Voters reject Terra’s proposal to redevelop Miami Beach Marina with condo tower

Voters reject Terra’s proposal to redevelop Miami Beach Marina with condo tower

Trending

Florida voters approve “Save Our Homes” extension, property tax discount for widows of veterans

Homeowners now have up to 3 years to transfer Save Our Homes benefit

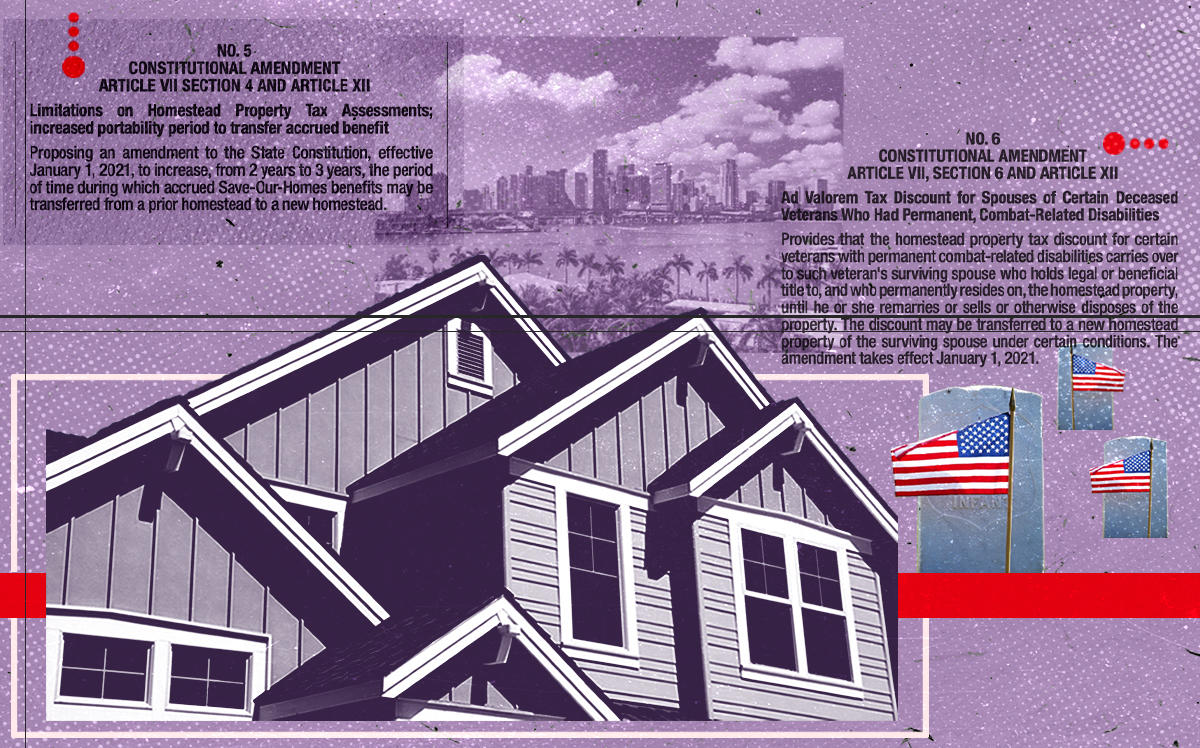

Floridians voted to pass two homestead-related amendments to the Florida Constitution on Election Day.

Amendment 5, the extension of the “Save Our Homes” portability period amendment, and Amendment 6, which grants a property tax discount for veterans’ widows, each received more than 60 percent of the vote in Tuesday’s general election. They will both go into effect on Jan. 1.

Amendment 5 gives homeowners up to three years to transfer their Save Our Homes benefit from a prior homestead to a new homestead. That’s up from two years. It received more than 74 percent of the vote.

Read more

Voters reject Terra’s proposal to redevelop Miami Beach Marina with condo tower

Voters reject Terra’s proposal to redevelop Miami Beach Marina with condo tower

Miami Beach voters overwhelmingly approve Wolfsonian-FIU expansion

Miami Beach voters overwhelmingly approve Wolfsonian-FIU expansion

Key Biscayne voters approve $100M bond tied to climate change

Key Biscayne voters approve $100M bond tied to climate change

Florida homeowners benefit from the homestead exemption, which allows property owners to receive an exemption that decreases the property’s taxable value by up to $50,000 if it is their principal residence. The Save Our Homes amendment was passed in 1992, limiting the annual increase in valuation of a homesteaded property to 3 percent.

Nearly 90 percent of voters supported Amendment 6, which allows the surviving spouse of a late veteran to receive the same homestead property tax discount. Spouses will be able to benefit from the tax discount until they remarry or sell the property. But if the spouse sells the property without remarrying, the tax discount – not exceeding the dollar amount from the most recent ad valorem tax roll – will be able to be transferred to a new residence.