Trending

Turbulence ahead as Covid-19 stimulus aid keeps rents afloat in SoFla CRE

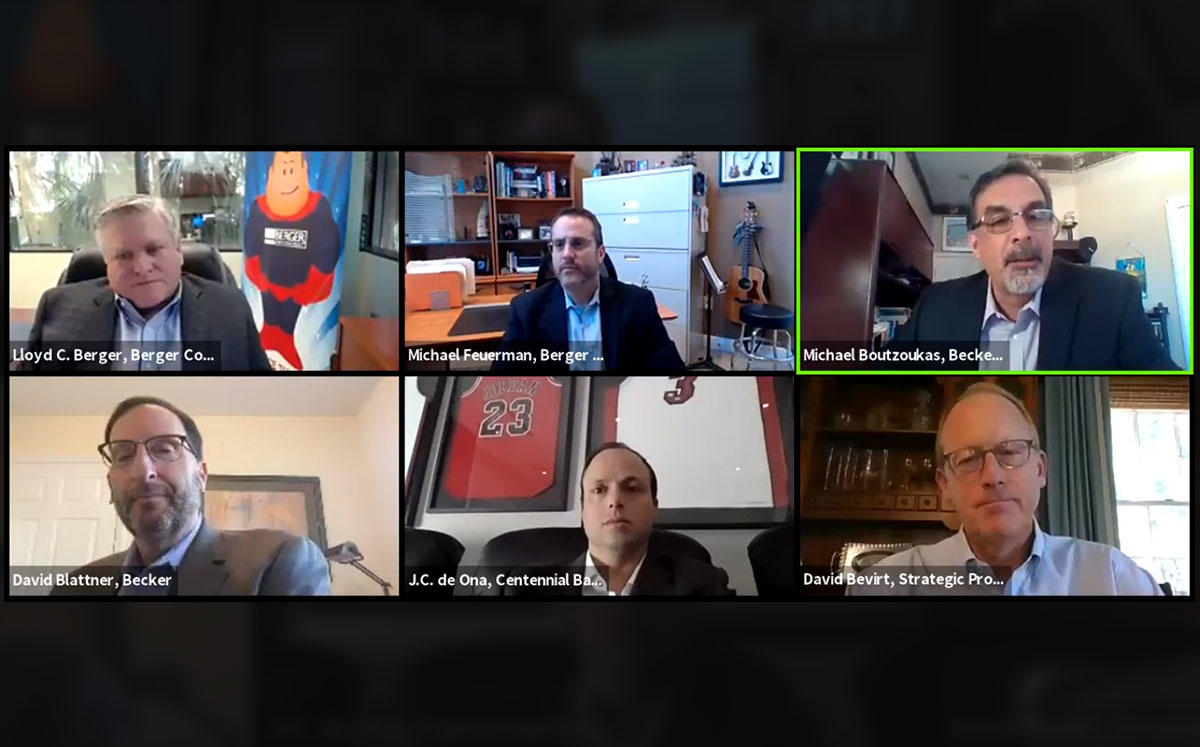

Becker & Poliakoff webinar panelists predict difficult months ahead as a deep recession is about to begin

Stimulus aid to small businesses has kept commercial landlords afloat since the coronavirus pandemic shut down most aspects of everyday life in South Florida. Yet, the future landscape remains uncertain amid an impending recession, according to brokers, bankers and lawyers.

“So much stimulus money is backing up tenants,” said Lloyd Berger, president of Fort Lauderdale-based Berger Commercial Realty. “We are collecting 90 percent of our rents on our commercial properties and 88 percent of our multifamily rents.”

Berger, a panelist on a Becker & Poliakoff commercial real estate webinar on Wednesday, said the aid has made it harder to gauge how big of a hit to rental income commercial landlords are facing.

“When that [stimulus money] passes, we will really know what the rent rolls are,” Berger said. “Until then, it is hard to advise clients.”

The panel also featured Michael Feuerman, Berger Commercial’s managing director; J.C. de Ona, southeast Florida division president for Centennial Bank; David Blattner, a Becker & Poliakoff shareholder; David Bevirt, executive vice president of Tampa-based Strategic Property Partners; and moderator Michael Boutzoukas, a Becker & Poliakoff shareholder.

De Ona said he has also noted apartment building landlords are benefitting from their tenants receiving stimulus checks. “Most of our clients in our multifamily [portfolio] are still collecting in the 90-plus percent range,” de Ona said. “That may change when the stimulus money is gone.”

Feuerman said commercial brokers, property owners and lenders need to prepare for the worst when the stimulus aid dries up. “There is going to be more turbulence in the market,” Feuerman said. “[Landlords will] have to deal with tenants who are asking for relief and dealing with tenants that vacate and abandon. We are in the beginnings of a deep recession.”

Centennial Bank views garden-style apartment projects and single-family home construction as safe bets going forward, de Ona added.

“Retail is a big, big question mark,” de Ona said. “Some retail stores are not going to come back from this. It was a dagger in a lot of sectors of retail.”

He said hotels, after years of record-breaking numbers for occupancy and revenue per room, are staring at a two-year recovery. “I think hotels on the coast will recover sooner,” de Ona said. “Those by the airport will take some time to get back to profitability or breaking even.”