Trending

Churchill’s Pub operator evicted amid foreclosure lawsuits against landlord

Bar’s owner Mallory Kauderer and several entities he manages are in default of at least five mortgages and promissory notes, court documents show

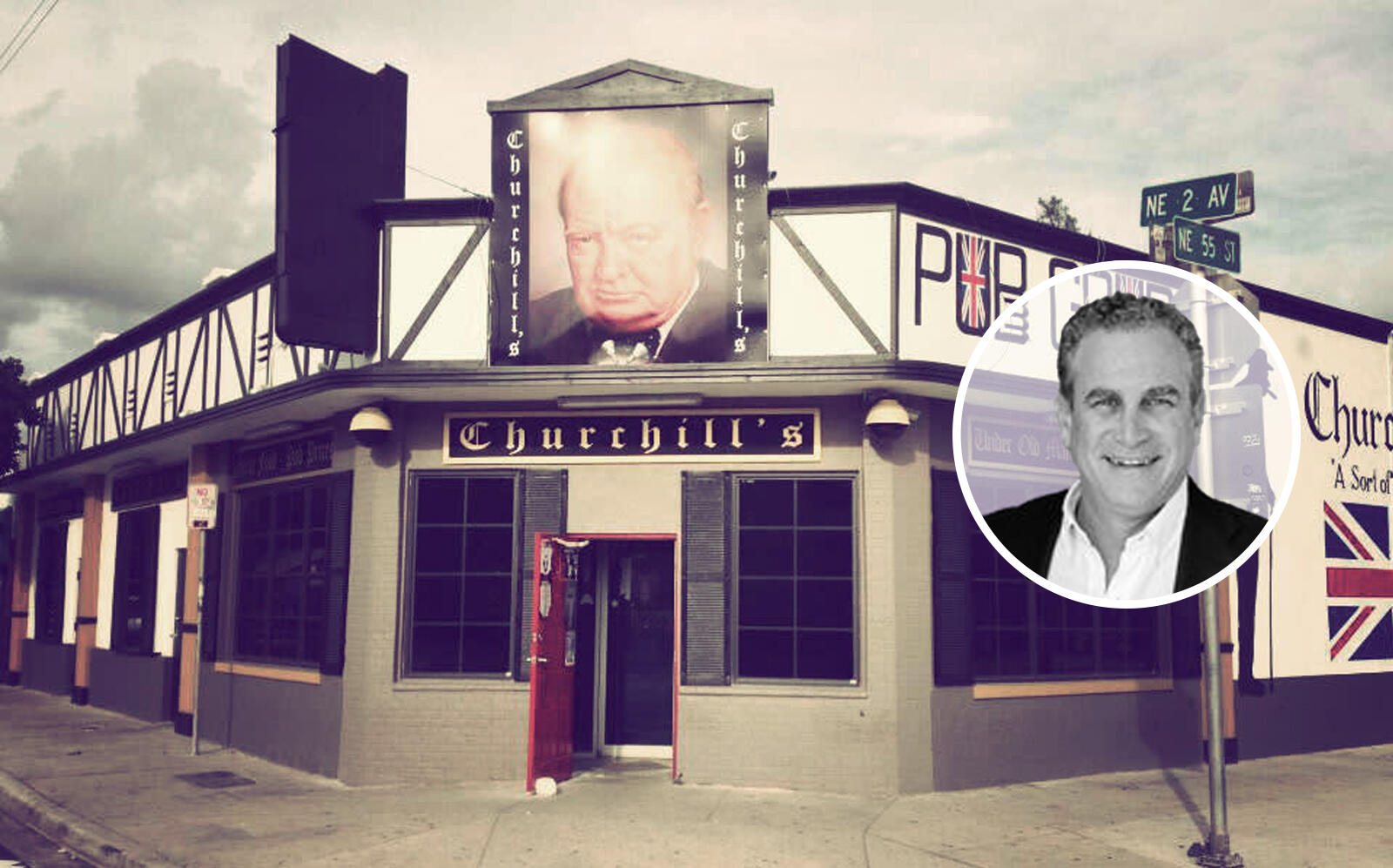

Churchill’s Pub, the storied live venue and bar in Miami’s Little Haiti neighborhood, could be gone for good after the property’s landlord secured a major victory in court last week.

Miami-Dade Circuit Judge Reemberto Diaz issued an eviction order and writ of possession against Churchill’s current tenant District Live Agency, after the company failed to deposit $205,000 in alleged owed rent into the court registry.

Meanwhile, Churchill’s property owner Mallory Kauderer and several limited liability companies he manages are facing multiple foreclosure lawsuits tied to other properties in Little Haiti that he and his partners own.

The eviction order is the latest development in a sordid saga that began shortly after Miami-Dade County shuttered bars, restaurants and nightclubs last year during the early months of the coronavirus pandemic.

Churchill’s Pub, at 5501 Northeast Second Avenue, is near the Magic City Innovation District mega-project.

In court documents, District Live Agency and its principal, Franklin Dale, accuse Kauderer of misappropriating $149,900 in pandemic relief funds provided by the Small Business Administration. The funds were meant to pay back District Live’s parent company The Beverage Group, or offset any back rent owed by the tenant. District Live filed a counterclaim and filed a notice of appeal regarding Diaz’s order that District Live was required to deposit $205,000 in the court registry.

“Kauderer never paid any amount of the EIDL CARES Act funds to The Beverage Group,” Dale wrote in an Oct. 26 court affidavit. “Kauderer also never applied any amount to off-set the rent. Instead Kauderer ‘loaned’ the monies to his parent company Little Haiti Development Partners LP. In doing so, pursuant to our agreement, Kauderer was obligated to advance credits to [District Live] to be used for future rents. Otherwise, Kauderer was misusing the CARES Act program, in violation of its strict requirements.”

Attached to the affidavit are bank statements and text messages between Kauderer and Dale that District Live claims is proof that the SBA funds were misappropriated.

Reached on his cellphone, Kauderer declined comment. A District Live representative who did not want to be named said Kauderer and his 5501 NE 2nd Avenue LLC that owns the Churchill’s property have made “glaring misrepresentations to the federal government and the courts.”

“It’s a damn shame the pub hasn’t been able to reopen for 18 months,” the representative said. “It’s a horrible situation and speaks to the pain experienced by small business owners during this pandemic.”

As the fate of Churchill’s Pub played out in court this past year, Kauderer and companies he controls or is involved with have been hit with five foreclosure lawsuits between March 16 and July 9. The most recent complaint, filed by Forensic Financial Services, alleges Kauderer and Little River Realty failed to pay back a $41,586 promissory note that was due on Jan. 31.

Three other lawsuits allege Kauderer and companies affiliated with him have failed to make monthly payments since February on separate loans for $675,000, $850,000 and $2 million. And according to a March 16 complaint, Chemtov Mortgage Group alleges Kauderer and nine other defendants haven’t made any monthly payments on an $8 million loan since November of last year.