What does a(nother) Covid spike mean for retail real estate?

What does a(nother) Covid spike mean for retail real estate?

Trending

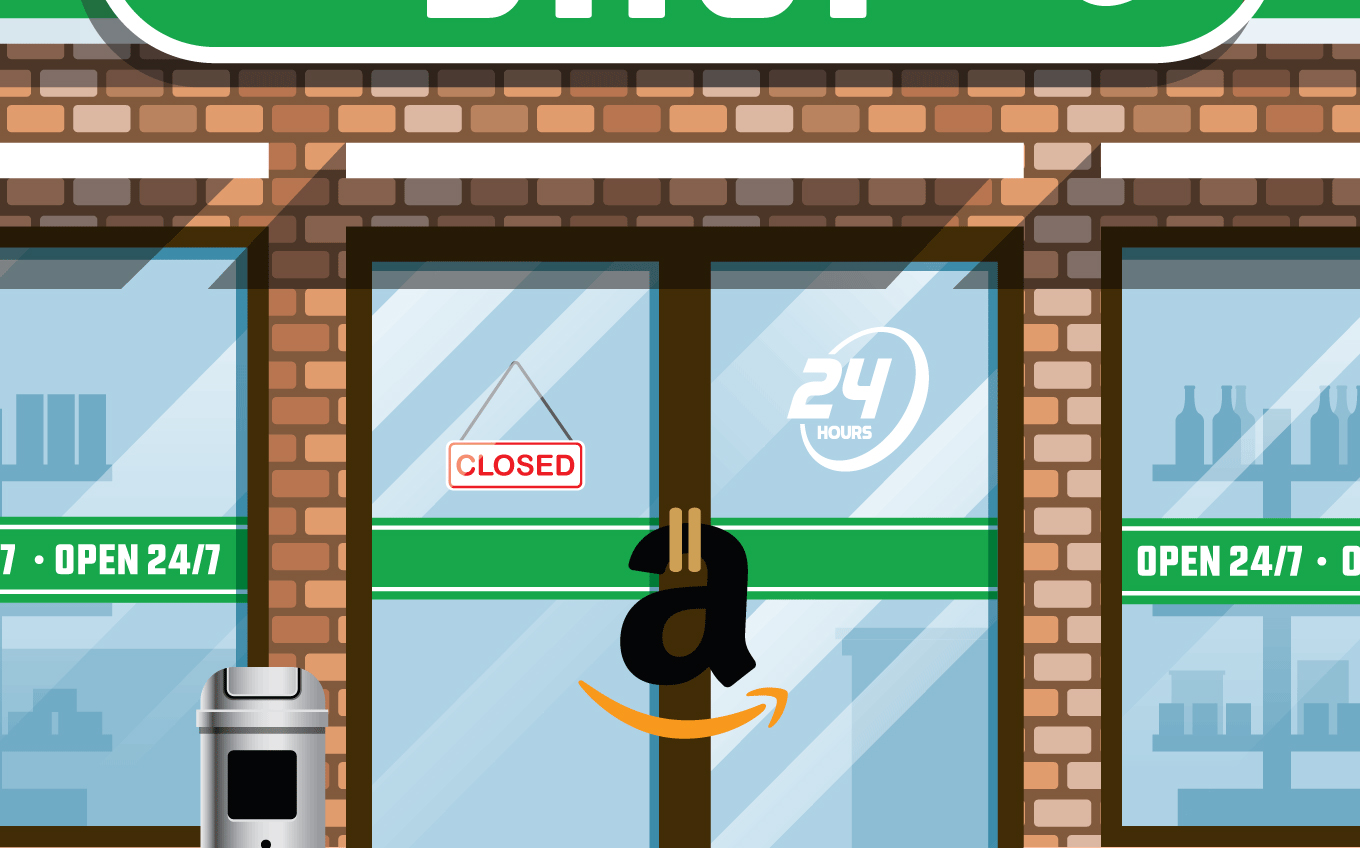

2020 proved Amazon has never been serious about brick and mortar

Infectious diseases experts designing the perfect grocery store to keep a hungry nation fed during a global pandemic likely would have created something similar to Amazon Go stores. Contactless retail that uses cutting edge scanning and sensors to create a streamlined shopping experience, keeping customers apart and ushering them out quickly. Years of testing has proven the technology works. So why does Amazon only have a handful of Go locations when the need for a safer form of retail has never been greater?

Read more

What does a(nother) Covid spike mean for retail real estate?

What does a(nother) Covid spike mean for retail real estate?

Amazon debuted the ‘future of retail’ when the company opened the first Amazon Go store to the public in 2018. The cashier-less store meant customers could simply scan their phones, grab products off the shelves and then walk out. Years of development were able to hammer out practically every issue, stores were well received by locals. News reports after the successful debut said Amazon had plans to start installing the technology for customers in the first quarter of 2020 and have hundreds of these stores working by the end of 2020. By the end of 2021, Amazon aimed to have 3,000 Go stores. As we approach the end of January 2021, it’s clear that’s unlikely to happen. Only roughly twenty Go locations are still operational amid the pandemic.

Implementing the future of retail is proving to be far more difficult than designing it. Amazon doesn’t comment on speculation, but it’s safe to say the company has struggled with how to leverage the Go technology. Developing Go branded stores were once the preferred option, then the company started to look at leasing the technology to other retailers. Charging retailers a percentage per sale was reportedly also explored as a business model for the Go technology. Strategies went back and forth trying to decide whether it was smart to develop Amazon branded locations, to target big box retailers like Walmart or Target first, or airports and stadiums.

In March of last year, Amazon announced it would start selling the technology behind its Go locations, packaging the cameras, sensors and AI together, dubbing it Just Walk Out technology. The news was followed by a deal with OTG, which planned to implement the tech at the more than 350 airport restaurants and retail locations in North American. Amazon’s claim that it already had several other major deals lined up was welcome news to an ailing public. With a deadly virus sweeping across the country, never has the need for Amazon’s new retail tech been greater. Yet now, 10 months after the announcement, those deals have not materialized. Airport retailer Hudson reached an agreement with Amazon for a test store. Far from the thousands of stores and a nationwide rollout of new retail technology.

Amazon’s history with the world of brick and mortar retail has been contentious. From its early days as an online book dealer, the e-commerce giant has been putting brick and mortar sellers out of business. Decades of bad blood may be holding Just Walk Out technology back. The idea that Amazon, the company who has put more brick and retailers out of business than any other business, has technology that can save brick and mortar retailers, likely doesn’t hold water for many.

Looking into Amazon’s data practices with Just Walk Out Technology, it’s easy to see why. During a pandemic, the most useful part of the technology is its benefits to public health. For business, it’s all about the data. Just Walk Out technology generates an enormous amount of valuable data on products, each individual customer and their shopping habits. That data and the ability to leverage it would give small retailers the same type of analytical muscle as Amazon. Which is why it’s a huge problem for retailers that the data will be shared with Amazon. Offering a technological lifeline to rivals to collect data on their customers, that Amazon can then turn around and use itself to gain yet another advantage over said rival, won’t help to settle any beef. Amazon says it will only collect information for billing purposes. Giving Amazon the most valuable data in your business and trusting them not to use it against you is a difficult proposition.

Backlash against Amazon is real, Walmart makes it a point not to use Amazon Web Services, but how much it’s impacting the rollout of Just Walk Out technology is hard to say. Cost may also be a major factor, experts estimate each location costs about $1 million, plus fees to Amazon for 24/7 support and data hosting. Many retailers will likely struggle to see any ROI, especially considering so many are already feeling financial pain. Amazon is also far from being the only purveyor of Just Walk Out tech. Retail tech is booming with startups like Grabango, Keyo, Aifi and others, who offer similar tech for a fraction of the price, making Amazon’s own efforts seem less serious by comparison.

What’s clear is that what could be the best brick and mortar retail technology to promote public health is missing its moment as Covid-19 continues to spread across the United States. While Amazon has raked in billions during the pandemic, technology it controls that could impact the course of the pandemic has languished. More brick and mortar locations closed last year than any other, while Amazon’s dominance became absolute. To give credit where it’s due, Amazon and its nationwide army of warehouse workers and drivers have been their own type of critical lifeline during quarantine fulfilling the safest form of retail: in home delivery.

Despite all of Amazon’s capabilities, creating a coherent brick and mortar strategy for itself has been one of the company’s greatest challenges. Amazon remains the e-commerce leader, accounting for $46.85 billion of the $108.13 billion worth of U.S. e-commerce sales growth in 2020. But e-commerce still only accounts for 14.5 percent of all retail sales, leaving the majority of the retail sector untapped by Amazon.

Amazon’s $13.7 billion acquisition of Whole Foods turned the online marketplace into a major real estate player overnight, transforming 500 locations into Prime real estate across the country. Integrating Whole Foods into Amazon’s operations has been far from seamless. The company’s brick and mortar retail strategy has become a confusing mix of hundreds of Whole Foods locations pushing Prime products, a handful of Amazon Go locations, book stores, Amazon 4-Star locations and a new smaller Amazon Fresh branded grocery store. In all, Amazon has seven different brick and mortar location types, with only Whole Foods operating more than a couple dozen locations. Nothing like a nationwide rollout of thousands of stores.

“You’re throwing a lot of stuff against the wall and it’s not sticking. That’s what all this is telling me,” Sucharita Kodali, an e-commerce analyst for Forrester, told CNET. Kodali added that despite the massive amount of press each new type of store generates, none of the concepts have proven to be success at growing business.

For nearly four years now Amazon has been betting on brick and mortar. The nation’s finest business reporters have written dozens of pieces rationalizing Amazon’s latest physical retail gambit. To date, Amazon’s ‘bets’ on brick and mortar retail have been little more than experiments, akin to prop bets more than anything else.

Amazon is firmly dedicated to the future of e-commerce, no matter what the headlines say. Amazon’s core competency is as a tech company, not a retailer. Last year was an unprecedented opportunity for Amazon to actually bet on brick and mortar retail, to use its technology for good, promoting public health and giving struggling business owners a tool for survival. Amazon, instead, took a pass, all the while gaining more than $600 billion in market cap. I guess brick and mortar’s biggest killer won’t turn out to be its savior after all. [Propmodo]