Trending

Money in the bank: Here are the South Florida real estate players who got PPP loans

Some of the largest loans went to Coastal Construction, Stiles, Turnberry Hotels and the Valls family

UPDATED, July 7, 6:30 p.m.: Many of South Florida’s top developers, contractors, hoteliers, architects and restaurateurs got a piece of the federal government’s Paycheck Protection Program.

Companies tied to the Related Group, Dezer Development, A-Rod Corp, Shoma Group, Whitman Family Properties and Coastal Construction are among those who scored PPP loans, according to the Trump administration’s release of the data. The release follows the recent approval of a third phase of applications for the $670 billion in PPP funding.

Here’s a look at South Florida’s biggest firms with real estate ties that received the loans:

Developers, investment firms

In the $5 million to $10 million range: Stiles Corp., a major developer in Fort Lauderdale, secured a loan.

Jorge Pérez’s Related Group received two loans, each ranging from $2 million and $5 million: PRH Investments LLC, which is short for Perez Ross Holdings; and TRG Management Company, a Related affiliate.

Whitman Family Properties, owner of Bal Harbour Shops, got between $1 million and $2 million.

The Allen Morris Company, a development and investment firm based in Coral Gables, also received between $1 million and $2 million.

Two of Moishe Mana’s companies, Mana Common Marketing and Mana Miami Management LLC, each secured loans in the $350,000 to $1 million range. So did Shoma Alliance Management Corp, led by Shoma Homes developer Masoud Shojaee; Butters Development Corp and Butters Realty Management Corp.; and Dezer Development, led by Michael and Gil Dezer. (Dezer Hotel Management received between $150,000 and $350,000.

Design District Management Inc., an affiliate of Craig Robins’ Dacra, scored a loan between $350,000 and $1 million. Dacra has led the transformation of the Miami Design District.

A-Rod Corp, the investment firm led by retired baseball superstar Alex Rodriguez, received between $150,000 and $350,000. Rodriguez’s Monument Real Estate Services received between $1 million and $2 million.

Advenir Real Estate and Tzadik Properties each scored loans in the $2 million to $5 million range.

Jeff Berkowitz’s Berkowitz Development Group got between $150,000 and $350,000. Metropica Development received a loan in the same range.

Construction

Coastal Construction was in the top tier, scoring a loan ranging from $5 million to $10 million. The construction company, led by the Murphy family, is one of the largest in South Florida. West Palm Beach-based Kast Construction Company also secured a loan in the same bracket.

Beauchamp Construction, Brodson Construction and Jaxi Builders each received loans between $1 million to $2 million.

Architecture

Zyscovich Architects, led by Bernard Zyscovich, received between $1 million and $2 million to retain 106 employees. Three companies tied to Bernardo Fort Brescia’s Arquitectonica – Arquitectonica International ($1 million to $2 million), Arquitectonica CA PA ($350,000 to $1 million) and Arquitectonica Geo ($150,000 to $350,000) – scored loans.

In the $350,000 and $1 million range: Kobi Karp Architecture & Interior Design, and Behar Font and Partners both received loans. Chad Oppenheim’s Oppenheim Architecture & Design secured a loan in the $350,000 to $1 million range.

Brokerages

South Florida’s top real estate brokerages also tapped the PPP program. Fortune International Group and Fortune International Realty each received between $1 million to $2 million. MDLV LLC, which is One Sotheby’s International Realty, and the Keyes Company each also scored loans in the same range.

Optimar Realty Group, based in Sunny Isles Beach, landed between $2 million and $5 million.

Hotels

A number of restaurants, hotels, and hotel management and investment firms received PPP money. Turnberry Hotels Management Group, led by Jackie Soffer, secured a loan in the $5 million to $10 million range, for about 500 retained employees. Jeffrey Soffer’s Fontainebleau Development received $1 million to $2 million to keep 87 employees.

Acqualina Management LLC, which manages the Trump Group’s Acqualina Resort & Spa in Sunny Isles Beach, scored between $2 million and $5 million. The Trump Group is not affiliated with President Trump.

The Biltmore Hotel

The Biltmore Hotel Limited Partnership received a loan in the $2 million to $5 million range for the historic Coral Gables property. South Beach Group Hotels, which laid off a number of employees early on in the pandemic, as well as Soho Beach House, Morgans Hotel Group Management, and the Betsy Hotel on Ocean Drive also received loans in the same range.

The Di Lido Beach Resort, a joint venture between Lionstone Development and Flag Luxury, got a loan ranging from $2 million and $5 million, for the Ritz-Carlton in South Beach, which is closed. Lionstone Group also got a loan in the $150,000 to $350,000 range.

Virgin Hotels North America, which is based in Coconut Grove, received between $350,000 and $1 million.

MDM Brickell Hotel Group and MDM Hotel Group, led by Ricardo Glas and Luis Pulenta, each scored between $1 million and $2 million.

Restaurants

The Valls family’s Valls Group Holdings received one of the larger loans, between $5 million and $10 million, for its group of restaurants, which include La Carreta and Versailles Restaurant. Flanigan’s Enterprises, which operates the popular chain of restaurants, bars and liquor stores, also scored between $5 million and $10 million.

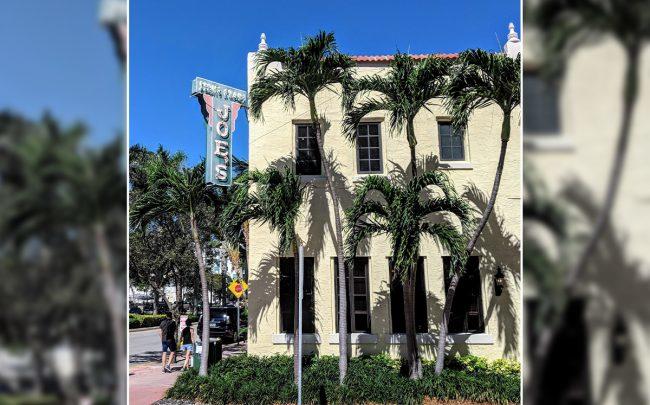

Joe’s Stone Crab (Credit: Cullen328/Wikipedia)

Joe’s Stone Crab, Mango’s Tropical Cafe, and Pizzerias LLC — which operates Papa John’s franchises — each received between $2 million and $5 million.

Companies tied to nightclub operator and restaurateur David Grutman, who sold a majority stake of his company to Live Nation Entertainment last year, also received PPP funds. Groot Design District Hospitality, tied to Live Nation, secured a loan ranging from $1 million to $2 million for Swan & Bar Bevy.

Salt Bae’s Nusret Miami, Nobu Associates, Prime 112, Milos by Costas Spiliadis, and the Pinecrest Bakery chain each scored loans ranging from $1 million to $2 million.

Cafe La Trova (Credit: Google Maps)

Michelle Bernstein’s Cafe La Trova in Little Havana, which voluntarily closed its dining room last week, Pincho Factory’s Pincho Holdings and the Salty Donut each received between $350,000 and $1 million.

Michael Schwartz’s Genuine Hospitality Group, owner of Harry’s Pizzeria, Michael’s Genuine Restaurant and Bar, and other restaurants, received a loan in the $150,000 to $350,000 range.

Benihana, Ra Sushi and Tap 42 also secured loans for multiple South Florida properties.

A spokesperson for Benihana confirmed that it applied for the loan but “did not ultimately accept the loan payment.”