Trending

Why investors are rushing into real estate ETFs

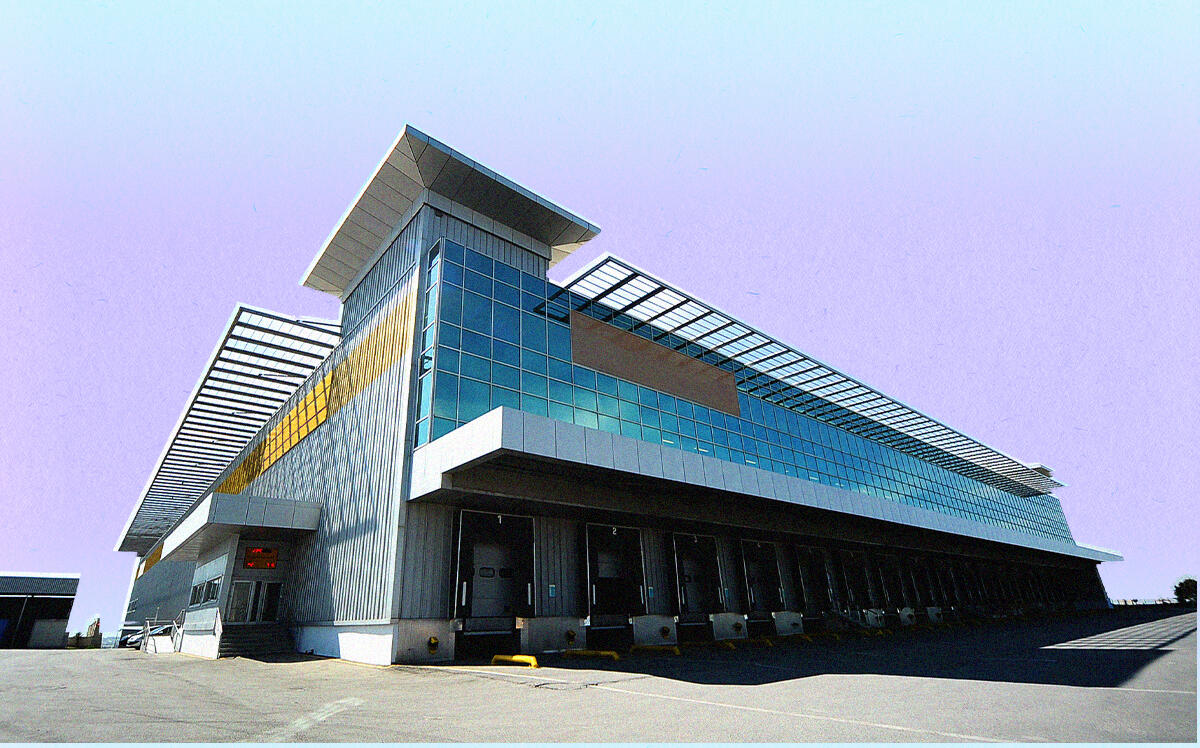

Beyond reopening, fund purchases reflect optimism about storage, supply chains

Investors are pouring money into real estate exchange-traded funds, in part as a bet on the storage and supply chain sectors.

The $6.2 billion iShares U.S. Real Estate ETF saw $1.3 billion of inflows last week, its most ever, making it the second biggest gainer among ETFs. The $41.4 billion Vanguard Real Estate ETF brought in $338 million following its $1.2 billion of inflows in May, according to Bloomberg News.

Though much of the activity in commercial real estate reflects optimism about reopening, the need for more data-related and supply-chain storage has remained consistent before and throughout the pandemic.

“It seems investors are using real-estate ETFs as a means of capitalizing on global logistics concerns,” Bloomberg Intelligence ETF analyst Athanasios Psarofagis told the publication.

Other real estate ETFs are expected to do similarly well as a strong demand for property, particularly residential assets, remains unmet because of low supply and the rising cost of building materials and labor.

“The big increases you’ve seen in single-family home prices is unprecedented in a recession and provides a lot of head room for apartment REITs,” BTIG analyst James Sullivan told Bloomberg.

[Bloomberg] — Sasha Jones