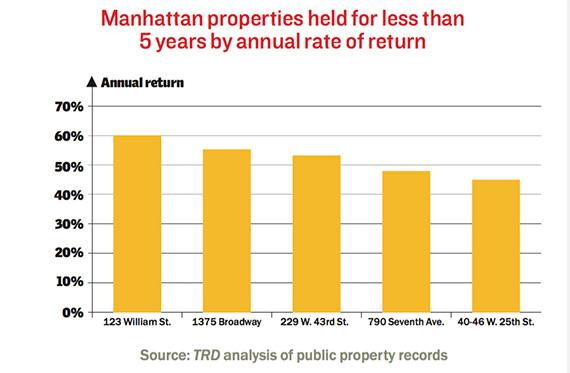

From the January issue: Some of the most profitable short- and medium-term commercial property deals that took place in Manhattan in 2015 fetched the sellers a hefty sum.

Those returns averaged between 44 percent and 59 percent annually, according to a TRD review of city records of assets acquired for more than $50 million since January 2011. In addition, TRD found that the four biggest investment sales of the year netted owners between $1.4 billion and $1.7 billion.

Meridian Capital Group’s David Schechtman said several factors, including taxes, often prompt owners to sell valuable cash-flowing assets. In addition, he said, “people sell because they want to feed [other] lines of business through new capital.”

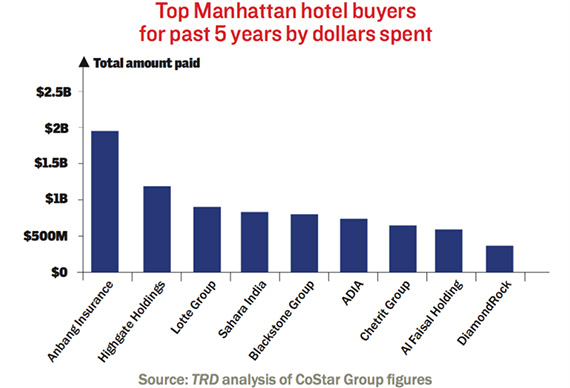

TRD also analyzed the Manhattan hotel-buying market over the last five years. The $1.95 billion purchase of the Waldorf Astoria in 2015 made the Chinese firm Anbang the biggest hotel buyer. Its one purchase amounted to more than what any other company spent on hotels combined.

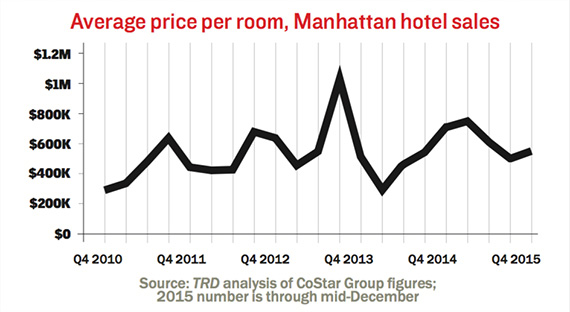

Some predicted that Manhattan could see less hotel construction ahead. “If RevPar [revenue per available room] is flat and costs for land, building and finance are working against you, theoretically that is putting pressure on new construction of hotels,” said Eastern Consolidated’s Ronald Solarz.