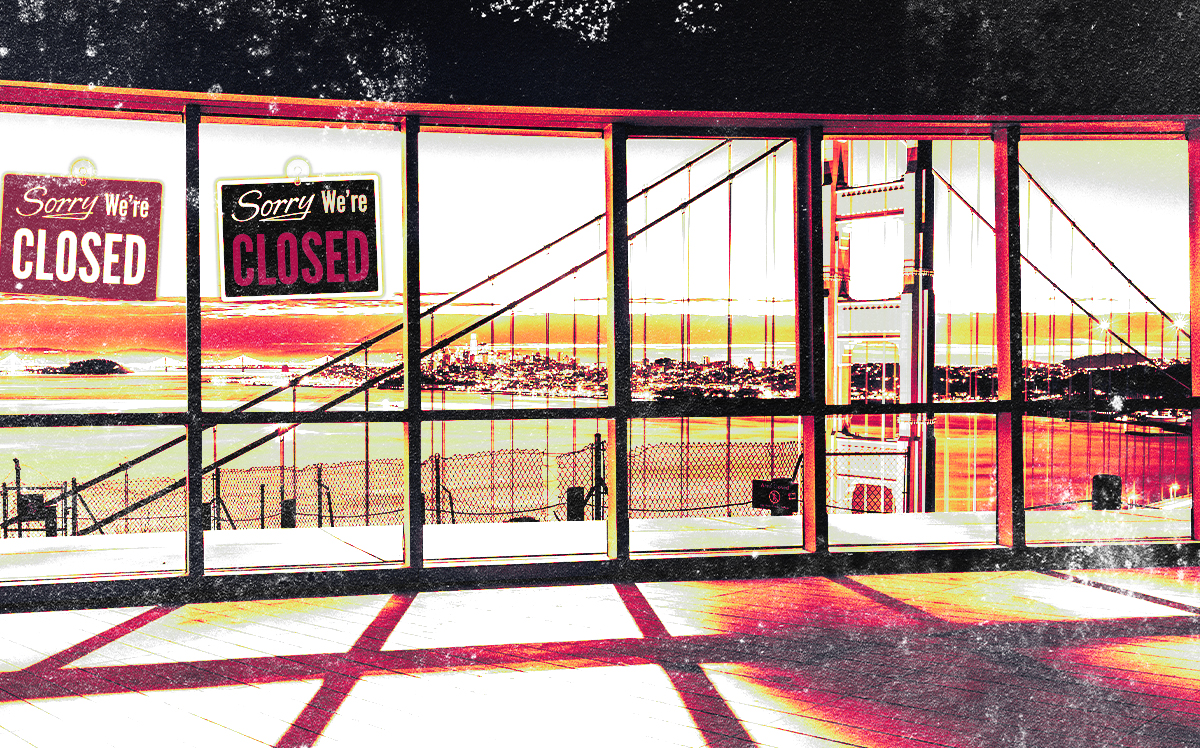

SF workers slowest in U.S. to return to the office

Trips to workplaces 37% lower in October than January 2020, Google mobility data shows

A new mobility study shows San Francisco has the slowest rebound to in-person work in the nation.

Trips to workplaces in San Francisco were nearly 40 percent lower in October than in January 2020, the biggest percentage drop among 50 major cities, the San Francisco Chronicle reported, citing Google mobility data.

By mid-April 2020, time spent in the workplace plummeted to 70 percent of what it was at the beginning of the year for San Francisco, according to Google’s COVID-19 Community Mobility Reports.

Despite some growth, time spent in the workplace among these Google users in San Francisco was still 37 percent lower in October 2022 than before the pandemic.

Meanwhile, New York was 31 percent lower and Los Angeles 28 percent lower than before the coronavirus onset.

Google mobility reports, which ceased publishing in October 2022, are based on data from anonymous Google users who have their “Location History” setting turned on in their account, so the numbers may not be representative of all users.

The Mountain View-based search giant uses its location tracking and map directions data to quantify the places people are visiting — “workplaces,” which includes offices and production facilities, and “retail and recreation” places.

While many cities report 30 percent to 35 percent lower workplace trips, San Francisco’s Chief Economist Ted Egan said “there’s probably a certain amount of ‘only in San Francisco’ phenomenon that’s keeping people away from the workplace.”

One reason might be that people are dragging their feet to commute to work.

Transit in the Bay Area has been slower to recover than in other comparable cities, according to Egan. Another reason could be that people are no longer interested in going Downtown.

Egan compared San Francisco to New York, where he said the nightlife is back and Manhattan residential rents are back. That’s not happening in Downtown San Francisco.

“It’s probably the kind of overall listlessness of Downtown,” Egan told the Chronicle, “which is a bit of a vicious circle because you really need the office workers to come back to have the vitality of the area returned to what people are used to.”

City offices, of which 27.6 percent are now empty, have a major impact on San Francisco finances. In 2021, office work contributed to three-quarters of the city’s GDP, according to Egan.

The speed with which San Francisco offices cleared out during the pandemic was faster than any city in the U.S., as many tech firms were the first to embrace remote work. Since then, many firms have downsized offices.

“Almost nowhere in San Francisco is sales tax recovery to where it was before the pandemic after you adjust for inflation, and it’s particularly bad in Downtown,” Egan said. “We’re missing office workers, we’re missing residents and we’re missing hotel guests who were usually customers to those businesses.”

— Dana Bartholomew