Shahab Karmely nabs $128M condo inventory loan for new Hallandale project

Shahab Karmely nabs $128M condo inventory loan for new Hallandale project

Trending

Ari Pearl completes luxury apartment tower in Hallandale Beach, scores $150M refi

Monthly asking rents for six penthouse units range from $10K to $18K

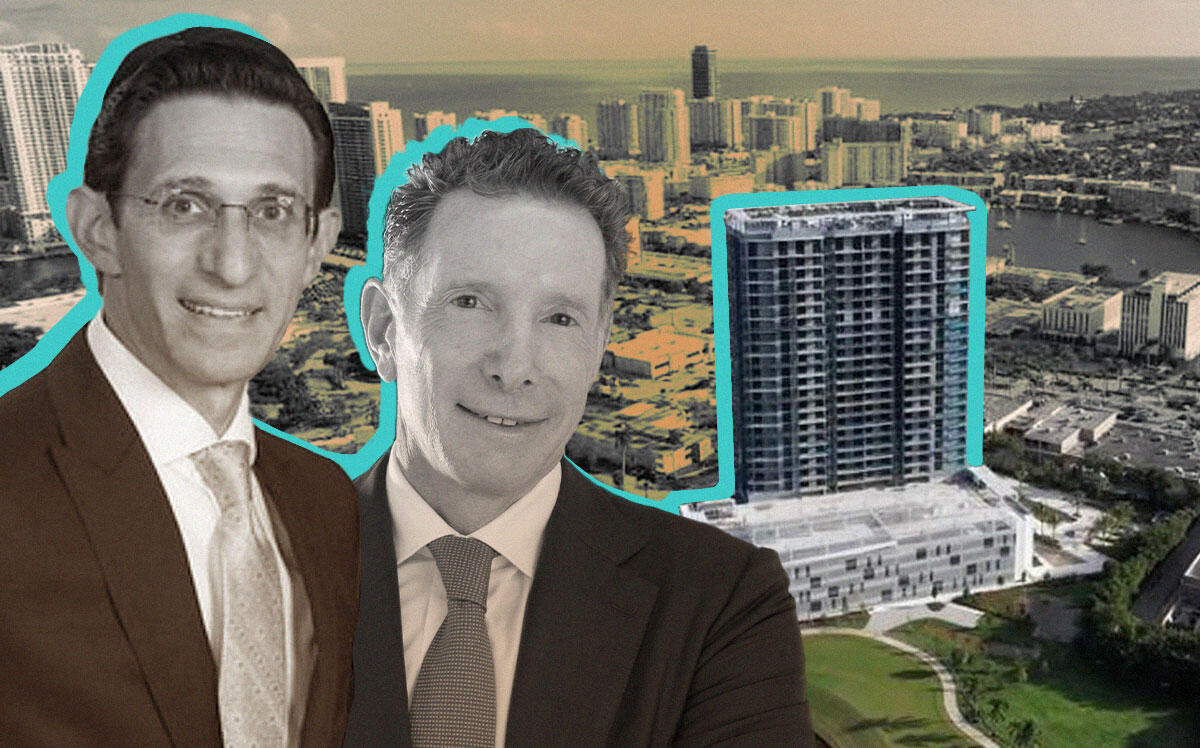

Ari Pearl’s mixed-use golf course development in Hallandale Beach completed its first phase, and he and his partner secured a $150 million refinancing, The Real Deal has learned.

Pearl’s PPG Development and Michael Herman’s Premium Capital received a certificate of occupancy for the 26-story, 250-unit high-end rental building at 101 Diplomat Parkway, Pearl confirmed. New York-based Arbor Realty Trust provided the financing, said Alexander Kaushansky, managing director of sales at Arbor. Arbor is led by founder and CEO Ivan Kaufman.

In 2018, a Pearl-led entity paid $43.3 million for the 127-acre former Diplomat Golf & Tennis Club property at 501 Diplomat Parkway, which includes an 18-hole Greg Norman-designed golf course, 10-court racquet center and a 48-slip marina. The redesigned golf course is expected to open within a year.

The first phase is the luxury apartment building, called Slate Hallandale Beach. Sixty percent of the units are two-bedrooms, with 20 percent one-bedrooms and another 20-percent three-bedrooms. Leasing is starting now.

Asking rents will start at $3,700 a month and 859 square feet, according to Apartments.com. They are expected to average about $4 per square foot or $5,000 a month, Pearl confirmed. Six penthouses, with 14-foot ceilings and ocean and Intracoastal views, will ask $10,000 to $18,000 a month.

Amenities at the Hallandale Beach apartment tower include a golf simulator room; a pool with cabanas, day beds and fire pits; a business center; fitness center with a spa; a wine and cigar room; children’s lounge; theater; tennis courts and a dog park. Atlantic Pacific will manage the building.

Read more

Shahab Karmely nabs $128M condo inventory loan for new Hallandale project

Shahab Karmely nabs $128M condo inventory loan for new Hallandale project

Chad Carroll sells waterfront Hallandale Beach home for record $5M

Chad Carroll sells waterfront Hallandale Beach home for record $5M

Witkoff joins Ari Pearl’s mixed-use golf resort development in Hallandale Beach

Witkoff joins Ari Pearl’s mixed-use golf resort development in Hallandale Beach

It was originally slated to be an SLS-branded tower, but the developers’ plans changed during the pandemic, Pearl confirmed.

The project is part of a growing trend of high-end rental developments with condo finishes and amenities. Developers are taking advantage of record multifamily rents and high demand for luxury apartments and homes.

Kaushansky said the loan is transitionary debt, meaning that After Pearl and Herman lease the building, they plan to secure more permanent financing.

“We love the asset, we love the location and we really like what [Pearl is] doing there,” Kaushansky added. Arbor also financed Pearl’s former Bay Harbor Islands property.

In September, Pearl brought Witkoff on for the second phase of the Hallandale Beach development. Pearl’s PPG Development and Premium Capital Resources formed a joint venture with Witkoff and secured $55 million in fixed-rate financing for phase two. That phase calls for extending the golf course and adding a 15-acre golf practice facility, a clubhouse with food and beverage outlets, a spa and wellness center, ballroom and entertainment space, 60 hotel suites, and condo-hotel units.