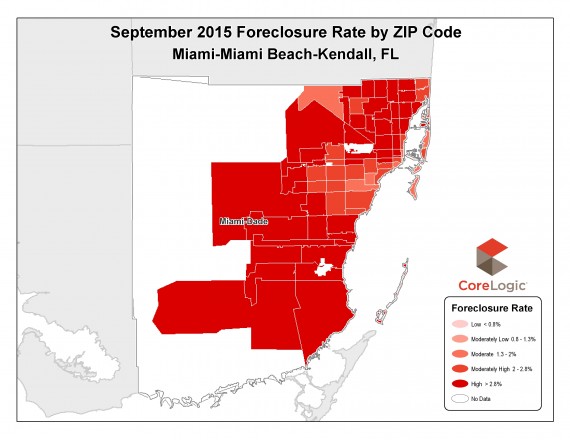

A heat map of foreclosure rates in Miami-Dade County

Miami-Dade foreclosure rate dips

Miami-Dade County saw yet another month of declining foreclosure rates during September, according to a new report from CoreLogic.

The county’s foreclosure rate stood at 3.38 percent during September, a decrease of nearly 2 percentage points compared to the same month in 2014.

Mortgage delinquencies, where a borrower doesn’t make a payment during a set time period, were also down in September. The county’s delinquency rate was 7.74 percent, a decrease of 3.57 percentage points from last year.

South Florida sees uptick in cash sales

Despite this year’s trend of declining cash sales, South Florida saw a small uptick in homes purchased without financing during October.

A new report from RealtyTrac said 53.7 percent of the tri-county area’s home sales were in cash. That’s almost a 4 percentage point increase in all-cash deals since this summer.

The Miami metropolitan area was once the king of cash sales throughout the U.S., partially thanks to its equally high foreclosure rate during the economic downturn. Now, the region ranks fourth, behind Homosassa Springs, Florida, Naples, Florida and Columbus, Georgia. — Sean Stewart-Muniz