Brookfield to spin off asset management business

Brookfield to spin off asset management business

Trending

San Jose Marriott part of Brookfield’s $3.8B deal for Watermark portfolio

Per-key average could price hotel at $245M, a 54-percent jump over $154M paid in 2016

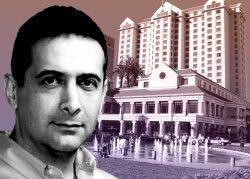

Brookfield’s $3.8-billion deal to buy Watermark Lodging Trust includes a major San Jose hotel.

The acquisition by the Toronto-based real estate investment trust raked in 25 hotels across the U.S., including the 510-room San Jose Marriott at 301 S. Market St., the San Jose Mercury News reported.

Among the individual properties acquired by Brookfield Real Estate Funds, a unit of Brookfield Asset Management, was the 510-room hotel in Downtown San Jose, along with the 336-room Ritz-Carlton San Francisco, a half mile from Union Square.

The 8,163-key deal, which also included the 226-room Fairmont Sonoma Mission Inn & Spa resort in wine country, is expected to close in the fourth quarter.

Brookfield estimates it paid an average $481,300 a key for its new portfolio of one-third resort hotels and two-thirds full-service hotels in different urban markets.

That price per key would value the San Jose Marriott at $245 million. OpenComps, which tracks the hotel investment market, estimated a price of around $237 million for the property

Either estimate is around more than 50 percent higher than the $154 million Watermark Lodging paid for the San Jose hotel in 2016.

“This transaction shows how Brookfield anticipates a strong recovery for the higher-end hotels in the Bay Area and Silicon Valley, and the return of the corporate traveler,” said Alan Reay, president of Irvine-based Atlas Hospitality Group, which tracks the Bay Area lodging sector.

Despite the prospects of an improving hotel sector, the local hotel market may still have a downside.

Across Market Street from the San Jose Marriott, the Westin San Jose was purchased in January for $62.3 million – 2.7 percent less than its purchase value of $64 million in 2017. The century-old Italian Renaissance Revival landmark, once known as the Sainte Claire Hotel, has 171 rooms.

Meanwhile, the 805-room Signia by Hilton San Jose, formerly the Fairmont San Jose, opened its doors at 170 S. Market St. late last month more than a year after its owner closed its doors and filed for bankruptcy. Like many Bay Area hotels, its business suffered during a pandemic hotel slump, considered the largest in the nation.

Brookfield Asset Management, among the largest commercial landlords in major U.S. markets such as Los Angeles and New York, announced this month it would spin off its asset management business to create a company worth up to $100 billion.

[San Jose Mercury News] – Dana Bartholomew

Read more

Brookfield to spin off asset management business

Brookfield to spin off asset management business

DTSJ hotel pushes back debut of new brand

DTSJ hotel pushes back debut of new brand