Year since deadly collapse marked by condo reforms, new development in Surfside

Year since deadly collapse marked by condo reforms, new development in Surfside

Trending

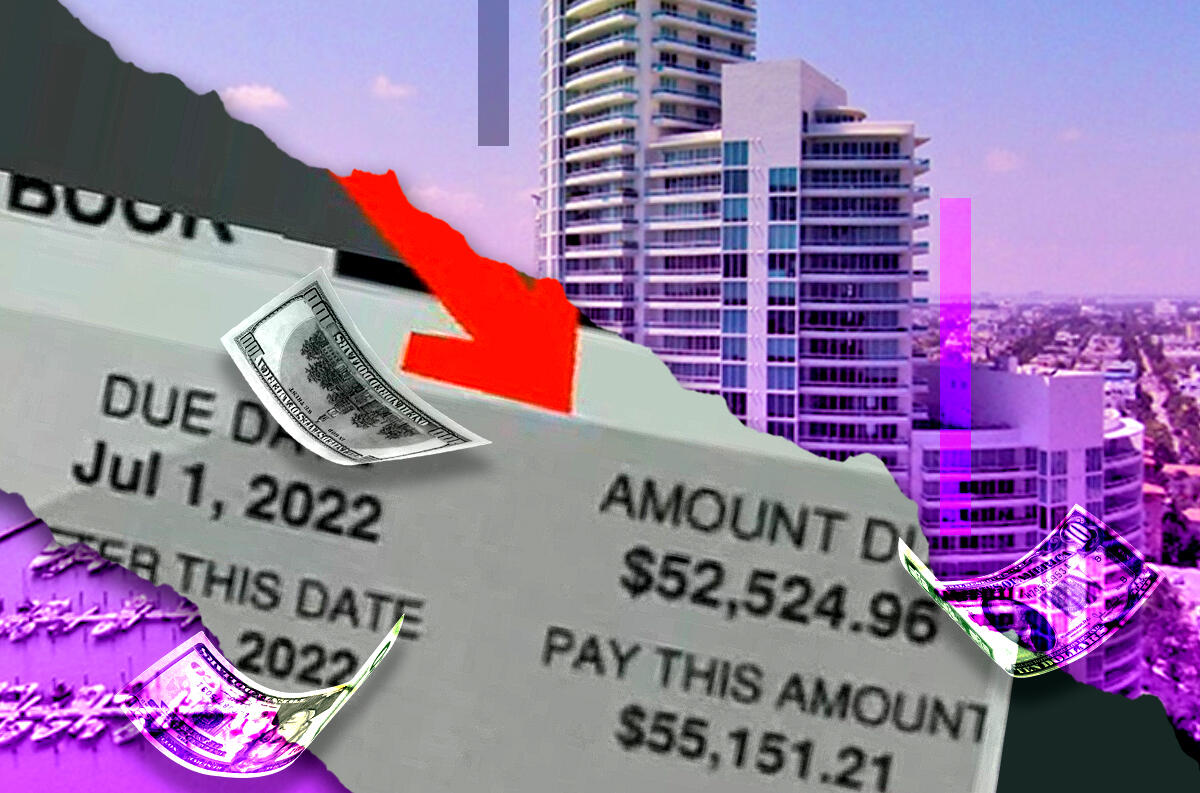

“Mind-boggling”: Condo owners in South Beach face millions of dollars in special assessments

Phase 1 at Murano at Portofino calls for $30M special assessment, or an average of $160K per unit

UPDATED, July 21, 11:50 a.m.: Unit owners at at least two condo towers in Miami Beach are facing millions of dollars in special assessments to pay for restoration and renovation work, an issue affecting dozens of properties across South Florida.

In the year since the deadly condo collapse in Surfside, such assessments are adding to other mounting costs for condo boards and unit owners, who are also grappling with rising insurance rates, property taxes and pressure to ensure that buildings are being maintained.

Read more

Year since deadly collapse marked by condo reforms, new development in Surfside

Year since deadly collapse marked by condo reforms, new development in Surfside

$1B Surfside settlement signals condo association, construction insurance premium hikes

$1B Surfside settlement signals condo association, construction insurance premium hikes

Surfside collapse a “come to Jesus moment” for South Florida’s condo market

Surfside collapse a “come to Jesus moment” for South Florida’s condo market

Most recently, Murano at Portofino, a 37-story, 189-unit tower at 1000 South Pointe Drive, and Murano Grande, a 40-story, 270-unit building at 400 Alton Road, are beginning to tackle projects that have been discussed for years, owners say. Both luxury condo buildings were developed by the Related Group and Thomas Kramer’s Portofino Group in the early 2000s.

Murano at Portofino is collecting funds from owners for the first of a two-phase project, said unit owner and broker Andres Asion. He recently posted a photo on social media of the first payment he owed: $52,525.

The first phase is estimated to cost close to $30 million. It calls for repair work to the stucco, balconies, waterproofing, water intrusion and other issues that buildings near the ocean commonly face. The work also includes non-essential upgrades like replacing luggage carts and renovating the beach club, and does not include pool/pool deck work, which would be in the second phase. Unit owners have not yet received an official estimate for that phase – a major concern for owners.

The initial roughly $30 million special assessment breaks down to an average of $160,000 per owner, though their share of the cost is based on the square footage of their units and how many units they own. The building isn’t offering financing, which means the unit owners have to figure out how they will come up with the cash.

Banks can typically provide an association with a loan or a line of credit they can draw from, said Jose “Joe” Rodriguez, a real estate attorney and partner at Rennert Vogel Mandler & Rodriguez. Rodriguez was part of the state condo task force formed after the Surfside collapse that made recommendations to the Florida Legislature.

The burden is on members of the condo board to hire consultants and determine what work to prioritize, he said. Boards will often throw in beautification work to get everything done at once.

“There’s no doubt that any condominiums that have deferred maintenance that’s been accumulating over time are going to be faced with special assessments or economic obligations,” he said.

Once work begins, contractors will often discover other problems that need to be repaired, increasing the cost to unit owners, said Alex Martin, vice president at KW Property Management & Consulting. Plus, as the cost of construction and materials continues to grow, Martin advises against waiting any longer to begin projects.

“Five million dollars five years ago is now $9, $10 million,” he said.

He expects older buildings with owners who live on fixed incomes will face the biggest challenge.

John Caprio, a board member who owners say has been leading the effort at Murano at Portofino, declined to comment on the planned project and referred The Real Deal to the building’s management company, which did not immediately respond to a request for comment.

At a town hall meeting last week for owners and residents of Murano Grande, a representative from KWPMC presented a proposal for a $7.4 million special assessment to pay for paint, and stucco and pool restoration work. Owners would make nine quarterly payments to cover the cost. The proposal, in its early stages, breaks down to about $27,400 per unit on average, or average quarterly payments of about $3,045 for a little over two years.

The meeting prompted many unit owners to criticize the process in which the board presented the proposal. That’s also become a more prevalent issue, as owners are split on how to move forward with needed improvements and repairs, especially after the collapse in Surfside last year.

“The collapse created a sense of anxiety and urgency,” said Asion, who owns units at both Murano buildings. Champlain Towers South in Surfside was embarking on a major restoration project when the building unexpectedly collapsed overnight in June of last year, killing 98 people. Leaks from the pool deck were seeping into the garage, one of many problems found at the building.

Hundreds of condo associations across the state will have to raise their monthly dues or enact special assessments to fully fund their reserves by the end of 2023, thanks to a new state law passed in May. Previously, boards could vote to waive reserve requirements.

“That wave is coming,” Martin of KWPMC said. “It’s going to happen a lot with the older buildings, a lot of individuals that have been waiving reserves.”

The new legislation also institutes 25-year inspections of condo buildings three stories or taller within three miles of the coast, or 30 years if farther.

Condos are typically more affordable than single-family homes, but a large special assessment or a substantial increase in monthly dues could make it unaffordable for many. And any investor who rents out their units will likely have to pass the cost onto their tenants.

“You’re going to have some flight,” said Dana Goldman, a real estate attorney at Shutts & Bowen. “People are going to be forced to sell if they cannot afford these assessments.”

Goldman called the first $30 million special assessment at Murano at Portofino “mind-boggling.”

She and others expect a push for government assistance in the form of low or zero interest loans to help unit owners finance these projects.

“There’s going to be a lot of pain and hardship over the next two years as this new legislation gets implemented, and as the insurance market is still very very constricted,” Goldman said. “How much more financial responsibility can a lot of these owners bear?”

Correction: An earlier version of this story incorrectly stated the total unit count at Murano Grande.