Politicians want Feds to rescue CMBS market

Politicians want Feds to rescue CMBS market

Trending

Blackstone says goodbye to CMBS fund

Net assets have declined by more than $200M since year-end

Blackstone Group is throwing in the towel on a mortgage-backed securities fund.

The company is winding down the Blackstone Real Estate Income Master Fund, which realized a 24 percent decline when the coronavirus struck in March, according to Bloomberg. In a filing, Blackstone said closing the fund would provide its shareholders with cash and the “best path to maximize portfolio recovery.”

The fund will continue to be actively managed until it is liquidated. Blackstone said in its filling that the Master Fund’s assets “have begun to see a recovery in pricing since the recent trough related to the outbreak of COVID-19.” CEO Stephen Schwarzman forecasted a V-shaped recovery last month.

Read more

Politicians want Feds to rescue CMBS market

Politicians want Feds to rescue CMBS market

Colony Capital may lose control of 2 largest CMBS hotel portfolios

Colony Capital may lose control of 2 largest CMBS hotel portfolios

Submerged in securities: Many CMBS hospitality loans may be underwater soon

Submerged in securities: Many CMBS hospitality loans may be underwater soon

At the start of the year, the fund had $687 million in commercial mortgage-backed securities, and $227 million in residential mortgage-backed securities. The securities the fund held were reportedly packaged by both government entities and private issuers.

Blackstone bought the fund’s assets in part with $400 million borrowed through reverse repurchase agreements, filings cited by Bloomberg show. In the past five years, the fund had an average annual return of 5.52 percent.

By May 31, the fund’s net assets had fallen to $553 million from $773 million at year-end.

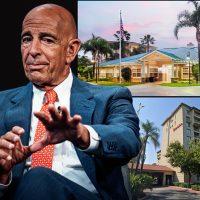

The closure of the fund comes as CMBS delinquencies soar, particularly in the hospitality sector. Tom Barrack’s Colony Capital is at risk of losing control of two hotel portfolios financed by CMBS, and consensus is emerging in Congress for the federal government to prop up the market. [Bloomberg] — Erin Hudson