Trending

iBuyer startup Opendoor launching new home loan program

The startup said it will offer competitive interest rates and no lender fees

Opendoor, an instant-homebuying startup with a valuation of $3.8 billion, is moving into lending.

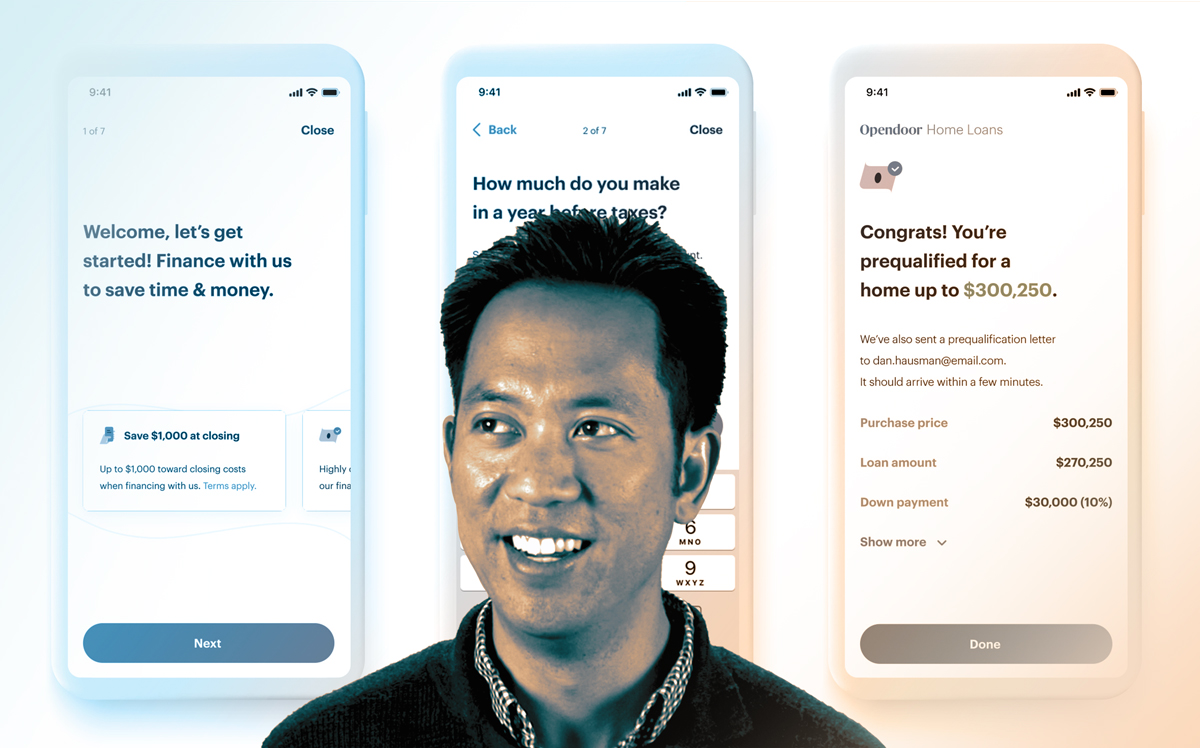

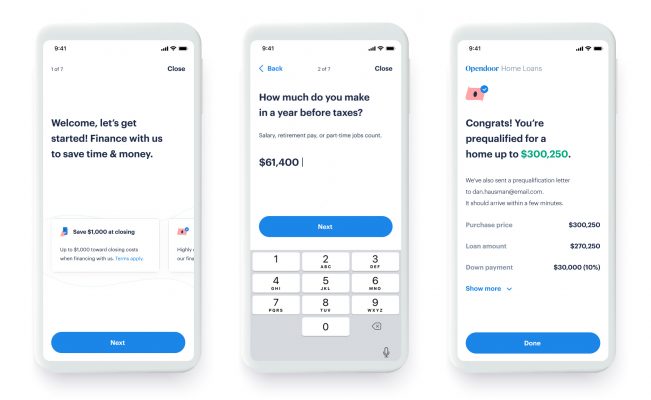

The company announced its newest program, Opendoor Home Loans, on Thursday, promising it would make the process of securing a mortgage quicker, simpler and more transparent.

Through the Opendoor app, consumers can determine if they pre-qualify for financing, regardless of whether they planned to buy a property through the iBuyer or in the wider market. Opendoor buys homes from individuals and flips them after completing renovations.

The company said it would offer competitive interest rates and no lender fees, however it does not currently have a function that allows users to compare these figures with third parties.

Each borrower would also receive assistance from a qualified mortgage consultant employed by Opendoor.

Opendoor is the latest iBuyer to enter the lending space after competitor Zillow launched a home loans division in April.

“It takes us one step closer to providing an end-to-end experience where you can buy, sell or trade-in a home in just a few clicks,” said Nadia Aziz, who heads up Opendoor Home Loans, in the company’s Thursday blog post.

Through the Opendoor app, consumers can determine if they pre-qualify for financing, regardless of whether they planned to buy a property through the iBuyer or in the wider market.

The announcement followed months of turbulence at Opendoor. The startup started firing about 50 of its 1,300 employees back in June, and asked hundreds of remaining employees to move to the company’s Phoenix location, where it said it plans to double its headcount over the next year. The company has also scaled back its free-lunch policy.

The company has also experienced a flurry of executive turnover, losing its co-founder JD Ross, CFO Jason Child and vice president of engineering Bali Raghavan all in the past year.

Opendoor announced a new $300 million fundraising round in the spring, with investors including SoftBank’s $100 billion Vision Fund.

The lending product was in development for about a year, and was initially tested in Texas. Aziz wrote in the blog post that Opendoor planned to move into other markets in the coming months.