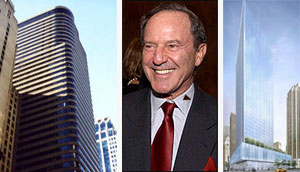

Boston Properties, led by Mortimer Zuckerman (center), ended a lease at 250 West 55th Street (right), where construction stalled and refinanced Two Grand Central Tower (left)

Commercial real estate investment firm Boston Properties said it is nearing the final round of talks to buy a $120 million stake in the $3 billion 1 World Trade Center project, which would potentially involve leasing and management of the property.

The Boston-based firm confirmed the bidding during its first-quarter earnings call with investment analysts this morning. Boston Properties is participating in the third round of bidding for the project, and faces high-profile competitors like Durst Organization, Related Companies and other firms.

“The idea is to try to bring in an equity partner that has a stake in the building but more importantly puts their expertise to use in managing the asset long term,” said Steve Sigmund, spokesperson for the Port Authority of New York & New Jersey, which controls the previously named Freedom Tower project.

Boston Properties, one of the biggest commercial office investors in the New York market, reported funds from operations of $149.6 million in the first quarter compared to $134.8 million in first-quarter 2008.

About 42 percent of the company’s income is derived from New York properties, where it owns several trophy towers, including the iconic General Motors building.

“We are, I think, continuing to do fairly well as a company in what has been a very, very bad environment, but one which I believe is somewhat moderating and improving,” said Mortimer Zuckerman, chairman of Boston Properties and publisher of the New York Daily News, on the conference call.

Funds included 5 cents a share related to ending a lease at 250 West 55th Street, where the company suspended construction of the 1-million-square-foot office tower designed by Skidmore, Owings & Merrill in 2009.

Boston Properties said that on March 1 it refinanced a mortgage loan at 125 West 55th Street, where it operates a joint venture that owns 60 percent of the property. The venture repaid $63.5 million in mezzanine loans and has a new $207 million mortgage loan that matures in 2015.

Boston Properties also refinanced a $190 million mortgage loan with a 5.1 percent fixed rate at Two Grand Central Tower, where it is also part of a joint venture that owns 60 percent of the building. The $190 million loan was originally scheduled to mature in July, but the loan, which now has a $180 million balance, comes due in 2015 at a higher 6 percent rate.

Zuckerman said the company recently raised $700 million, and along with about $3 billion in equity, it will be looking at opportunities to buy distressed assets over the next 12 to 18 months.