Trending

EJF Capital is latest investor to tap Opportunity Zones profit potential

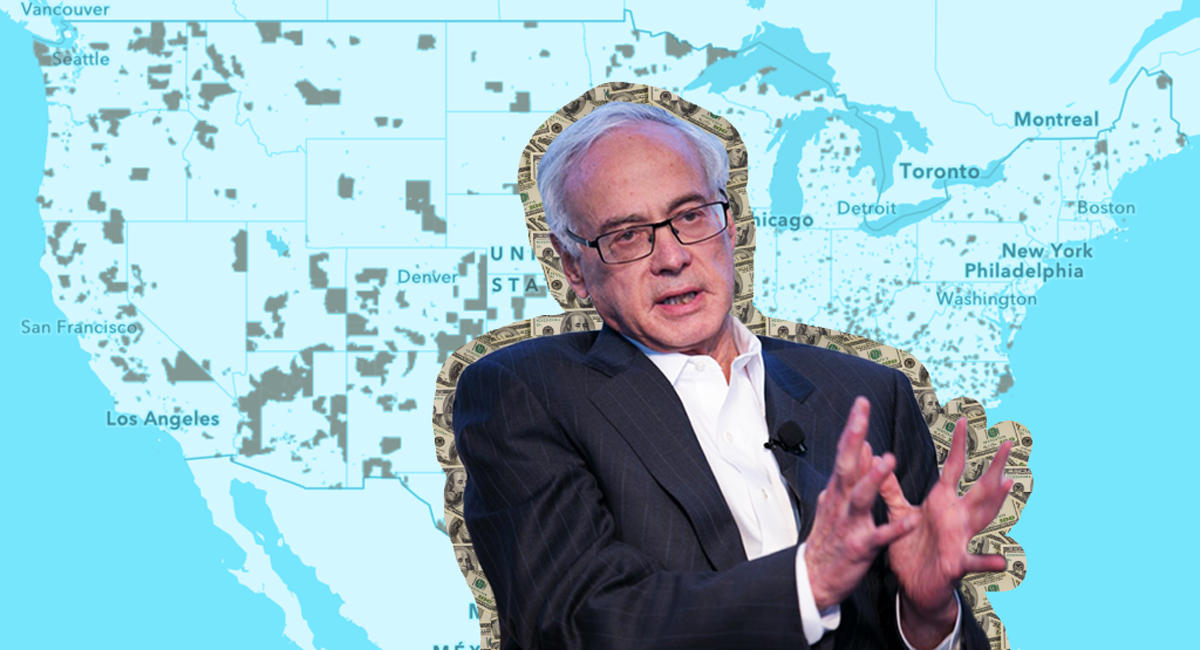

The hedge fund is aiming to raise $500M in real estate projects in low-income areas nationwide

Investors are going all in on a government program that allows them to defer and potentially forgo paying capital gains taxes by investing in economically distressed areas.

EJF Capital is the latest institutional investor seeking to tap the Opportunity Zones program, Bloomberg reported. The Arlington, Virginia-based hedge fund aims to raise $500 million through a fund to invest in real estate projects in those low-income areas nationwide.

The Opportunity Zones program was passed as part of President Trump’s tax reform plan in late December and has begun to catch investors’ eye in a big way.

So far, 8,700 low-income communities across the U.S. have been designated Opportunity Zones.

Investors have begun pouring in. In July, crowdfunding startup Fundrise said it plans to raise $500 million to take advantage of the federal program. A month after that, RXR launched a fund seeking to raise $500 million for the Opportunity Zones, primarily through high net-worth individuals and in August; developer Youngwoo & Associates and investment startup EquityMultiple said it also wanted to raise $500 million for the program.

Goldman Sachs has said it was considering setting up a fund to invest in these zones.

EJF, led by Emanuel “Manny” Friedman, has nearly $7 billion in assets under management. It is looking to make its Opportunity Zones fund available to some wealth management platforms, according to Bloomberg. That would allow it to raise additional money and to increase the pool of investors. The money manager is seeking to partner with developers nationally and plans to take equity stakes in a diversified group of projects.

Supporters say the Opportunity Zones program will spur on large amounts of new development in struggling areas. But some argue that because the legislation has been written so broadly, smart real estate developers and investors will take advantage by investing in projects they would have developed anyway. [Bloomberg] — Keith Larsen