Here’s what’s next for victims of the Surfside condo collapse and the property

Here’s what’s next for victims of the Surfside condo collapse and the property

Trending

Dubai developer’s $120M contract for Surfside site approved, appraisal for unit owners totals $96M

Appraisal estimates the market value as of the day before deadly collapse

A judge approved the Dubai-based developer’s $120 million contract to purchase the site of the Surfside condo collapse, while a new appraisal valuing the units at about $95.6 million will help determine the future distribution of funds.

Additional proceeds from the sale will likely go toward death and personal injury claims, Judge Michael Hanzman told attorneys, victims and their families at a hearing on Thursday.

Dubai developer Damac Properties was revealed last week as the stalking horse bidder for the oceanfront property in Surfside, where nearly 100 people died in the partial collapse of Champlain Towers South more than three months ago.

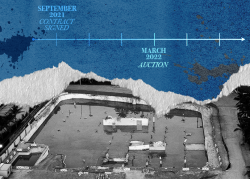

Hanzman granted the motion to approve the sales contract to Damac affiliate East Oceanside Development LLC, setting a timeline in motion for the entire bidding and sale process. The stalking horse set the minimum price for the property, and an auction is expected to occur between late February and early March.

Akerman attorney Michael Goldberg, the court-appointed receiver for Champlain Towers South condo association, said a final appraisal will likely be filed on Friday that pegs the aggregate value of the units on the day before the collapse at about $95.6 million. The final report will show the market value of each unit.

Hanzman said he wants to hash out the disbursement process, including whether victims with property loss claims can be paid out first, and whether he can use the excess funds to pay death and injury claims.

Read more

Here’s what’s next for victims of the Surfside condo collapse and the property

Here’s what’s next for victims of the Surfside condo collapse and the property

Surfside officials agree to carve Champlain site out of planned downzoning

Surfside officials agree to carve Champlain site out of planned downzoning

Surfside site’s stalking horse bidder signed contract, auction slated for February as claims could reach $1B

Surfside site’s stalking horse bidder signed contract, auction slated for February as claims could reach $1B

Method of disbursement

The judge said he is leaning toward putting victims with property loss claims first in line, because the land is owned by all unit owners and the property insurance is for the entire building. But he said he is keeping an open mind, and wants attorneys to figure out the legality and process and be ready to discuss the issue at the next hearing on Wednesday.

Hanzman offered an example: If the land sells for $150 million, coupled with $30 million in insurance, a total of $180 million will be available to disburse. Unit owners would receive $95.6 million for the fair value of their units.

“Does the court have the discretion to use the excess, meaning $85 or $90 million, to compensate for death and personal injury claims?” Hanzman said at the hearing, explaining the question he wants attorneys to analyze.

The court also has to decide whether to reimburse property loss based on the appraiser’s determination of units’ fair-market value — or based on each owner’s percentage stake in Champlain Towers South under the condo declaration.

Hanzman is pushing for these decisions to be made before year end to avoid any delays once the land is sold in early 2022.

The judge also cautioned that the division of disbursements should not be a source of contention among victims.

“It is going to be sad, in my view, if we see unit owners going up against one another on this issue,” he said.

The appraiser’s report determined the fair value of units by first estimating the sixth-floor unit lines’ value, which is the mid-point of the 12-story building. Then the appraiser adjusted the value for the upper floors, taking into account factors like larger balconies on higher-level units, and also slightly adjusted values for lower-floor units, Goldberg said at the hearing. The estimates took into account comparable sales and two unique units, a penthouse and a combined unit, he added.

Still, some owners already took issue with the appraised value, with one saying her unit also should have received special consideration because it had high ceilings and direct beach access.

Another owner, Oren Cytrynbaum, said the fair value actually is the sale of each unit separately on the market.

Hanzman responded that generally property owners would disagree with an appraiser’s estimate of their home’s market value, but at some point the court has to use objective evidence. “It is not science,” he added. “It is an art. And it is not going to be perfect.”

And ultimately, Hanzman said, the day before the tragedy the building was in disrepair to an extent that a collapse was imminent. So, if the state of this building had been adequately disclosed to a buyer the day before, these units would not have been able to sell.

Still, before any decision on disbursements is made, victims will be heard by the court, the judge said.

Hanzman also struck objections to some of the requests for records from 8701 Collins Development LLC, the Terra-led entity that built the neighboring condo tower Eighty Seven Park, as well as from its geotechnical engineering firm that took vibrations at nearby buildings during Eighty Seven Park construction.

Neighbors and residents have raised concerns about the project’s proximity to Champlain Towers South and vibrations caused by the construction.

Although the judge allowed lawyers to file arguments that some records from the geotechnical firm should not be turned over because of attorney-client privileges, he mandated all other records be turned over in 10 days to victims’ attorneys. The records requested from the Eighty Seven Park entity are to be submitted on a rolling basis through the end of October at the latest.

What’s next

Once the receiver, on behalf of the condo association, signs the contract with the Damac affiliate, it will set the effective date for the clock to start ticking, said attorney Paul Singerman.

Damac is required to put down a $16 million deposit within five days of that effective date.

Goldberg would issue notice to Damac to give the company access to the property to begin the 60-day inspection period.

During that period, Damac could back out of the contract and receive all but $150,000 back from the cash deposit it will have made.

At the end of the inspection period, the entire $16 million deposit is nonrefundable. Also at that point, competing bidders have a 45-day period to make their offers, starting at $120.3 million. Additional bids would be considered in $100,000 increments at the auction.

If Goldberg gives Damac access to the site in mid-October, the inspection period could end Dec. 15.

At that date, “if there are competing bids, we’ll work to reconcile the contractual differences in any competing bids,” and ask the judge to schedule an auction to determine the highest and best bidder, Singerman added. The period for competing bidders would end at the end of January 2022.