From the September issue: On Oct. 3, 2008, Daniel Herzberg, a British expatriate in Spain, called his bank, the Icelandic Landsbanki, to ask if his money was safe. He had read reports about financial difficulties, but got an encouraging reply and told his wife “everything will be fine.”

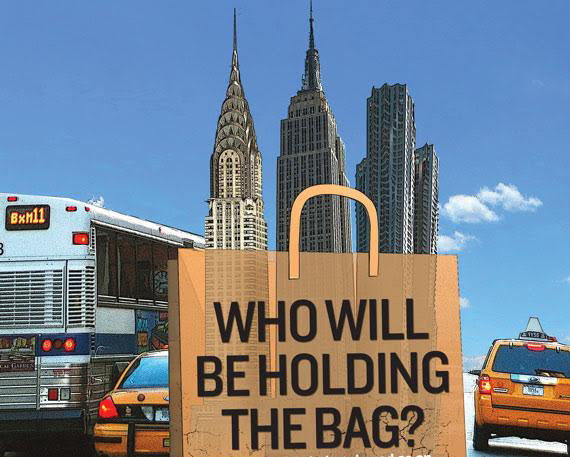

Four days later, his account was frozen and the bank was nationalized. Herzberg’s fate, reported in the Wall Street Journal at the time, was not unusual. When the U.S. housing bubble burst in 2008, it exposed a complicated web of financial stakes that few were aware of.

Banks in Iceland, Germany and elsewhere — not to mention U.S. institutions such as Bear Stearns and Lehman Brothers — suddenly faced default as a result of their investments in U.S. mortgage-backed securities. Many of the individual depositors who got burned were fanned out across Europe. And the European economy is still reeling from that domino effect. [more]