Michael Stern and Kevin Maloney’s ultra-skinny tower at 111 West 57th Street will soar to 1,400 dizzying feet. But how high will prices go?

Stern’s JDS Development Group and Maloney’s Property Markets Group are projecting a sellout of $1.45 billion for 65 apartments, according to the offering plan, which was approved by the New York Attorney General in October. The priciest condo is asking $58 million, or $8,179 per foot.

Those numbers fall short of the potential price tags described in early AG filings. The developers originally envisioned two- and three-bedroom units asking between $40 million and $100 million, according to filings last year. Five-bedroom units (which are situated on lower floors) were tentatively priced between $40 million and $75 million.

The approved offering plan as of Oct. 15 has three-bedroom condos starting at $15.5 million and topping out at $53 million. The four-bedroom units, four in total, are priced between $53 million and $57 million.

A person with knowledge of the building said several pricier units are not currently being offered and aren’t listed on the plan. Vornado Realty Trust used a similar tactic at 220 Central Park South, where hedge funder Ken Griffin is reportedly buying a $200 million mega unit.

At 111 West 57th, all of the units are accounted for on the offering plan, but sources close to the project said the prices could be placeholders for larger sums.

The SHoP Architects-designed building has an average asking price of $5,740 per square foot. Corcoran Sunshine Marketing Group is handling sales.

By comparison, Vornado Realty Trust’s 220 Central Park South has an average asking price of $7,374 per foot, and Zeckendorf Development’s 520 Park Avenue is asking an average of $6,742 per foot.

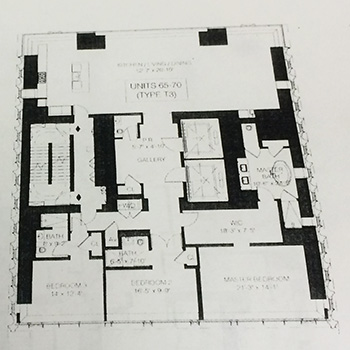

Floorplan for floors 65-70

The project’s units will be split between the landmarked Steinway Hall and a tower portion of the building. In Steinway Hall, prices are lower and will start at $1.4 million for a 564-square-foot studio. In the tower portion of the building, the least expensive unit is asking $15.5 million, or $3,451 per square foot. There are 25 units priced between $20 million and $30 million, and seven units asking $50 million and up.

The lower-than-expected prices may speak to a slowdown in the ultra-luxury market, which developers like Douglaston Development’s Jeffrey Levine and HFZ Capital’s Ziel Feldman have called “frothy.”

Last month, Stern predicted that not all ultra-luxury projects on “Billionaire’s Row” would succeed.

“There are a lot of mediocre projects out there that don’t make a lot of sense,” he said. “You’re going to see some of those projects that need $3,000 a foot to break even, especially if they’re on a side street or don’t have any kind of special attribute, start to struggle. And that’s okay – they should struggle.”