Trending

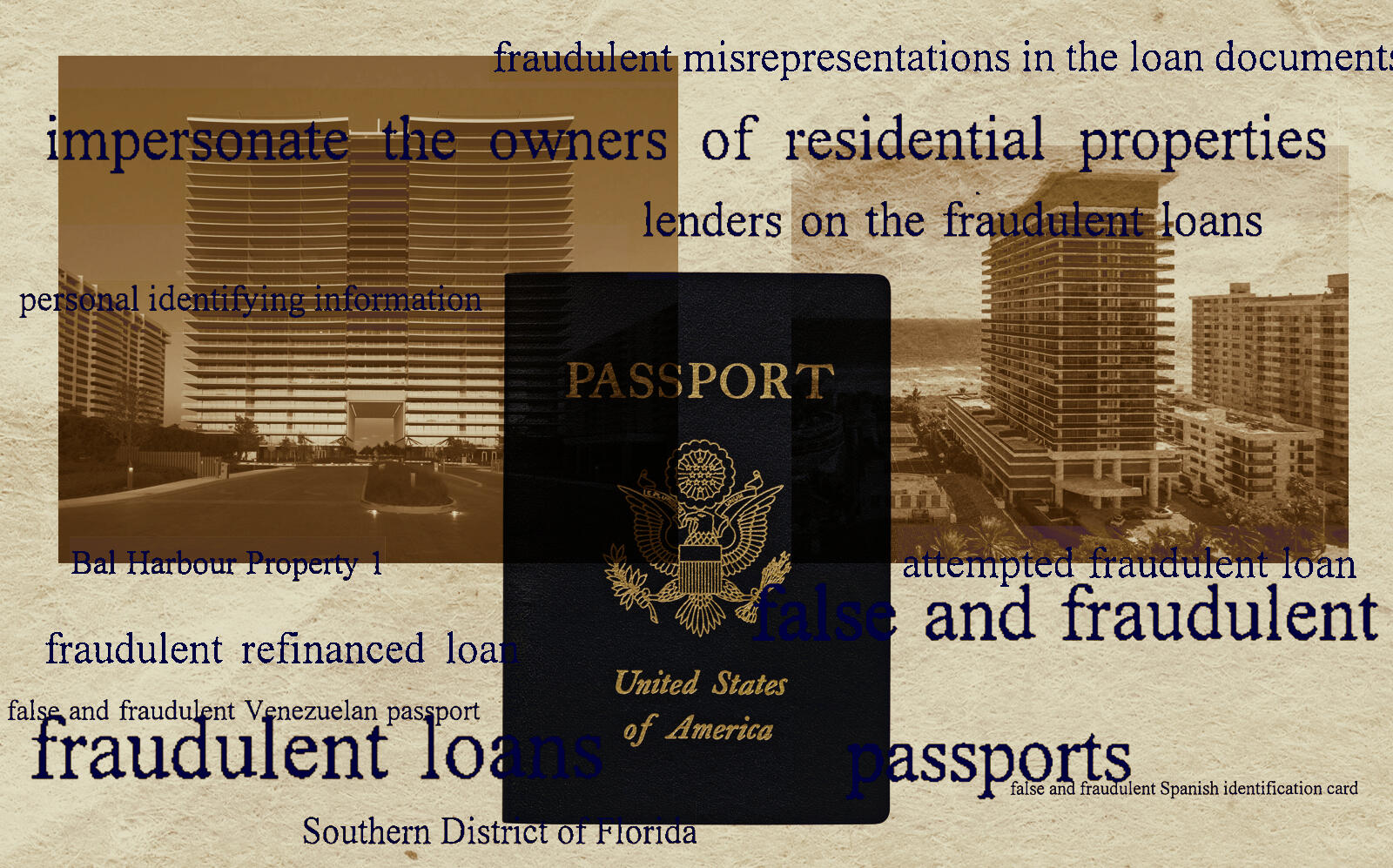

$10M mortgage fraud honed in on Oceana Bal Harbour, Mei Miami Beach condos

Scheme also looped in Pinecrest mansion

When Carlos Rafael Castaneda Mendez embarked on a scheme to take out fraudulent mortgages, he set his sights on four high-end residential properties in South Florida that neither he nor his accomplices owned, according to prosecutors.

Castaneda is one of seven people sentenced this week for their roles in what federal authorities say was a $10 million mortgage fraud and identity theft scheme.

From May 2019 to May 2020, the strategy was to pose as the property owners, using fake passports and driver’s licenses, open bank accounts in the owners’ names, and take out loans on the real estate, the indictment states. The co-conspirators used the funds to splurge on payments for a Mercedes-Benz Sprinter and watches.

The first step of the plot: To find luxury homes with absentee owners and no outstanding loans or liens, according to court filings.

Ringleader Castaneda settled on two condos at Oceana Bal Harbour, one unit at the Mei condo in Miami Beach and a six-bedroom Pinecrest mansion at 9000 Southwest 63rd Court, prosecutors say.

The seven co-conspirators received reduced sentences after they pleaded guilty to some of the counts, and signed plea agreements and statements, court records show.

Castaneda was sentenced to 78 months imprisonment, Alejandro Boada Oliveros to 46 months, Jonnathan Jesus Gonzalez to 44 months, Yanjeisis Alejandra Pompa Villafane to 28 months, Lilia Rosa Morales Moreno to 30 months, and Katherine Hansen Mendoza to seven months. All are of Miami, except Villafane, who is of Hialeah.

Isbel Rodriguez Batista, who was sentenced to 30 months, is of Teaneck, New Jersey.

Castaneda’s attorney said he was facing up to 121 months imprisonment, but his sentence was reduced “due to his acceptance of responsibility and other mitigating factors.”

“I think that was a sufficient, but not greater than necessary, sentence,” said the attorney, Sherleen Mendez.

Attorneys for some of the others claimed their clients had minor roles or fell victim to exploitation by con men.

Morales Moreno, a “struggling immigrant,” was manipulated into getting entangled in the plot by one of the others sentenced, said attorney Celeste Siblesz-Higgins.

“He took advantage of her situation, seduced her, and then took advantage of their relationship to get her to commit a crime. Nevertheless, she admitted her involvement to the judge who sentenced her fairly and appropriately,” said Siblesz-Higgins, who did not identify the collaborator she said exploited Moreno. “South Florida is filled with fraudsters who take advantage of the rich, as well as the less advantaged.”

According to Morales Moreno’s statement, she impersonated the owner of one of the Oceana units using a fake Venezuelan passport with her own photo to obtain a $1.1 million loan. The passport was created by others involved in the scheme, using the true owner’s name and “Cedula” number, the Venezuelan equivalent of a Social Security number.

Rodriguez Batista was involved in an attempt to take out a $700,000 loan that did not go through, said her attorney, Silvia Beatriz Pinera-Vazquez. The court agreed she “played a minimal role in the conspiracy,” and the court and prosecutors also agreed she is not on the hook for any restitution.

“Ms. Rodriguez was the only defendant that did not garner any benefit from the scheme,” Pinera-Vazquez said. “During sentencing, Ms. Rodriguez expressed her sincere remorse to the court for her actions in this case.”

According to her statement, she impersonated the owner of the Mei condo using a fake Spanish passport with her photo. But when she tried to take out the loan in May 2020, an undercover agent posing as a loan processor arrested her after she signed the mortgage documents, her statement reads.

As for Gonzalez, he “and his girlfriend were preyed upon by a more sophisticated individual who used them to commit a serious financial crime,” his attorney, Ana Davide, said via email. Gonzalez “accepted responsibility and is ready to move on with his life,” she said.

Hansen was trying to transfer $305,000 at a TD Bank in Miami from one of the fraudulently opened bank accounts. She was using a fake Venezuelan driver’s license and passport with her photo, but with the name and Cedula number of the real owner of the Pinecrest home, according to her statement. When the wire did not go through because of insufficient funds, an off-duty police officer on assignment at the bank branch approached Gonzalez, who was waiting in a white Range Rover outside the bank.

In the car, the officer saw a driver’s license in the cup holder with a photo of Hansen, and asked Gonzalez about it, according to Hansen’s statement. Gonzalez said it is his girlfriend’s, who is inside the bank. The officer went back to the bank and asked Hansen for identification, and she showed him the fake documents. She was detained and then confessed to her true identity, according to her statement.

Attorneys for Hansen, Oliveros and Villafane did not return requests for comment.

South Florida’s luxury residential real estate often appears in allegedly fraudulent schemes.

In September, the Securities and Exchange Commission filed civil charges against a Miamian who allegedly ran a $66 million payday loan scheme and diverted some of the money to pay for a $1.5 million unit at Epic Residences & Hotel.