Trending

Air paying $471M for South Florida apartments

Apartment REIT under contract to pay $298M for Miami Beach towers, already scooped Fort Lauderdale multifamily project for $173M

Air Communities is spending big bucks on South Florida multifamily projects.

The Denver-based real estate investment trust is paying $471 million for two apartment properties in Miami Beach and in Fort Lauderdale’s booming Flagler Village neighborhood.

Air bought The District at Flagler Village building at 555 Northeast Eighth Street in Fort Lauderdale for $173 million, and has Southgate Towers at 900 West Avenue in South Beach under contract for $298 million, according to the REIT’s third quarter earnings release.

Mill Creek Residential sold The District, after completing the 24-story building with 350 units last year. The Boca Raton-based firm had paid $7 million for the 2-acre development site in 2019.

The District’s apartments range from studios to three-bedroom units with monthly rents from $2,301 to $3,847, according to Apartments.com.

Air’s purchase, which closed in the third quarter, pencils out to $494,000 per unit.

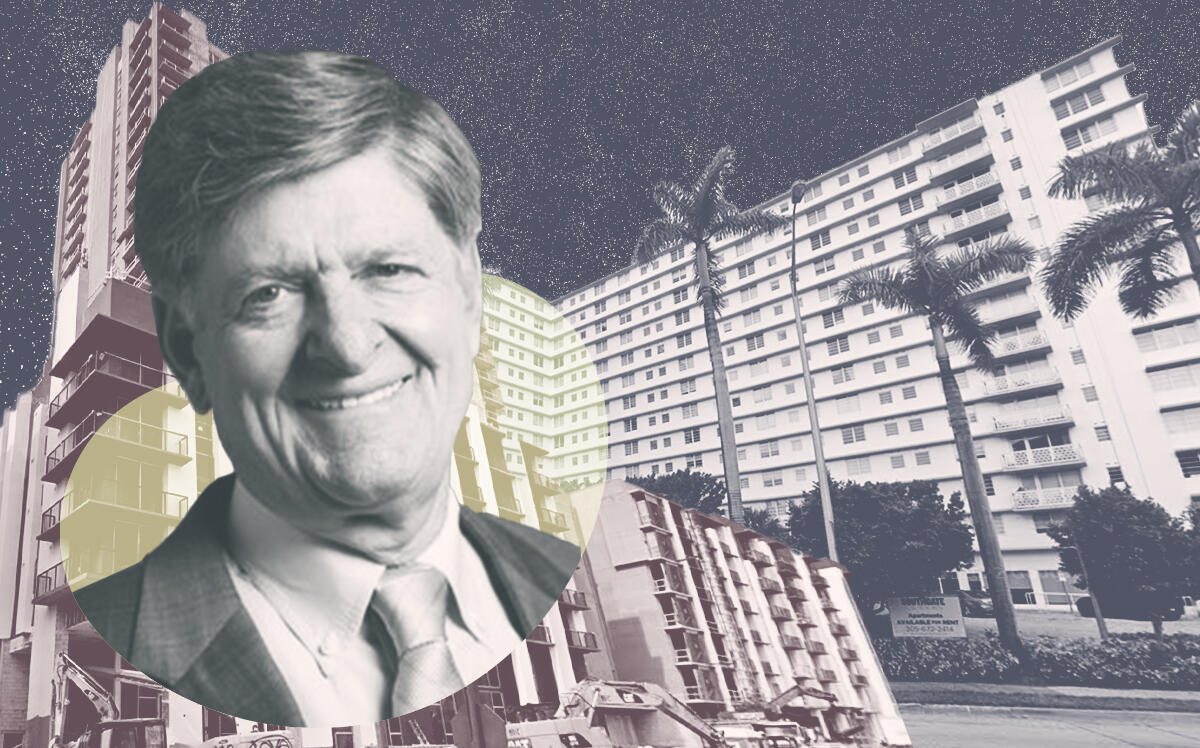

The 495-unit Southgate Towers consists of a pair of 14-story buildings on 4 acres in South Beach, overlooking Biscayne Bay and Miami. Gumenick Properties, based in Richmond, Virginia and Miami Beach, owns the property, according to records. The late Nathan Gumenick, who founded Gumenick Properties in the 1940s, developed Southgate, according to media reports. The firm is now led by Chairman Randy Gumenick.

The buildings offer apartments ranging from studios to three-bedroom units with monthly rents from $2,179 to $5,465, according to Southgate’s website.

Air’s purchase of the buildings, which equates to $602,000 per unit, is expected to close early next year.

The REIT also bet on the multifamily market in Miami’s Edgewater neighborhood this summer. Air paid $211 million for the 28-story, 296-unit Watermarc at Biscayne Bay on the northeast corner of North Bayshore Drive and Northeast 21st Street. Mill Creek also sold this property.

South Florida’s apartment market has experienced hefty investment sales activity. The influx of residents since late 2020 fueled record rent hikes, although the growth rate has slowed. In September, the area’s rents increased 13 percent, year-over-year, to $2,590, according to Realtor.com.

Air, led by Terry Considine, spun off from Aimco in 2020 as an apartment communities REIT.

Aimco also has been investing in the South Florida market. In Flagler Village, Aimco paid $100 million in three deals this year, assembling 9 acres at 901-927 North Federal Highway and land on both the southeast and southwest corners of Northeast Ninth Street and Northeast Fifth Avenue. The properties allow for 3 million square feet, including up to 1,500 units, more than 300 hotel keys, and over 100,000 square feet of retail.