Trending

Mesirow buys Fort Lauderdale multifamily complex for $84M

261-unit community was built in 2015

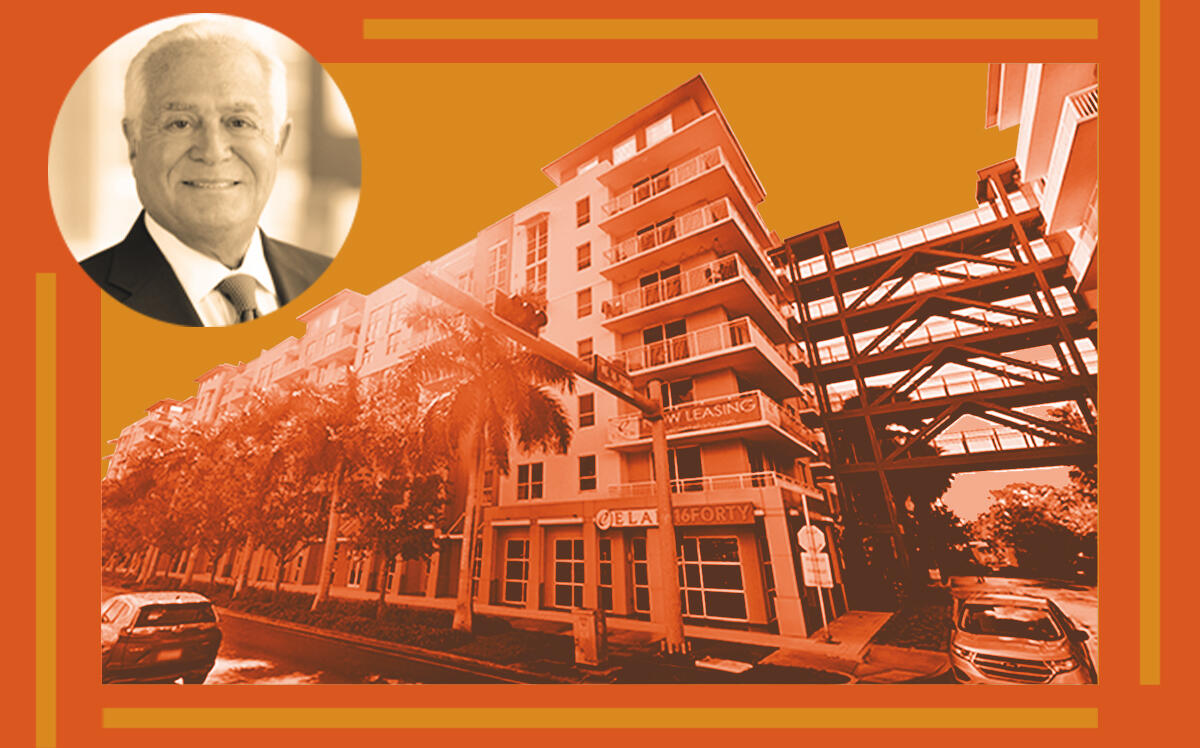

Mesirow Financial bought a Fort Lauderdale multifamily complex for $83.5 million.

The Chicago-based financial services firm bought Elan 16Forty at 1600-1700 East Sunrise Boulevard from GS Sunrise Subsidiary, an affiliate of Greystar and PGIM Real Estate, according to records.

Charleston, South Carolina-based Greystar, led by Bob Faith, developed the 261-unit community with three buildings on 4.2 acres in 2015, records show. Its GS Sunrise Subsidiary bought the site in 2013 for $9.8 million, according to a deed.

The latest purchase breaks down to $319,923 per unit.

Mesirow Financial, led by chair and CEO Richard Price, offers global investment management, investment banking, wealth management, capital markets and retirement advisory services, according to its website. The employee-owned company, which Norman Mesirow started in 1937, has $206 billion of assets under supervision.

The sale is part of a slew of recent multifamily deals in South Florida.

This month, Pantzer Properties bought a 392-unit community in Royal Palm Beach from Related Group for $119.4 million. Also, Greystar sold a 279-unit apartment complex at 1015, 1111 and 1201 East Sunrise Boulevard in Fort Lauderdale to Bell Partners for $99.5 million.

Last month in Oakland Park, Israel-based R.O.I. Capital Group made its first venture into the South Florida multifamily market, buying the 296-unit complex at 5201 North Dixie Highway from Northland Investments for $58.5 million.