Trending

Cortland pays $92M for Hollywood apartment complex

Deal equates to $273K a unit

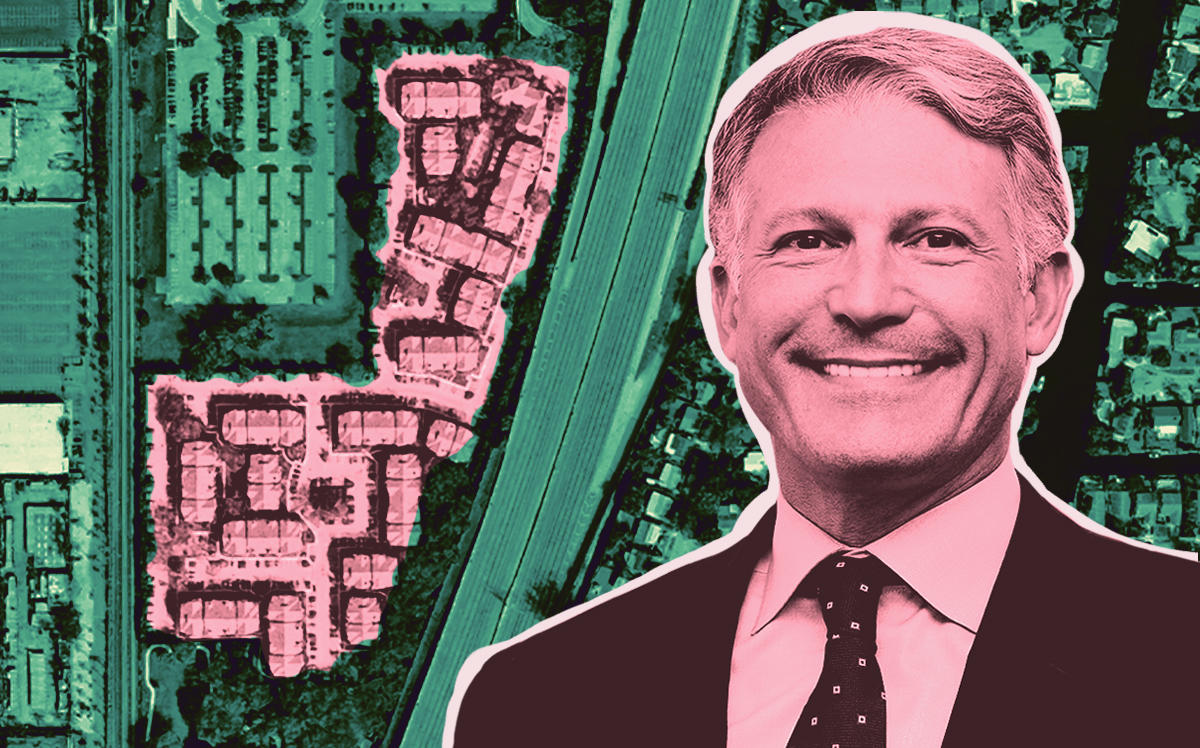

An Atlanta-based real estate investment firm paid $91.7 million for a 336-unit Hollywood apartment complex.

Cortland Partners bought the 377,000-square-foot complex, called “Parc Station,” at 1900 to 2300 North 29th Avenue, according to records. The deal equates to about $273,000 a unit.

The seller is a company tied to New York-based JPMorgan’s asset management arm and a holding company called LP 1A REIT Unlevered Holding LLC. In 2017, a separate company managed by JP Morgan bought the building for $90.3 million.

Developers Ram Realty Services and the Pinnacle Housing Group opened Parc Station in 2016.

Matthew Lawton, Maurice Habif, Simon Banke and Ted Taylor of JLL represented the seller in the deal.

At that time, monthly rents at the complex started at $1,550. An online listing shows monthly rents now range from $1,626 for a one-bedroom unit to $2,263 for three-bedroom units.

Cortland, led by Steven DeFrancis, has made other investments in South Florida’s multifamily market recently. In July, it paid $73.9 million for the Depot Station apartment complex in Delray Beach.

Recent activity from JPMorgan’s asset management arm include the launch of a $700 million fund focused on developing single-family and multifamily rental properties in Sunbelt cities, and landing a $400 million refinancing on its office tower at 605 Third Avenue in New York.