Trending

Spurred by new-to-market firms, South Florida office rents hit record highs

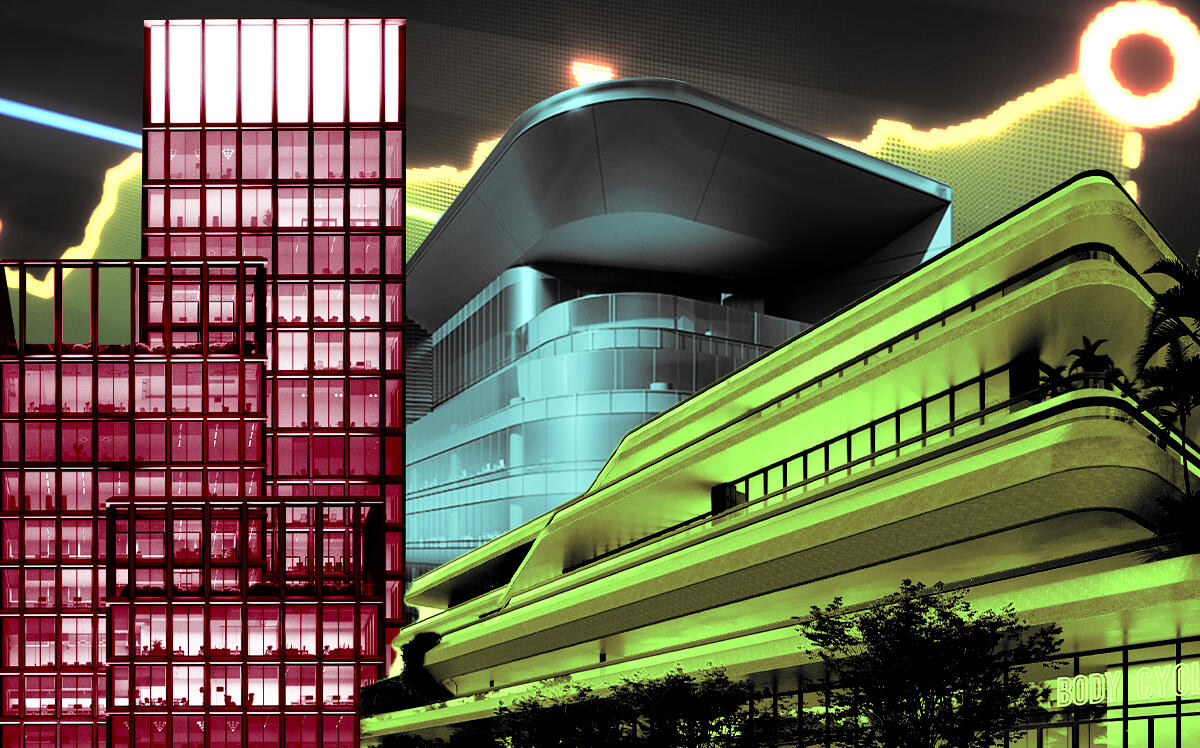

Vlad Doronin’s 830 Brickell in Miami and Stephen Ross’ One Flagler in WPB are two buildings driving rent spikes

In South Florida, asking more than $100 a square foot for premium office space could soon become the norm. Already, some new buildings in downtown areas have cleared that threshold, according to commercial brokers and recent quarterly reports.

One Flagler, a 25-story Class A tower with 275,000 square feet of primarily office space in West Palm Beach, developed by Stephen Ross’ Related Companies, set a new standard during the second quarter, with asking rents between $140 and $180 a square foot, according to JLL.

Not far behind are a pair of office projects in Miami-Dade County. At 830 Brickell, a 55-story Class A building under construction at 830 Brickell Plaza, developers Vlad Doronin’s OKO Group and Cain International were asking between $125 per square foot and $150 per square foot in the second quarter — a $25 per square foot bump from the first quarter, according to JLL.

In Miami Beach, Eighteen Sunset, a five-story mixed-use project under construction at 1795 Purdy Avenue, is also asking in the range of $150 a square foot, triple net, according to Colliers’ Stephen Rutchik, who is leading leasing at the project. Developed by Miami-based Deco Capital Group, Eighteen Sunset will have two floors of offices spanning 32,000 square feet, as well as ground-floor retail and a residential penthouse.

Since last year, as companies sought to have employees return to the workplace, South Florida’s office market has experienced an explosion of new-to-market tenants. Tech companies, financial services firms and hedge funds from around the country are either expanding or relocating their headquarters to commercial business districts in Miami and West Palm Beach, and to a lesser extent, Fort Lauderdale. Naturally, rents have shot up dramatically.

The biggest moves involve billionaire Ken Griffin’s hedge fund Citadel and financial services firm Citadel Securities. In June, he announced he is relocating both companies’ global headquarters from Chicago to Miami, where he plans to co-develop a new office tower in Brickell. Citadel will also place employees in a former Neiman Marcus store in West Palm Beach that is being converted into an office building, fully leased by Griffin’s firm.

“In the office market, we are seeing the impact of a great migration to the tax-friendly, pro-business state of Florida,” said Cushman & Wakefield’s Eric Messer. “Another contributing factor is that a lot of businesses from the Northeast U.S. still see our rents as being affordable.”

To be sure, 830 Brickell’s asking rents are above the norm, compared to the rest of the Miami office market. Cushman and JLL’s quarterly reports show that Brickell’s overall asking rents averaged between $63 and $82 a square foot, while Class A space fetched between $70 and $86 a square foot. Asking rents in other areas of Miami, such as downtown Miami and Wynwood, are hovering at about $51 a square foot and $70 a square foot, respectively, the reports show. In Miami Beach, overall asking rents are about $63 a square foot.

However, those prices are below the average rents in the Big Apple. In the second quarter, the direct asking rent in New York City hit $82 per square foot with Class A space going for $90 a square foot, per JLL.

As the newest office project under construction, 830 Brickell’s landlords are able to push asking rents past $100 a square foot because the submarket’s Class A available space is also at a pre-pandemic low, Messer said.

“You are seeing the $150 per square foot mark for top floors at 830 Brickell,” Messer said. “But that is kind of a unicorn because Class A vacancy is now at 6.9 percent in the Brickell submarket.”

JLL’s Jeff Gordon represented a tenant who recently signed a lease at 830 Brickell. He confirmed the building is commanding record asking rents for Miami’s central business district. Gordon declined to comment on specific dollar amounts.

“The quality of a building targeted by new-to-market tenants is paramount in their decision making,” Gordon said.

In the second quarter, the Brickell submarket took the lead in Miami-Dade County’s leasing activity, as a result of strong pre-leasing at 830 Brickell, the Cushman report states.

Office asking rents in Miami-Dade rose by 8 percent from the first quarter to the second quarter, according to Cushman. “Because of tight market conditions, even Class A buildings that have not been recently built are still quoting higher asking rents,” Messer said. “Class A space tenants are definitely looking for quality over costs.”

With 830 Brickell setting a new threshold for asking rents above $100 per square foot, landlords of other office projects in the pipeline will set their prices on a similar scale, experts say. In addition to Citadel’s new tower, which will be co-developed with Sterling Bay, a joint venture between Swire Properties and Related Companies plans to build One Brickell City Centre at 700 Brickell Avenue and 799 Brickell Plaza. The proposed tower would feature the largest floor plates for a Class A office building in Miami.

Asking rates in both new towers will surely be over the $150 per square foot mark, said Colliers’ Maggie Guajardo Kurtz.

Other Brickell trophy and Class A buildings’ landlords are playing follow-the-leader, jacking up their asking rates by $5 a square foot to $15 a square foot in the past three months, according to JLL.

Class B properties also are seeing a windfall, Kurtz said. 777 Brickell and 800 Brickell, both undergoing renovations, are quoting over $70 per square foot for full-service rent, up from $40 a foot in early 2020, she said. “They have their own water views, and the demand is there,” Kurtz said. “So they are commanding it.”

Yet, Neil Merin with NAI Merin Hunter Codman cautioned that South Florida office landlords setting asking rents at $150 a square foot and above are not necessarily closing deals at those rates.

“One Flagler has closed a deal recently at $108 a foot and some at $105 a foot,” he said. “No one is getting a $180 per foot rate. Those kinds of numbers are not indicative of the market. ”