Trending

Starwood weighs buying back Israeli bonds as price tumbles

Bond price fell 42% since bonds were offered in March

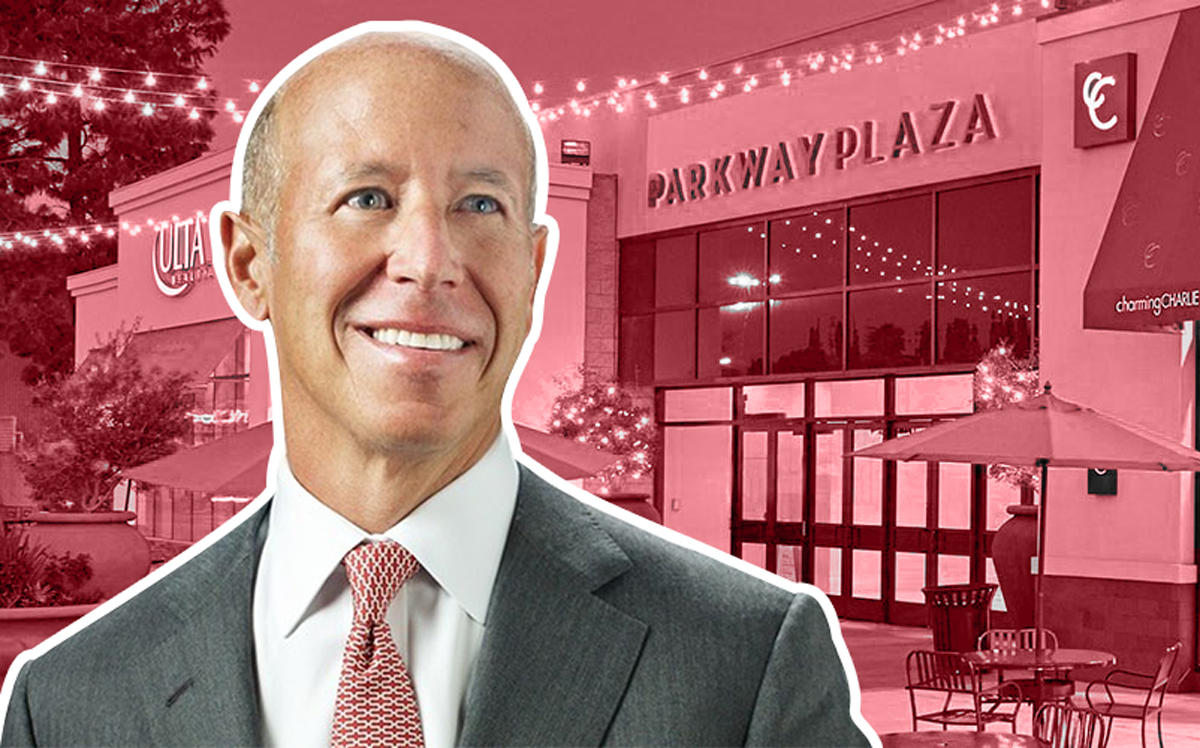

The Israeli bond price of Starwood Capital Group’s debt on a portfolio of U.S. shopping centers has plummeted 42 percent since the bonds were offered in March, leading the firm to consider buying back the bonds.

The Tel Aviv bond market offers cheaper financing at better rates than in the U.S. While Israeli bonds issued by other real estate firms in the U.S. trade at yields between 2.8 percent and 5.9 percent, Starwood’s yield on the mall debt surged to 23.6 percent.

A Starwood unit raised about $244 million, or 910 million shekels, to refinance the portfolio of seven malls in March, according to the Wall Street Journal. The combined net operating income of the shopping centers fell 4.8 percent between January and September of this year, which Starwood attributed to rent cuts dealt to tenants to maintain occupancy.

The portfolio also includes five Sears stores, two of which are owned by Sears Holdings Corp. Sears filed for bankruptcy in October.

A Starwood spokesperson told the Journal that the Miami Beach and Greenwich, Connecticut-based firm is reviewing taking a buying position in the bonds, but that “any consideration of investing into these bonds requires a careful review of our fiduciary duties and additional approvals.” [WSJ] – Katherine Kallergis