There are more large office blocks available in Midtown now than at any time in recent history, and landlords who don’t want to watch their spaces linger will have to get creative.

That’s according to a new report by Newmark Grubb Knight Frank identifying more than 80 blocks of 100,000-plus square feet of available space in Midtown, a 60 percent increase over the number of spaces available at the peak of 2007.

“If we take a snapshot of the Midtown office market right now with an eye to the not-too-distant future, it’s hard not to be aware of the significant amount of space that has recently or will soon come to market,” the report states. “While commercial real estate is a constant game of musical chairs, the significant movement to new construction is a different variable, last seen in abundance during the 1980s.”

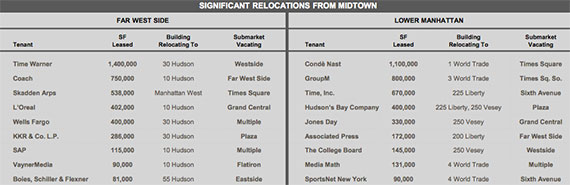

With landmark projects such as Hudson Yards and Brookfield Place coming to life, Manhattan is expected to add at least 12.5 million square feet of new product over next five years. According to the report, 30.5 percent of that space has already pre-leased, and relocating tenants are expected to leave some 3.8 million square feet of vacant space behind.

Not only are tenants opting out of Midtown for new construction on the Far West Side and Lower Manhattan, they’re also backfilling large blocks in Midtown South And Below Canal Street.

In all, Newmark is tracking more than 80 blocks of space 100,000 square feet and greater that either are available or will become available in the near future. That’s compared to 50 blocks the firm was tracking back in 2007.

At greatest risk, according to Newmark’s analysis, are landlords in the Sixth Avenue submarket, where 17 buildings are expected to have a combined 10 million square feet of available space. Time Inc., for example, is leaving 670,000 square feet behind at 1271 Sixth Avenue as it relocates to Brookfield Place in Lower Manhattan (Major League Baseball is reportedly talks to replace the publisher at the Time & Life Center), and HBO is vacating large blocks at 1100 and 1114 Sixth Avenue as it relocates with parent company Time Warner to Hudson Yards.

Savvy property owners would be wise to reposition their buildings in the hopes of attracting TAMI tenants, which in 2015 saw a 71 percent uptick in expansions over the prior year, and are experiencing annual employment growth of 5.4 percent, dramatically more than seen in the finance sector.

“Some building owners planning to market large amounts of available space in the coming years have begun taking measures to reposition assets, including: assigning a new property name (5 Manhattan West) . . . [and] completely reimagining their structures (390 Madison Avenue and 425 Park Avenue),” Newmark’s researchers wrote.