Developers bet big on build-for-rent in these uncertain times

Developers bet big on build-for-rent in these uncertain times

Trending

Investors building single-family rentals to meet demand

Rising prices and reluctant lenders have put homebuying out of reach for many

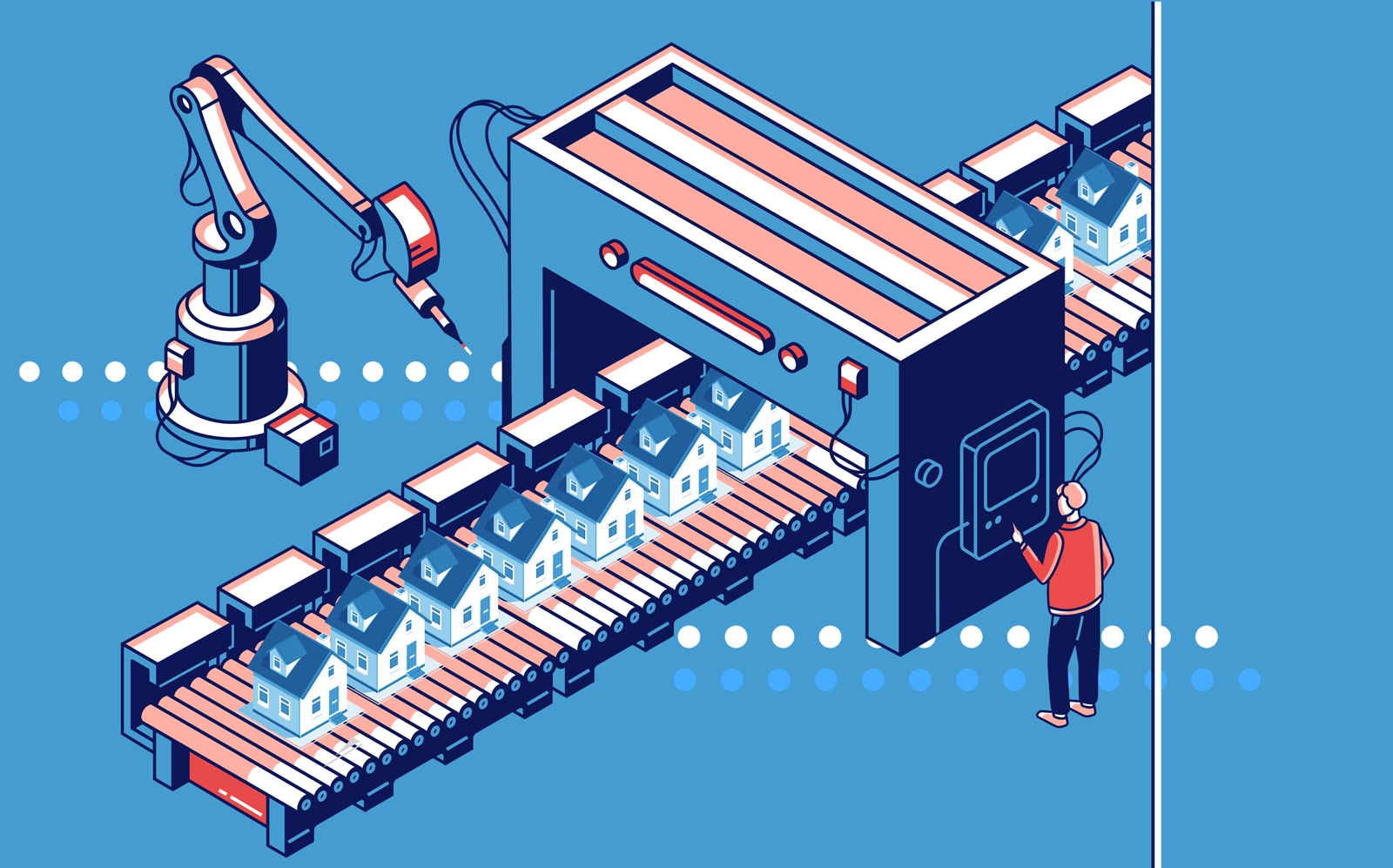

Instead of buying houses in foreclosure and converting them to rentals, as many investors did in the last recession, investors are building their own rental communities.

They are seeking to profit from a trend: Many Americans are seeking more spacious homes, where they can more comfortably work from home and have more space for family, but many cannot afford to buy or are not ready to commit, the Wall Street Journal reported.

Read more

Developers bet big on build-for-rent in these uncertain times

Developers bet big on build-for-rent in these uncertain times

“The home used to be just shelter. Now it is the hub of our entire lives”: Lennar reports strong Q4, full-year results

“The home used to be just shelter. Now it is the hub of our entire lives”: Lennar reports strong Q4, full-year results

Jonathan Miller: Single-family markets are facing a "chronic lack of inventory"

Jonathan Miller: Single-family markets are facing a "chronic lack of inventory"

High demand and low supply has driven house prices up, and ownership is unaffordable for average earners in 55 percent of U.S. counties, up from 43 percent a year earlier, according to Attom Data Solutions.

But with few affordable homes, and no foreclosure crisis, investors like the Carlyle Group and American Homes 4 Rent have shifted their approach. More than 50,000 such homes were purpose-built for rentals during the 12 months ended Sept. 30, according to John Burns Real Estate Consulting, roughly two-thirds more than the average over the past four decades.

“Banks and lenders stopped providing financing to the lower middle class and so home builders stopped building entry-level homes,” Thibault Adrien, whose Lafayette Real Estate began buying foreclosed homes a decade ago, told the newspaper. “The last way to increase our exposure was to build our own.”

[WSJ] — Georgia Kromrei