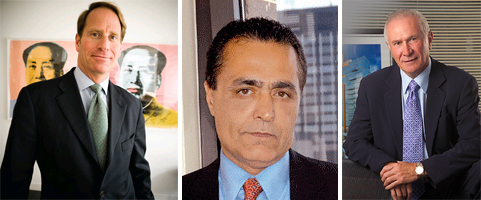

Kent Swig, Yair Levy, Serge Hoyda

Kent Swig, Yair Levy, Serge HoydaA state Supreme Court judge has agreed to hear arguments July 20 to block the auction of the Sheffield57’s senior mezzanine debt and force Fortress Investment Group and developer Kent Swig to answer questions under oath.

Lawyers for Yair Levy and Serge Hoyda, the majority investors at the luxury condominium, asked Judge Bernard Fried to order an injunction blocking the auction, the release of all documents related to the loan agreement and the chance to depose Swig and Fortress about the terms of the debt sale.

“He’s going to consider my request for expedited discovery,” said Stephen Meister, lead attorney for Levy and Hoyda. “There will be a hearing to determine whether to issue an injunction restraining [Fortress] from committing a [non-judicial] foreclosure sale.”

Meister claims that the agreement between Swig and Fortress would allow the developer to retain some equity in the project, while wiping out the equity stake held by Levy and Hoyda, who own about 70 percent of the Sheffield57 condo.

Meister claims that the agreement between Swig and Fortress would allow the developer to retain some equity in the project, while wiping out the equity stake held by Levy and Hoyda, who own about 70 percent of the Sheffield57 condo.

Attorneys for Fortress were not immediately available for comment and Swig was not immediately available for comment.

However, in a court filing dated today and obtained by The Real Deal, attorneys for Swig argued that the allegations are false and nothing more than an attempt by Levy and Hoyda to wrest control of Sheffield57 from Swig.

“…plaintiffs’ goal is to seize total control of the project in contravention to the parties agreement,” wrote Swig attorney Y. David Scharf. “Plaintiffs’ allegations are invented and there is no evidence to suggest that [Swig Equities] has committed any wrongdoing. By instituting this action, plaintiffs are simply attempting to take advantage of the project’s current economic woes, which are being caused by the global recession, and tremendous downturn of the residential condominium market over the last year and a half.”

Court records reveal that Meister sent letters to Fortress asking that it disclose details of its agreement with Swig, but did not receive a response. In a June lawsuit, Meister alleged that the deal was part of a “loan-to-own” scheme involving so-called predatory behavior by the Sheffield57 lenders, including Wells Fargo, the trustee of the senior mortgage loan and Guggenheim Structured Real Estate, which held the senior mezzanine loan before selling it to Fortress.

In May, Swig defaulted on senior and mezzanine loans with a remaining balance of about $100 million, which were then sold at a discount to Fortress, which agreed to come in and recapitalize Sheffield57.  Unless another firm buys the Sheffield57 debt in the Aug. 6 auction, Fortress would assume ownership of the building at a substantial discount to the price in a normal equity sale, according to real estate analysts.

Unless another firm buys the Sheffield57 debt in the Aug. 6 auction, Fortress would assume ownership of the building at a substantial discount to the price in a normal equity sale, according to real estate analysts.

Lawyers for the Sheffield57 principals were joined by attorneys for Fortress and other lenders Tuesday to hear whether Levy and Hoyda should be granted a motion for a temporary receiver at Sheffield57.

Ben Michelson, managing director of Fortress, warned that the investment firm had agreed to make “protective advances” to fund millions of dollars in unpaid common charges, outstanding mechanic’s liens and operational expenses prior to the auction, but may decline to pay them if a receiver is appointed.

“Should a receiver be appointed, a receiver would not have any funds to pay outstanding liens or ongoing expenses, much less complete the construction needed to complete the building, get the condominium plan re-effective and resume selling unsold units to the public,” said Michelson, in an affidavit filed yesterday and obtained by The Real Deal.

He warned that receivership would likely push the Sheffield57 project into bankruptcy proceedings.