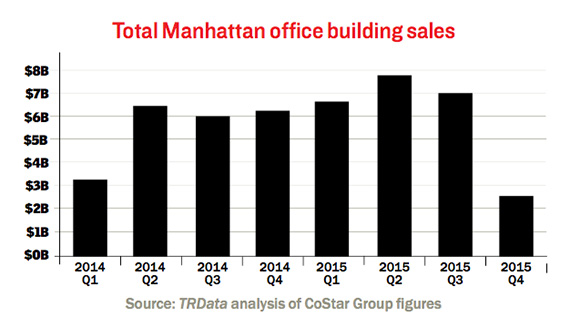

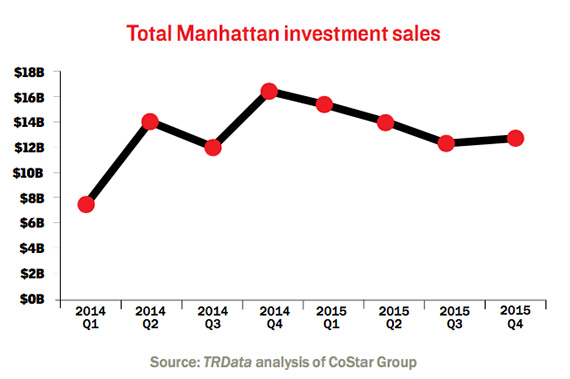

Brokers are sounding a cautious note in the investment sales world. In 2015, citywide sales volume hit a record $74.5 billion, but the general sentiment is that figure will not be bested this year. In fact, despite that high-water mark, the fourth quarter saw a steep decline in closed office building trades, typically the main driver of Manhattan investment transactions.

The largest traditional office building sale to close during that end-of-the-year stretch was the $247 million purchase of the 295,000-square-foot 370 Lexington Avenue by Unizo Holdings — although there are several mega-deals pending, like RXR Realty’s expected purchase of 1285 Sixth Avenue for $1.7 billion.

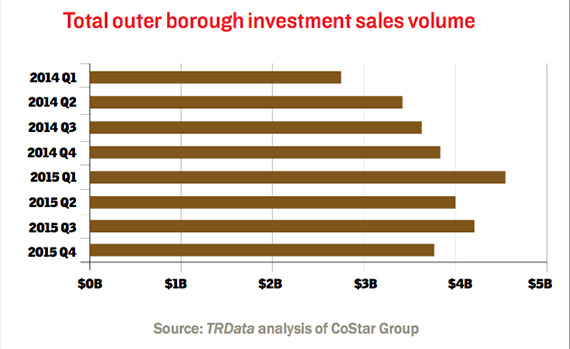

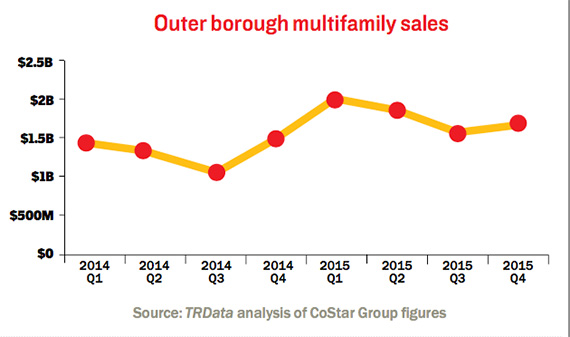

Several brokers said that while their buyers remain in the game, the mood so far in 2016 is decidedly more circumspect. “I think at some point what goes up must go down,” said George Niblock of commercial brokerage Friedman-Roth Realty Services. In the outer boroughs, multifamily sales activity, the main market driver, dipped at the end of 2015 compared to earlier in the year.

And residential development site sales — generally seen as a canary in the coal mine of the NYC market — were slowing, said Adam Hess, a partner at the Brooklyn-based brokerage TerraCRG. “It’s coming more into focus that the peek was in the middle of last year,” said Hess.