Trending

UK tax break expiration could hurt struggling retailers

Without the tax reclamation measure, tourists may go elsewhere, business owners argue

A popular tax break is expiring in the United Kingdom in January, threatening the country’s status as a shopping destination and potentially dealing another blow to struggling retailers.

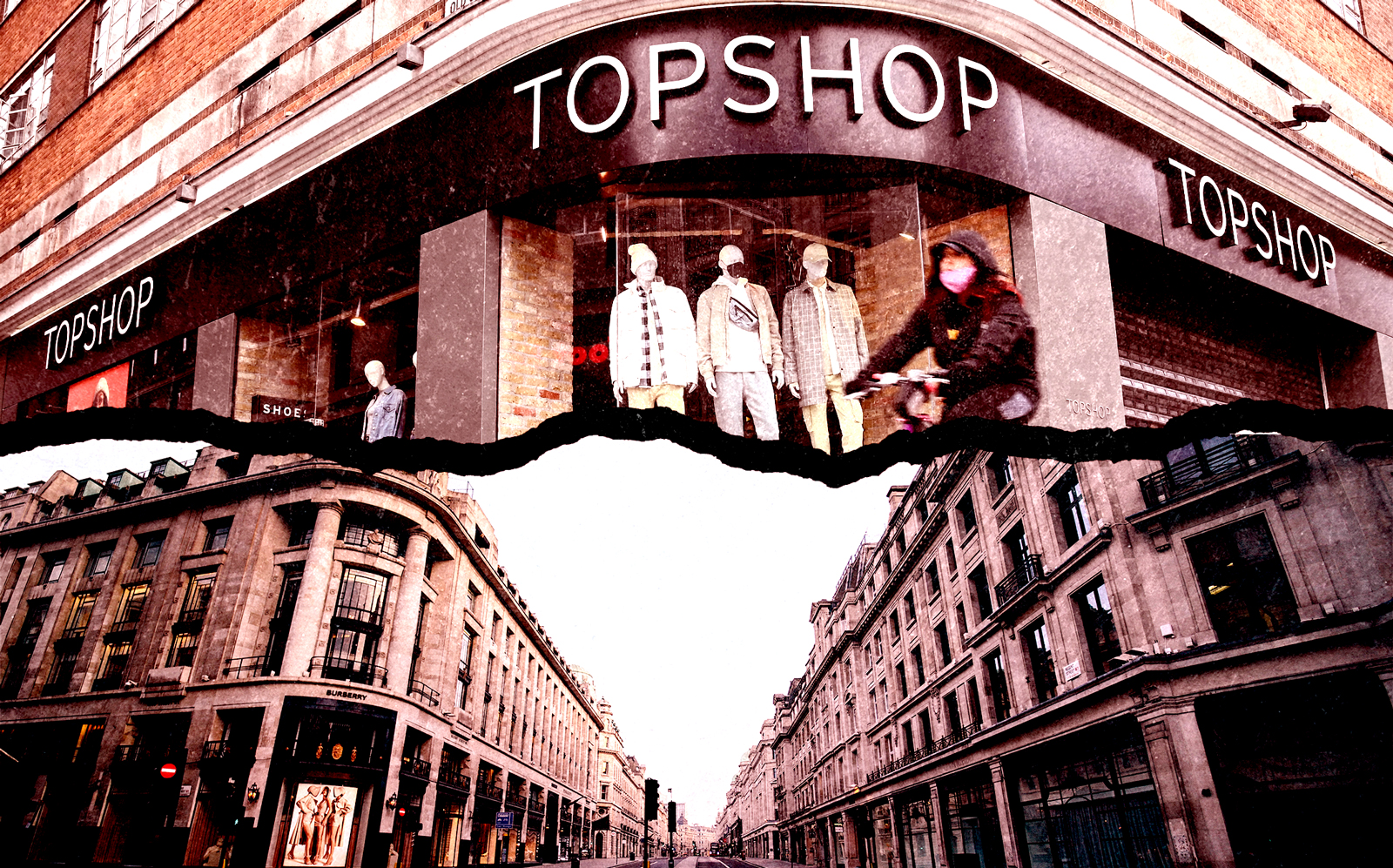

The scheme allows foreign visitors to reclaim a sales tax of 20 percent on items bought in the country for more than £30, or roughly $40, according to the Wall Street Journal. That can add up, especially for foreign visitors dropping serious coin in pricey shops on London’s high streets — which are already seeing an exodus of retailers — and premier shopping districts.

The tax break expires after the U.K. formally withdraws from the European Union Customs Union and European Single Market on Dec. 31.

British business owners worry that shoppers will stop coming to the U.K. in favor of other European destinations, such as Paris or Milan, that have similar tax schemes. Visitors from outside the European Union can claim 20 percent of their spending in France and 22 percent in Italy.

A recent survey of tourists found that at least 70 percent of visitors from Asia and the Middle East, along with 70 percent of Americans, are less likely to visit the U.K. after the tax break expires.

The coronavirus pandemic is also putting pressure on British retailers. More than 7,800 retail stores closed in the first half of the year.

The owners of Heathrow Airport are leading a legal challenge against repealing the tax refund, claiming in the British High Court that the government failed to consult parties most affected by the change and for miscalculating the financial details of the repeal. [WSJ] — Dennis Lynch