Historic Oakland Rotunda Building under contract to be sold

Historic Oakland Rotunda Building under contract to be sold

Trending

Rubicon buys majority ownership stake in Oakland’s historic Rotunda Building for $72M

SF firm plans to modernize 110-year-old property, add some new features and reduce its carbon footprint

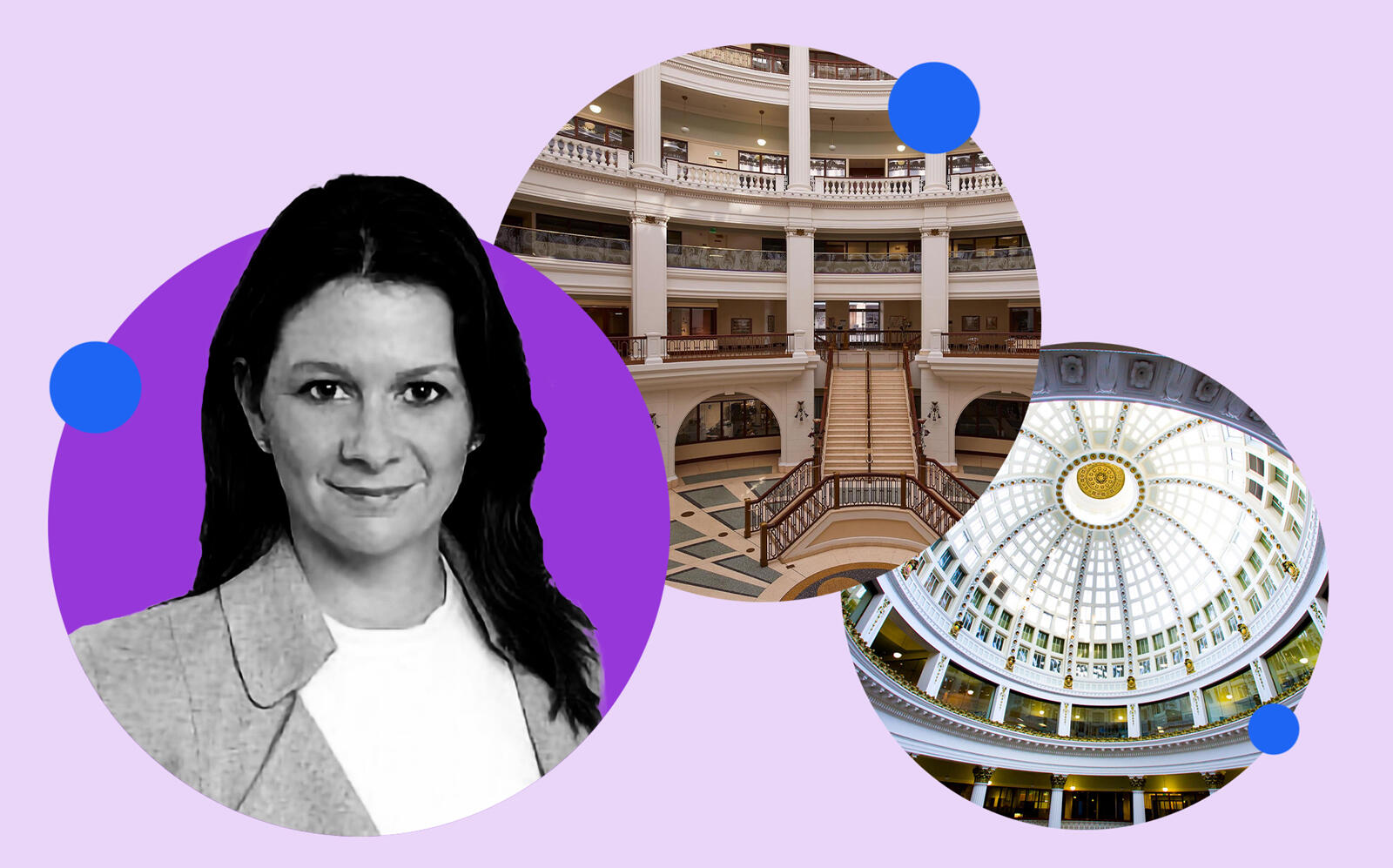

Downtown Oakland’s historic Rotunda Building has a new majority owner: Rubicon Point Partners, which plans to modernize the 110-year-old property and add some new features.

The San Francisco real estate investment firm acquired the 340,000-square-foot office building from a subsidiary of California Capital & Investment Group for just over $72 million, according to a news release and the Mercury News. Rotunda Partners II, its sole owner for more than two decades, retained a minority stake. The deal was recorded at the Alameda County Clerk-Recorder’s Office on Jan. 24.

Rubicon plans to incorporate a fitness center, upgraded common areas, room for hybrid digital meetings and “collaboration infrastructure” into the eight-story building, which also includes a four-story parking garage, and reduce its carbon footprint, the release said. The company intends to offer the property, which is on the National Register of Historic Places, as a venue for galas and events that benefit the city of Oakland.

“We look forward to implementing an improvement plan that will honor its history but also modernize it to allow for a new generation of companies to thrive,” Rubicon’s Ani Vartanian said in a statement. “We are especially excited to work with key stakeholders to activate Frank Ogawa Plaza and integrate it with the building’s indoor space. This indoor-outdoor environment is rare in urban settings like downtown Oakland.”

Located across from City Hall, the Rotunda Building was completed in 1912 and designed by Charles W. Dickey, the same local architect who designed the Claremont Hotel. Rotunda Partners reinforced the building with a full seismic retrofit in the early 2000s after it was damaged in the 1989 Loma Prieta earthquake, the release said. It obtained a $12 million loan from the city for the project, which stipulated that once the property sells, Oakland will receive 50 percent of all proceeds above $38 million.

“We selected Rubicon because of their track record in transforming historic assets and are confident that they will be great custodians of this Oakland jewel,” Rotunda’s Phil Tagami said in a statement.

UPDATED: This story has been updated to include the sale price, cited from a Jan. 24 Mercury News article.

Read more

Historic Oakland Rotunda Building under contract to be sold

Historic Oakland Rotunda Building under contract to be sold

Rubicon Point Partners buys San Francisco building slated to become state-of-the-art medical facility

Rubicon Point Partners buys San Francisco building slated to become state-of-the-art medical facility

Rubicon targets SF, Seattle office space with $230M fund

Rubicon targets SF, Seattle office space with $230M fund