New Jersey office vacancy rate (source: CresaPartners)While the Manhattan office market was generally strong in the third quarter, across the Hudson, conditions were substantially weaker. Like the rest of the country, New Jersey’s office market heavily favored tenants.

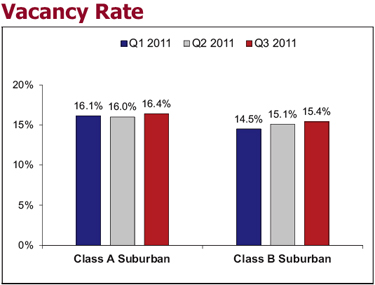

According to a market report released today by commercial tenant representative CresaPartners, the vacancy rate for Class A office space was 16.4 percent, up from 16 percent the previous quarter. The Class B vacancy rate rose 0.3 percentage points to 15.4, continuing an unabated rise from 2006 when the sector’s vacancy rate was 9.9 percent.

The most significant trend during the quarter was the shift from subleasing to direct leasing for Class A space. There was a positive net absorption of 265,000 square feet of directly leased space compared to 464,000 square feet of negative absorption in the second quarter. Sublet space fell to negative 431,000 square feet of net absorption after coming in at 354,000 square feet on the positive side the last quarter.

CresaPartners speculated that tenants have begun to use sublease space as leverage when negotiating with landlords, who know most businesses are not looking to expand in the current economic climate. The discount rate for sublease space was 22.5 percent in the third quarter, driving average rents down 13 cents to $26.52 per square foot.

Meanwhile, Class B space experienced a net negative absorption of 193,000 square feet, continuing a trend of minus 200,000 square feet per quarter since late 2008.

The one strong spot was the industrial sector, which saw a positive net absorption of 1.9 million square feet; as a result, new construction has followed. — Adam Fusfeld