Trending

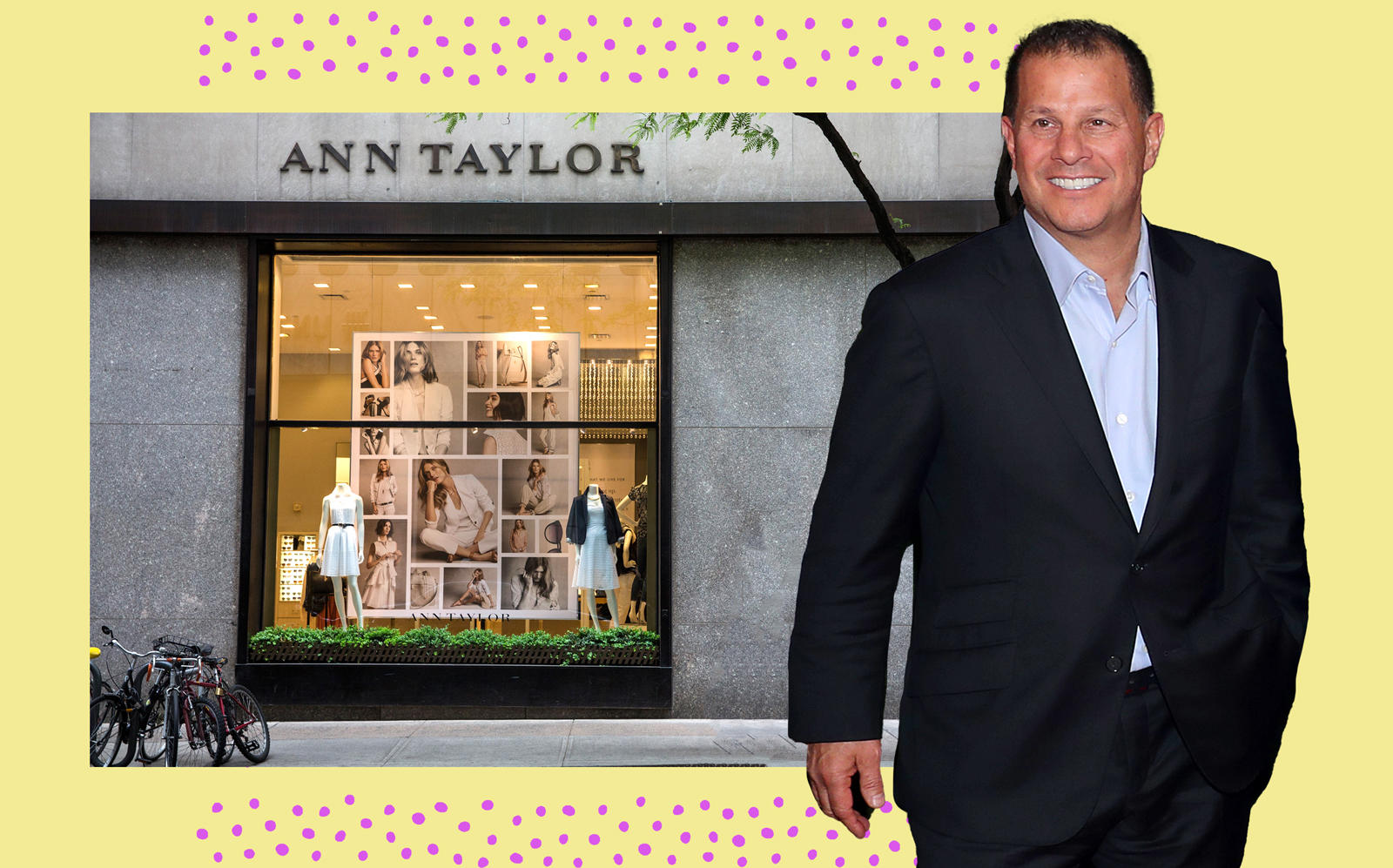

Authentic Brands, Sycamore eye buy of Ann Taylor parent company

The companies, along with mall owners Simon and Brookfield, have been buying bankrupt retailers

Authentic Brands wants to make another big investment in the retail apocalypse.

The company, along with frequent partners Simon Property Group and Brookfield, is eyeing the purchase of Ascena Group, according to Bloomberg. The parent company of Ann Taylor, Loft, and Lane Bryant filed for Chapter 11 bankruptcy last week.

Private equity firm Sycamore Partners is also looking to bid on the struggling company.

In its filing, the terms of which remain fluid, Ascena said it would close 1,200 of its 2,800 locations putting many of its 40,000 employees at risk of unemployment.

Authentic and Sycamore have emerged as major players in the consolidation of retail, a trend ignited by e-commerce and fueled by coronavirus closures. The companies are also looking to purchase bankrupt department store J.C. Penney.

Ascena’s current bankruptcy terms will allow lenders — Bain Capital and Monarch Alternative Capital are reportedly among them — to acquire equity and appoint directors to its board in exchange for relieving a portion of its debt.

While Bain and Monarch plan to each appoint their own director, a consortium of other lenders including Eaton Vance and Lion Point will collectively appoint a single director to the board.

In the last 18 months, Authentic acquired Forever 21, Barneys New York and Sports Illustrated, and has bought more than 40 companies since 2010.

Sycamore has invested in companies such as Staples, The Limited, Aerospostale and Hot Topic.

Ascena’s other brands include Lou & Grey, Cacique, Justice and Catherines. The company said it will close all its Catherine’s locations, and auction off its assets. [Bloomberg] — Orion Jones