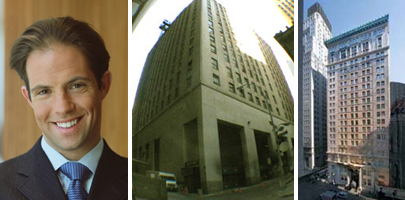

From left: Michael Shvo, 20 Pine Street and 25 Broad StreetStalled condominium developments that suffered during the recession are now

being revived in the Financial District. However, as the neighborhood emerges

from the downturn, the new developments are falling short of previous

expectations, in terms of pricing and design, the Wall Street Journal reported.

The new owners of William Beaver House, for instance, are slashing condo

prices, while the creditors of The Setai Wall Street are selling their defaulted

loan, to help closings resume. The lenders to 25 Broad Street are foreclosing on the

property, paving the way for converting it to rentals. “People in the

Financial District got a little over-ambitious, both in terms of prices and

concepts,” said Frederick Peters, president of Warburg Realty. He noted

that some developers became so obsessed with luxury amenities that they lost

site of such basics as floor plans. But other troubled developments, including two

buildings developed by Africa Israel USA, are doing better. At 20 Pine Street, the

former JPMorgan Chase building, more than 90 percent of the 406 condos are either

closed or in contract, according to Lori Ordover, a consultant to the

developer. Africa Israel’s other project, the District on Fulton Street, recently sold the last of

its 163 condo units, she added. Africa Israel has also brought in Warburg for

20 Pine, to replace broker Michael Shvo. Shvo said his relationship with the 20

Pine developers ended on a previously agreed-upon date, and that he sold condos

there at record prices. [WSJ]