Six months after the building was auctioned off in a fire sale, the New York State Attorney General’s office has approved an amended offering plan for the Sheffield57 condominium near Columbus Circle in a move that could lead to a resumption of sales for the first time since May 2009.

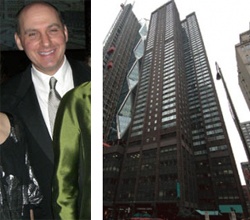

Sales at the tower at 322 West 57th Street have languished for months, after former developer Kent Swig defaulted on millions of dollars in mortgage and mezzanine loans and failed to provide an updated plan with state regulators.

The building’s current owner, Fortress Investment Group, has been working with Rose Associates, the building’s recently named management firm, to complete renovations at the building so sales could resume.

“The Sheffield is moving steadily towards resolution and ultimately being a success,” Adam Rose, co-president of Rose Associates, told The Real Deal.

Fortress acquired Sheffield57 for $20 million, plus the assumption of debt, in a so-called mezzanine auction in August 2009.

Fortress acquired millions of dollars of Swig’s defaulted mezzanine and mortgage loans and made the only bid during the auction.

Fortress still owes $34.7 million on a senior mortgage loan that has a maturity date of April 2010.

Swig no longer has any involvement in the building, but still has an agreement to share potential back end revenue, Swig’s attorney Y. David Scharf told The Real Deal. Swig is now facing $54 million in judgments against him after

defaulting on several loans related to Sheffield57 and other projects.

According to a copy of the amendment, obtained by The Real Deal, Amy Rose, co-president of Rose Associates and Fortress executive Constantine Dakolias, are directing the condominium project.

In addition to its management role, Rose has been retained as the interim selling agent, according to the amendment, however it remains unclear whether Rose will direct sales and marketing if the sales office resumes operation. The sales office shut down in May 2009, after Swig failed to update the building’s offering plan. The prior plan called for the 845-unit building to be converted to about 497 units, and about half remain unsold.

Fortress is raising common charges by 11.9 percent, according to the amendment, and said it will fund any shortfall remaining from the prior ownership. Units owners at Sheffield57 previously settled with Swig amid allegations that he failed to pay $5.4 million in common charges at the property.

Fortress has also made significant contributions to restore the building’s reserve fund, and retained PKF to audit the fund amid prior allegations by owners that Swig withdrew funds to make unauthorized expenditures.

Fortress has hired a new design consultant to redesign the 57th and 58th floors, which the amendment says did not conform to requirements from the original offering plan.

Lilly Donahue, managing director of investor relations at Fortress, was not immediately available for comment and nor was Ora Gordon, a spokesperson for Swig Equities.