Home price growth continues to slow

Home price growth continues to slow

Trending

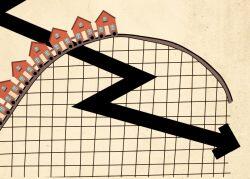

Home prices cooled at historic rate in July

Annual gain down 2.3 percentage points from previous month

Home prices slowed their roll this summer — at a historic rate.

The S&P CoreLogic Case-Shiller Index posted a 15.8 percent annual gain in July, down from June’s 18.1 percent increase. Not only was it the fourth straight month of deceleration, but the 2.3 percentage point difference was also the largest recorded in the index’s 27-year history.

Before the spring, one had to go back to November for signs of deceleration in housing prices. The market appears to be normalizing, however, as rising mortgage rates and inflation hamper would-be buyers.

The 10-city composite, which measures the nation’s 10 largest metros, increased 14.9 percent in July, down from 17.4 percent in June and 19.1 percent in May. The 20-city composite jumped 16.1 percent in July, down from 18.7 percent in June and 20.5 percent in May.

Price growth deceleration is not the same as price growth decline. Decelerating growth in recent months is still high from a historical perspective and overall prices are still on the rise, notching regular records.

But the market still has the potential to turn further toward buyers as the Federal Reserve continues ramping up interest rates in an effort to curb inflation.

“Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate,” said S&P’s Craig Lazzara in a statement.

Read more

Home price growth continues to slow

Home price growth continues to slow

U.S. home price growth slows for first time in five months

U.S. home price growth slows for first time in five months

Mortgage rates jump, but so do applications

Mortgage rates jump, but so do applications

Tampa was top among the major metros with a 31.8 percent year-over-year gain in home prices in July. It was the city’s fifth straight month atop the chart, but Miami is on its heels, sporting a 31.7 percent increase in July. Dallas held on to third for another month, coming in slightly shy of a 25 percent increase.

All 20 cities posted gains year over year, but none of the cities posted a stronger gain in July than June, marking deceleration across the board.

Home prices soared at the start of the pandemic when buyers were freed up by remote work and drawn by different climates and more space. Low inventory has been among the factors propping up prices since.

Mortgage rates have surged since the start of the year, cutting the buying power of many Americans. Demand for mortgages has become more volatile, slowing down sales and alleviating ballooning prices.