The latest batch of reports from around the industry found that the Financial District was the most active neighborhood for new development in Manhattan and Brooklyn’s residential prices more than doubled over a decade.

Residential

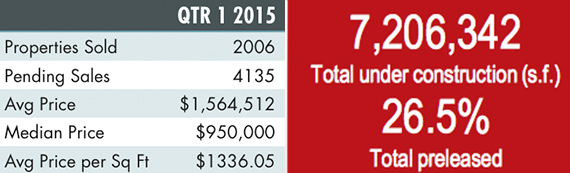

1Q 2015 Manhattan sales: BOND New York

Demand for Manhattan inventory was robust during the first quarter of 2015, despite a particularly harsh winter. The average cost for a Manhattan apartment was $1.6 million, a 3.8 percent jump from the previous quarter, according to a quarterly report from BOND New York. View the full report here.

1Q 2015 FiDi rentals and sales: Platinum Properties

First quarter sales in the Financial District fared well, with prices averaging $1.3 million, an 18 percent year-over-year increase, according to a quarterly report from Platinum Properties. With more people signing contracts with longer closing periods, inventory fell to 64 units during the first quarter, a 35.3 percent decline from the previous quarter and a nearly 50 percent drop from the previous year. View the full report here.

1Q 2105 New development: Halstead Property Development Marketing

Nearly half of all new development listings during the first quarter of 2015 were in Downtown Manhattan, and the Financial District was the most active neighborhood in the borough, according to a new development report from Halstead Property Development Marketing. During the first quarter, nearly 300 units closed or were in contract in the borough, 73 of which were in FiDi. View the full report here.

Manhattan luxury contracts March 23-29, 2015: Olshan Realty

In the final week of March, twenty-seven contracts were signed for apartments priced at $4 million and above, according to the Olshan Luxury Market Report A total of 135 contracts were signed during the month, up from 125 during the same period last year, but short of the month’s record of 190 units. The average asking price for contracts signed during the week was $7.1 million. View the full report here.

Brooklyn seven-year CAP and GRM report: GFI Realty Services, Inc.

Between 2007 and 2014, the average price for a Brooklyn apartment more than doubled, jumping from $80,000 in 2003 to $200,000 by the end of 2013, according to a report from GFI Realty Services, Inc. The borough’s capitalization rate fell from eight percent in 2003 to below six percent in recent years. View the full report here.

Office

1Q 2015 JLL Manhattan office leasing: JLL

Manhattan’s overall vacancy rate rose to 10 percent in the first quarter of 2015, according to a quarterly report from JLL. Despite overall strong leasing acitvity during the quarter, vacancy was up 5.2 percent from the previous quarter and remained 1.1 percent above the first quarter of 2015. View the full report here.